Ready, Set, File: Key Dates & Deadlines to Navigate Tax Season 2024

The tax filing season is upon us, bringing with it a period of critical preparation and deadlines for CPAs, accountants, and accounting firms. It’s time to gear up for a busy season, ensuring all necessary documents are in order and perhaps setting aside funds for any impending tax liabilities. Read on for the specifics of what this tax season entails, including the key start and end dates and essential information for efficient and timely tax filing.

When Does Tax Season Start in 2024?

The official start of tax season is January 29, 2024, when the IRS begins accepting and processing 2023 tax returns. Early preparation is essential. Many tax preparers and software services are ready for use even before this date, allowing taxpayers and firms to get a head start. Keep in mind that W-2 and 1099 forms must arrive by the end of January to complete filings without delay.

What is the Federal Tax Filing Deadline for 2024?

The deadline for filing federal tax returns is April 15, 2024. In some cases, such as natural disasters or military service abroad, extensions or additional time may be granted. However, requesting an extension allows you to submit the paperwork by October 2024 but not to delay any tax payments due.

Can Clients Request an Extension?

Yes, clients can request an automatic six-month extension, giving them until October 15, 2024, to submit their returns. However, it’s important to explain that the extension applies only to the filing of tax returns, not the payment. Any outstanding taxes must still be paid by April 15, or clients will incur interest and late payment penalties.

Special Circumstances for Extensions

There are situations where an extension is granted automatically, and you, as a CPA, may not need to file for it on your client’s behalf. These circumstances include:

- Natural Disasters: If your client resides in a federally declared disaster area, the IRS often provides an automatic extension for both filing and paying taxes. These extensions typically vary based on the severity and timing of the event, so staying updated with IRS announcements is key.

- Overseas Military Service: Clients serving abroad, particularly in combat zones, may also qualify for automatic extensions. The IRS offers special provisions that delay filing and payment deadlines for these individuals.

What Happens if the Deadline is Missed?

It’s critical to communicate the consequences of missing the deadline, as the IRS imposes substantial penalties. For failing to file by April 15 (or October 15 with an extension), the penalty is 5% of the unpaid tax amount for each month the return is late, capping at 25%. A separate failure-to-pay penalty also applies, which is 0.5% of unpaid taxes per month.

To avoid these costly penalties, ensure that clients who need additional time submit a Form 4868 (Application for Automatic Extension) well before the deadline and pay any expected tax liabilities by April 15. The importance of clear communication with clients about the differences between filing and payment deadlines cannot be overstated.

How Do State Tax Deadlines Vary in 2024?

State tax deadlines mostly align with the federal April 15 deadline, but certain states, including Delaware, Iowa, Louisiana, and Virginia, have different deadlines or exceptions. For residents in states with no income tax requirements, like Alaska, Florida, and Texas, tax season presents different considerations. Stay updated on state-specific tax deadlines to avoid penalties.

What Happens if You Miss the April 15, 2024, Deadline?

Missing the April 15 deadline can lead to penalties unless an extension is filed. However, remember that an extension only applies to filing paperwork; any taxes owed are still due on April 15. Failing to pay by this date can result in interest and late payment penalties.

How Fast Can You Expect Tax Refunds in 2024?

The IRS generally processes tax refunds within 21 days for electronically filed returns, especially for those opting for direct deposit. However, due to IRS regulations on holding such refunds until mid-February, refunds for those claiming the earned income tax credit (EITC) or additional child tax credit (ACTC) should be processed by February 27, 2024.

Are There Any Extended Tax Deadlines in 2024?

Individuals or businesses who file for an extension before April 15 can expect extended tax deadlines in 2024. This extension extends the deadline to October, though, as mentioned earlier, payments must still be made by the April deadline. IRS-specific extensions may also be in place for certain regions or individuals facing extraordinary circumstances like natural disasters.

