Audit Support Outsourcing: Comprehensive Guide for CPAs

Audit outsourcing services are designed for CPA firms conducting external audits for client firms.

Audit outsourcing gives CPA firms skilled remote auditors who improve efficiency, accuracy, and turnaround time. By shifting audit-heavy tasks to experienced auditors, CPA firms avoid staff overload and reduce errors. This creates predictable capacity, ensures accurate work, supports deadlines, and improves ROI. Resulting in higher-value client relationships instead of operational strain.

By outsourcing audit work, these firms can outsource their stress to professional remote auditors, who provide complete support and guidance and make audits hassle-free.

Auditing is one of the most intricate and demanding tasks in the accounting world.

It requires auditors to meticulously assess the quality, relevance, and authenticity of a client’s financial statements, all while shouldering significant responsibility.

Given the high costs, time intensity, and inherent risks, many CPAs are turning to outsourced professional audit support services to streamline this process.

- What are Audit Services?

- Understanding Outsource Audit Support Services

- Internal Audit Vs External Audit

- Audit Support Services Outsourcing – How Does It Work?

- Myths And Facts of Audit Support Services

- When Should CPAs Outsource Audit Support Services?

- How to Find the Right Audit Support Services Provider?

- Advantages And Disadvantages of Outsourcing Audit Support Services

- Advantages

- Disadvantages

- Factors to Consider Before Outsourcing Audit Support for CPAs

- Pricing Models for Audit Support Services Outsourcing

- Dedicated Outsource Audit Support for CPAs with QXAS

- The QXAS Difference

- FAQs

- 1.How do professional audit support services help CPA firms?

- 2.When should a firm outsource management audit services?

- 3.How do you choose the right audit support services provider?

- 4.What are the benefits of outsourcing audit support services?

- 5.What are the benefits of outsourcing audit tasks?

- 6.How do providers of audit support services ensure data security?

For many audit professionals, the solution lies in professional audit support outsourcing services.

This guide delves into how outsourcing these critical functions can streamline operations, reduce overhead, and maintain compliance without the need to expand in-house staff.

In this professional audit support outsourcing services guide, you’ll gain valuable insights into how specialized audit outsourcing can enhance efficiency and drive the success of your CPA firm.

What are Audit Services?

Audit services refer to the services provided by an external auditor to review and assess a firm’s financial statements or services.

The auditor typically evaluates the statements and reports for their authenticity and correctness.

There are various types of audit services, such as financial, compliance, operational, performance, IT, system security, due diligence, etc. On this page, we will solely refer to financial audit services provided by external auditors.

Understanding Outsource Audit Support Services

Audit support outsourcing services are often confused with audit services but are not the same.

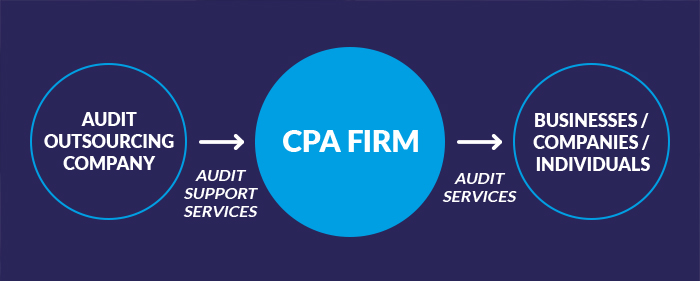

While audit services refer to the services provided by an accountant or CPA to a business firm, audit support services refer to the comprehensive support and guidance provided by an audit support specialist from an outsourcing company like QX Accounting Services to these accountants and CPAs.

Audit outsourcing services are designed for CPA firms conducting external audits for client firms.

These firms often struggle with insufficient, unskilled or overused staff and fail to deliver quality work or meet deadlines.

By outsourcing audit work, these firms can outsource their stress to professional remote auditors, who provide complete support and guidance and make audits hassle-free.

In simple words, audit services refer to professional services provided by CPAs to client firms, while audit support services are meant for CPA firms to outsource their external audit workload.