Maximizing Efficiency with Tax Technology in 2024

Tax professionals should leverage the latest tax software to streamline filing, reduce errors, and ensure timely submissions. Automated tax preparation tools can also help identify eligible tax credits and deductions, including those for homeowners or small businesses. Staying updated on the latest tax tech innovations can save significant time during tax season.

Leveraging Technology and Expertise

When anticipating tax refunds, the IRS typically processes refunds for electronically filed returns within 21 days, especially for those opting for direct deposit and without any complications in their returns. For claims involving the earned income tax credit or additional child tax credit, refunds are expected to be processed by February 27, 2024, for those using direct deposit, following the IRS’s mandated waiting period until mid-February.

This tax season, it’s crucial to be well-informed about the latest tax software and to understand tax breaks relevant to various scenarios, including those for homeowners. As always, staying abreast of the latest updates and requirements is key to a smooth and successful tax filing season. As we venture into the 2024 tax season, CPAs and accounting firms face a landscape punctuated with critical deadlines. It’s essential to keep these key dates at the forefront of your planning to ensure seamless tax filing for your clients.

THE ULTIMATE TAX RETURN CHECKLIST TO SEND TO YOUR CLIENTS

A Handy Guide for CPAs to Facilitate Clear Client Communication This Tax Season

Download Free Guide

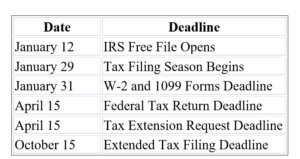

Here’s a detailed breakdown of the 2024 tax calendar:

January 12, 2024: IRS Free File Opens

Ahead of the tax season, the IRS Free File program becomes available. This platform provides free tax preparation software to qualified taxpayers, offering a head start on tax filing. For clients eligible for this service, it’s a valuable resource to expedite their tax preparation process.

January 29, 2024: Tax Filing Season Begins

This is the day the IRS starts accepting and processing 2023 tax returns. It’s a pivotal moment for tax professionals to begin submitting prepared returns. If you’re leveraging tax software for filing, this is the time to shift from preparation to submission.

January 31, 2024: W-2 and 1099 Forms Deadline

Employers are mandated to send out W-2 and 1099 forms by this date. Ensure your clients are checking their mailboxes regularly to gather these essential documents promptly. These forms are the bedrock of accurate tax filing, and timely receipt is crucial.

April 15, 2024: Federal Tax Return Deadline

Marked as the official deadline for filing federal tax returns, this date should be circled in red on every tax professional’s calendar. While there are some state-specific exceptions, this remains the general deadline for the majority of taxpayers across the nation.

April 15, 2024: Tax Extension Request Deadline

Also, April 15 is the deadline to request an extension for filing tax returns. It’s crucial to convey to clients that while an extension grants additional time for filing the paperwork, it does not postpone the due date for any tax payments owed.

October 15, 2024: Extended Tax Filing Deadline

For those who have requested and been granted an extension, this is the final deadline for filing their tax returns. It’s important to manage these extended filings diligently to avoid any last-minute rush.

Throughout this period, it’s also vital to stay attuned to state-specific deadlines and requirements. Each state may have its unique set of rules and deadlines, particularly for states like Delaware, Iowa, Louisiana, and Virginia, which don’t strictly adhere to the April 15 federal deadline. Staying updated with each state’s department of revenue is essential for CPAs and firms handling tax preparations across multiple states.

When is the last day to file taxes in 2024 in the USA?

The last day to file taxes in the USA for the year 2024 is April 15, 2024. This is the official deadline for filing federal income tax returns for the 2023 tax year. It’s important to file by this date to avoid potential penalties and interest for late filing. If you need more time, you can request a tax extension, which grants additional time to file your return but does not extend the time to pay any taxes owed.

How can I request a tax extension for 2024?

To request a tax extension for 2024, you need to file Form 4868 with the IRS by the original tax filing deadline of April 15, 2024. This form is an Application for an Automatic Extension of Time To File a U.S. Individual Income Tax Return. Filing this form gives you until October 15, 2024, to file your tax return. Remember, this extension only applies to the filing of the return, not the payment of any taxes you may owe.