Internal Audit Vs External Audit

An internal audit refers to the audit procedure carried out within an organization, wherein the auditors assess the company’s processes and functions.

This is particularly important for larger organizations with complex processes and operations.

An external audit, on the other hand, refers to an independent auditor’s audit of a corporation’s financial statements and reports.

This audit is highly critical and risk-intensive.

It is carried out by all firms, irrespective of their size, through a professional external auditor.

An internal audit is a year-long and continuous process, whereas an external audit is carried out only once a year by an external auditor.

Further, while a firm’s in-house team carries out an internal audit, an external audit is usually handed over to a third-party onshore or remote auditor for an efficient and unbiased opinion.

| ASPECT | INTERNAL AUDIT | EXTERNAL AUDIT |

|---|---|---|

| Purpose | To improve the organization’s operations and internal controls. | To verify the accuracy of financial statements for stakeholders. |

| Primary Focus | Operational efficiency, risk management, and compliance. | Financial statement accuracy and adherence to accounting standards. |

| Performed By | Employees of the organization or outsourced professionals. | Independent, external auditors not employed by the organization. |

| Reporting | Reports are given to management and the board of directors. | Reports are provided to shareholders, investors, and regulators. |

| Frequency | Can be continuous or at set intervals throughout the year. | Typically annually, at the end of the fiscal year. |

| Regulatory Basis | Not usually required by law, but guided by standards such as the IIA. | Often legally required, based on standards like GAAP or IFRS. |

| Scope | Defined by management or the board; can be broad or specific. | Defined by the relevant auditing standards, primarily financial. |

Audit Support Services Outsourcing – How Does It Work?

Audit outsourcing companies offer clients various audit support services, from external audits to IRS tax audit support.

These companies employ highly proficient auditors and train them on global audit regulations so that they can seamlessly blend into the clients’ work systems.

The auditors take care of the clients’ end-to-end audit functions in three phases: planning, execution, and completion.

During this process, the client can remain carefree about the entire function and rely entirely on the expertise of the outsourced audit support specialist.

Once the audit is complete, it is thoroughly scanned for accuracy and then handed over to the client.

As a part of the contract, audit outsourcing companies maintain complete transparency and accountability of their resources’ work.

All the reports and timesheets representing the remote auditors’ productivity are regularly shared with the client so that the latter can be assured of the quality and capacity of their work.

Ready to simplify your accounting processes? Connect with us today and see how we can make a difference.

CONTACT US

Myths And Facts of Audit Support Services

Many CPAs remain hesitant about leveraging auditing outsourced services, largely due to longstanding misconceptions about the nature and risks of compliance and audit support services.

This reluctance is often rooted in uncertainties about the feasibility and safety of outsourcing critical audit tasks.

Interestingly, some CPAs aren’t even aware that outsourcing audit services is a viable option.

This lack of awareness contributes to hesitations that could be dispelled with a clearer understanding of the benefits and safeguards involved.

One common myth is that audit support outsourcing services are prohibitively expensive, a misconception that ignores the significant cost efficiencies outsourcing can offer.

In reality, firms that opt for professional audit support outsourcing services can reduce overhead costs associated with hiring, training, and maintaining office infrastructure, all while enhancing their capacity to scale effectively.

Concerns about data security also play a part in the reluctance to outsource.

However, top audit outsourcing companies prioritize data protection, adhering to stringent security standards to ensure client data is handled with the utmost care and confidentiality.

By debunking these myths and highlighting the factual benefits, CPAs can make more informed decisions about incorporating professional audit support services into their practices, ultimately enhancing their operational efficiency and competitive edge.

When Should CPAs Outsource Audit Support Services?

Outsourcing is great, yes, but an important question that needs to be answered is- When should CPAs outsource audit support services? How do firms determine if it is the right time to outsource their clients’ audit requirements? Let us answer that for you.

The accounting industry in the USA has been facing quite a few challenges over the last few years, especially with respect to staffing gaps.

To add to it, the era of the Great Resignation has made things worse.

It is, therefore, a challenge for CPAs, especially small and mid-sized firms, to find skilled accountants and hire auditors who can take care of their audit services.

Moreover, the industry also faces the challenge of incompetent resources, redundant methods, outdated technological expertise and much more.

This is where audit outsourcing services come into the picture.

Outsourcing audit work to a trusted outsourcing partner gives you access to experienced audit professionals and frees up your existing staff to take up additional, value-based tasks.

How to Find the Right Audit Support Services Provider?

Once you have decided to outsource audit support services, the next important task is to find the right outsourcing partner.

This is crucial for a firm as its success, profits and productivity depend largely on the outsourcing service provider.

While the right partner can significantly fuel your profitability and scalability, the wrong firm can mess up the entire task and put your reputation at risk.

There are several audit outsourcing companies in the market out there. To choose the right partner for their firm, CPAs must consider the core factors of quality and experience.

As a client, you would want only top-notch compliance and audit support services to gain your clients’ trust. When a firm has considerable experience, it is more likely to be proficient in its services.

CPAs can ask outsourcing firms for references and speak to them first-hand about their experiences.

Another indication of a firm’s expertise is the awards and accreditations won by them.

CPAs may look for client testimonials on the firm’s official website or client platforms to gain insight into their experience and knowledge.

Data security is the next vital factor to consider while picking the right outsourcing partner.

Most good firms providing outsource audit support for CPAs have a robust system for ensuring complete client data security and compliance with global security standards.

Advantages And Disadvantages of Outsourcing Audit Support Services

When it comes to outsourcing external audits or IRS tax audit support, outsourcing is the quickest and easiest way for accounting firms to scale and achieve profitability while keeping the growing costs in check.

Let’s look at some of the advantages and disadvantages of audit outsourcing services.

Advantages

Experienced professionals

Outsourcing compliance and audit services with top-tier outsourcing companies gives CPAs access to highly skilled and trained audit support specialists, thus beating staffing challenges.

Cost savings

Audit outsourcing services fuel massive cost savings by keeping the overhead costs in check, thus driving profitability.

Technological proficiency

A significant advantage of outsourcing audit support for CPAs is that firms can easily integrate the latest technology into their processes.

This particularly is a challenge for several small-scale CPA firms as the accounting industry struggles to remain updated with the ever-changing technology.

Higher scalability

Another primary reason CPAs outsource professional audit support services is that it increases a firm’s capacity to scale.

In today’s competitive world, CPA firms must offer a wide range of services and add to their client base to scale effectively. Outsourcing is a sure-shot solution for accountants and firms to ensure higher scalability.

Disadvantages

While the advantages of auditing outsourced services outnumber the disadvantages, it is important for firms to consider these in order to be aware of the whole scenario.

Communication woes

One of the most common disadvantages of outsourcing compliance and audit support services is that it leads to a tricky communication channel.

CPA firms may find it difficult to effectively communicate their clients’ requirements to the outsourcing partner and vice versa.

The tricky communication channel may sometimes lead to a loss or manipulation of critical information, thus posing a risk to the final audit report.

Data security

Another major concern for CPA firms is data security. Auditors deal with a lot of sensitive financial data of clients.

When accountants outsource audit support services, they give the outsourcing firm access to their clients’ sensitive and confidential data.

While most outsourcing firms treat data with utmost privacy, even the slightest error in the system can cause a leak and thus put your client’s data at risk.

In order to minimize the risks associated with audit support outsourcing, CPA firms need to be highly diligent while choosing their outsourcing partner.

It is essential to conduct thorough research and analysis before signing the contract with the final one.

Factors to Consider Before Outsourcing Audit Support for CPAs

An accountant or firm may recognize the gaps in their processes and opt for outsourcing audit work to ensure better efficiency.

However, the task does not simply end there. You might be confident about your exact requirements, but there are other essential factors that CPAs must consider before signing the contract with the outsourcing firm.

It is true that audit outsourcing companies take care of your clients’ end-to-end audit processes, but it is vital to assess the pros, cons and impact of outsourcing on your firm beforehand. Here are a few points that accountants must consider.