What are the tax deadlines for estimated tax payments in 2024?

In 2024, the deadlines for estimated tax payments for individuals are typically April 15, June 15, September 15 2024, and January 15, 2025. These dates are for the four quarters of the tax year and are essential for taxpayers who need to make estimated tax payments, such as self-employed individuals or those with significant income not subject to withholding.

Can I file my taxes electronically before the official start of the tax season in 2024?

While the IRS officially starts accepting and processing tax returns on January 29, 2024, you can prepare your tax return and file electronically before this date using tax software. Many tax software programs allow you to complete your return and then hold the submission until the IRS begins processing returns. This early preparation can be advantageous, ensuring your return is ready to be processed right at the start of the tax season.

What are the new tax updates for the 2024 tax season that CPAs should be aware of?

For the 2024 tax season, CPAs should be aware of several updates, including changes in tax brackets, standard deductions, and contribution limits for retirement accounts. Additionally, any new regulations passed by Congress, such as updates from the Inflation Reduction Act, could impact tax filing. Staying current with IRS publications, updates on the IRS website, and professional accounting resources is crucial for CPAs to ensure compliance and optimal tax planning for their clients.

How has the IRS improved its services for the 2024 tax season?

In 2024, the IRS has made several improvements to enhance taxpayer services. These include expanded in-person services, increased support on toll-free lines, and enhancements to online tools like ‘Where’s My Refund?’. The IRS has also introduced more digital options for submitting documents and correspondence, aiming to streamline the process and reduce response times.

Are there any changes in tax deductions or credits for 2024 that CPAs should know about?

CPAs should be aware of any updates to tax deductions and credits for the 2024 tax season. These could include changes in itemized deductions, education credits, and business-related deductions. It’s important to review the latest tax law changes, IRS guidelines, and professional tax resources to understand how these adjustments may affect tax planning and filing for clients.

What are the implications of missing a tax deadline in 2024?

Missing a tax deadline in 2024 can result in various penalties and interest charges. For instance, late filing can incur a failure-to-file penalty, while late payment leads to a failure-to-pay penalty. The specific implications depend on how late the filing or payment is and the amount owed. CPAs should advise clients to file and pay on time or request extensions to avoid these penalties.

WRAPPING UP

This calendar serves as a roadmap through the maze of deadlines that define the 2024 tax season. Adhering to these dates ensures not just compliance but also offers peace of mind for both tax professionals and their clients. Remember, successful navigation through this season hinges on meticulous planning, timely action, and staying informed about the latest tax regulations and updates.

It’s evident that tax return preparation outsourcing is a strategic move for CPAs and accounting firms. This approach is not just a convenience; it’s a competitive edge. By choosing to outsource tax preparation, you access global expertise, ensuring accuracy and compliance while freeing up your team to focus on core business activities.

Outsourcing tax services to offshore experts means you’re aligning with professionals who are up-to-date with the latest tax regulations and technologies. This partnership enhances your firm’s capacity to handle complex tax scenarios efficiently, particularly during the demanding tax season.

Incorporating tax return preparation outsourcing into your business model is a smart, forward-thinking decision. It’s an investment in quality, efficiency, and client satisfaction. For firms aiming to excel in today’s fast-paced business environment, outsourcing tax preparation is a step towards achieving that goal with confidence and finesse.

Ready to transform your firm’s approach to tax season? Consider partnering with a reliable tax preparation outsourcing provider. This move promises to streamline your operations and elevate the level of service you offer to your clients.

Bhagyashree Patankar

With over 14 years of global experience in finance and accounting, Bhagyashree is a Chartered Accountant and US CPA with a master’s in Accounting and Finance. She leads an 80+ member team across accounting, audit, and tax, driving operational excellence, talent development, and high-quality delivery. Known for her precision and strategic insight, she transforms financial data into actionable business strategies that enhance decision-making, efficiency, and sustainable growth.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Our Latest Insights

Let’s Work Together

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.

Get Your ROI Estimate

Get Your ROI Estimate