The volume and nature of work

Before you consider going for audit outsourcing services, it is essential to consider the volume and nature of your work.

Not every firm has the same amount of work or clients. Besides, the nature of audits varies from client to client.

In addition, not every audit needs to be outsourced. Your internal team may be capable of managing some clients, while you would need outsourced resources for certain other clients.

For this reason, CPAs must do a thorough internal analysis to determine their needs before approaching an outsourcing partner.

This will also help the outsourcing partner develop the right pricing and engagement model for you.

Interim SWOT analysis

A SWOT analysis is the most realistic measurement of a firm’s standing. It helps determine the businesses’ strengths and weaknesses and growth opportunities.

It is recommended that CPAs conduct an interim SWOT analysis before approaching an outsourcing partner or requesting a pricing quote.

Through this exercise, firms can effectively determine the exact number of resources they need to fill their team. It would also help ascertain the total work hours, which is a crucial parameter to outsourcing compliance and audit support services.

Competitor analysis

A thorough competitor analysis is an excellent way for any firm to understand their business challengers. It helps devise and implement counter-strategies and innovate and retain one’s spot in the market.

CPA firms need to conduct a detailed competitor analysis to understand the gaps and areas of improvement within their firm.

This can be extremely helpful in determining if a CPA firm needs to add new services to their existing offerings and how much work they should outsource in order to scale the firm.

Outsourcing budget

This one is probably the simplest but also the most crucial of all the factors.

Before a CPA firm decides to outsource their clients’ audits, the management needs to be certain about the available budgets and the amount they can invest into outsourcing.

Remember, outsourcing is supposed to be an investment and not a liability.

If you do not have enough budget to add outsourced auditors to your team, it probably isn’t a good time for your firm to widen its horizons and team up with new clients.

Like any other investment decision, CPAs must consider all internal and external factors that may affect their firm’s market standing and end profits before choosing to outsource professional audit support services.

Pricing Models for Audit Support Services Outsourcing

By now, we all know that accountants can fuel growth and profitability for their practice when they outsource professional audit support services.

But how much does it cost to outsource these services?

The pricing models for audit outsourcing services vary from company to company and depend largely on factors such as the volume of the work and the reputation of the outsourcing partner.

Several audit outsourcing companies customize their pricing models based on their clients’ requirements.

To suit their clients’ diverse needs, these companies devise flexible pricing and engagement models, each with pros and cons.

Let’s look at two of the most common pricing models offered by audit outsourcing companies.

Full-time Employee (FTE) model

The Full-time Employee (FTE) pricing model is the most common and widely preferred model for audit outsourcing services.

As the name suggests, the FTE model offers CPAs a dedicated full-time resource who works exclusively for them.

The outsourcing company typically bills the CPA firm monthly against the resources’ time.

The FTE model is an excellent choice for firms with a high and consistent volume of work.

Here are some of the pros and cons of this engagement model.

Pros

- Dedicated audit support specialist exclusively on your project

- Seamless communication and coordination

- Highly economical to CPAs with a steady flow of work

- More control and better work management for CPA firms

- Quick scalability and enhanced profitability

Cons

- Not a viable option for firms with inconsistent workflows

- Requires vast managerial experience and a standardized process within the firm

Ad-hoc Model

The ad-hoc model for compliance and audit support outsourcing services is specifically designed for companies that do not have large volumes of work or many clients.

In this model, CPA firms opt for professional auditors on an ad-hoc basis as and when they receive work from their clients.

The outsourcing company designs the payment structure accordingly, wherein the CPA firm is billed for the resource on an hourly basis.

Here are some of the pros and cons of this model.

Pros

- Easy expansion and constriction of your team based on the workload

- You pay only for the number of hours of work you outsource

- Better service guarantee for existing and new clients

- Quick scalability and enhanced profitability

Cons

- Not suitable for firms with many clients or huge volumes of work

- You may have to work with multiple resources every time you outsource

- Consistency may be an issue

When it comes to audit outsourcing services, there are several companies and their corresponding engagement models to choose from.

CPA firms must be sure about their exact requirements and choose a provider that best fits their need.

Dedicated Outsource Audit Support for CPAs with QXAS

QXAS is a global outsourcing company specializing in dedicated audit support services for CPAs. Our team of highly professional and experienced auditors works dedicatedly for your firm so that you can always keep your clients happy and satisfied.

QXAS is the accounting outsourcing division of QX Global Group, one of West India’s fastest-growing accounting outsourcing companies.

We began our operations as a mere 5-member startup in 2003 and have grown to be market leaders in accounting outsourcing.

We have built a robust team of knowledgeable professionals that helps individual accountants and small and mid-sized CPA firms to outsource professional audit support services for improved cost savings and maximum profitability.

QX thrives upon the core values of Quality and Excellence. We exhibit these principles in every project we undertake and have been instrumental in helping CPA firms better manage their audit services.

Our commitment to excellence was reinstated in 2022 when QX earned a 100% score in all audits conducted by the British Standards Institution (BSI). We are proudly an AICPA SOC 2, ISO 27701, ISO 27001 and ISO 9001 compliant company.

In addition to compliance and audit support services, our widely preferred services include accounting and bookkeeping outsourcing, payroll outsourcing, and comprehensive tax support.

Must Read: Outsourcing Audit Support Services – How Does It Work?

The QXAS Difference

There are several reasons why QXAS can be the ideal audit outsourcing partner for your CPA firm.

- 12+ years of experience in accounting outsourcing and audit support services

- Highly qualified auditors with a seamless understanding of the US market

- AICPA SOC 2 and ISO 27701 compliant accounting outsourcing company

- Fully compliant with ISO 27001 for information security and ISO 9001 for quality

- ACCA-approved Gold Employer

- Leader in IAOP’s 2022 Global Outsourcing 100 List for eight consecutive years

To learn more about our services, call +1 (551) 3075522, drop us an email at [email protected], or log on to Outsourced Accounting, Bookkeeping, and Payroll Services | QXAS USA (qxaccounting.com).

FAQs

1.How do professional audit support services help CPA firms?

Professional audit support services provide expert external resources to assist CPA firms with tasks like audit planning, documentation, and reporting. They help reduce workload, improve accuracy and allow firms to focus on client relationships.

2.When should a firm outsource management audit services?

A firm should consider outsourcing management audit services when its in-house team lacks bandwidth, the workload becomes inconsistent, or there’s a need to scale quickly without hiring full-time staff. Outsourcing also helps when regulatory or client demands increase.

3.How do you choose the right audit support services provider?

When selecting a provider, look at their experience with CPA firms, data-security compliance (such as SOC 2/ISO), ability to scale up or down, and their communication model with your team. These factors help minimise risks and ensure smooth collaboration.

4.What are the benefits of outsourcing audit support services?

Outsourcing audit support services can deliver cost savings, access to specialised audit expertise, improved turnaround times, and greater operational flexibility for a CPA firm. It also helps firms remain competitive and respond to audit demand fluctuations.

5.What are the benefits of outsourcing audit tasks?

Outsourcing audit tasks allows access to expert auditors and specialized knowledge that may not be available internally. It enhances the efficiency of the audit process, provides scalability during high-demand periods, and helps maintain an unbiased perspective in financial reporting.

6.How do providers of audit support services ensure data security?

Providers prioritize data security by adhering to international standards and regulations, employing robust encryption practices, and conducting regular security audits. Ensure that any provider you consider has a strong framework in place to protect sensitive information.

Bhagyashree Patankar

With over 14 years of global experience in finance and accounting, Bhagyashree is a Chartered Accountant and US CPA with a master’s in Accounting and Finance. She leads an 80+ member team across accounting, audit, and tax, driving operational excellence, talent development, and high-quality delivery. Known for her precision and strategic insight, she transforms financial data into actionable business strategies that enhance decision-making, efficiency, and sustainable growth.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Our Latest Insights

Let’s Work Together

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.

Get Your ROI Estimate

Get Your ROI Estimate