How many times have you had to delay or cancel your Friday night plans to stay back at work, buried under spreadsheets?

For accountants, this scene is all too common. 9 in 10 accountants in the UK still rely on manual effort for tasks as simple as sending out emails, making processes lengthy and prone to errors (Source: QX survey).

But what if there was a way to skip all those repetitive tasks? Enter process automation.

Automation is quickly becoming the buzzword not just in the tech industry but across the accounting sector. Accountants might not be tech experts by trade, but in today’s world, implementing automation tools is becoming essential.

If you’re looking to save time, eliminate human error, and focus on value-driven tasks, accounting automation might just be the next big thing your firm needs.

The demands on accounting firms are increasing year on year. Managing client expectations while meeting deadlines, ensuring quality, and sustaining profits can be exhausting for firms. This is where automation emerges as a game-changer.

Process automation can save accounting firms up to 2,000 hours annually (yes, we’ve tried and tested it). Let that sink in for a moment. That’s time that can be spent on high-value tasks, such as advising clients, growing your business, or, better yet, finally heading home early on a Friday.

The real impact of automation isn’t just in automating individual processes. It’s about integrating your existing tools and systems, so they work seamlessly together.

Imagine a system where you no longer have to import data from one platform to another. It not only makes the process faster but also more efficient with minimum reliance on human effort.

Let’s explore why accounting automation is more than just a trend – it’s the future of accountancy.

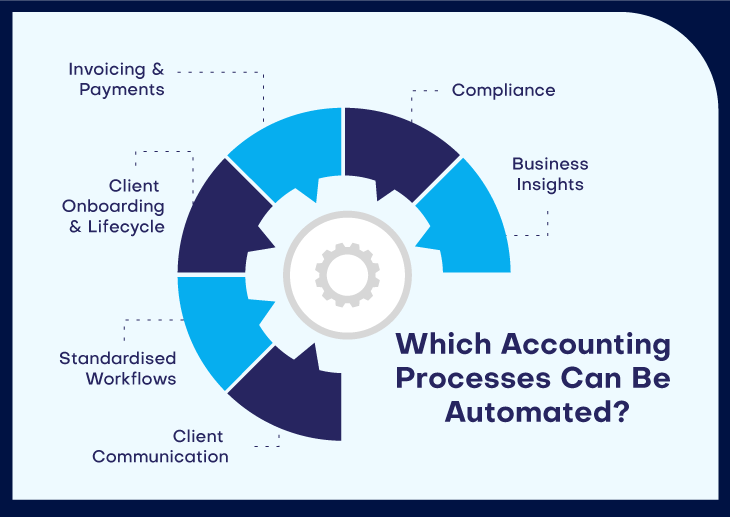

Process automation in accountancy refers to the use of technology, particularly software, to handle routine and repetitive tasks. These tasks range from data entry and client communication to processing payments and invoices and onboarding clients.

But why is it important? The simple answer is efficiency. With clients looking at accountants as strategic partners, you can’t be just offering basic accounting services, right?

Automation lets you get rid of routine mundane tasks and shift focus on strategic services such as client advisory, directly contributing to business growth.

Additionally, automation minimises the chances of human error. We’ve all experienced that gut-wrenching moment when a number doesn’t match, and hours are spent hunting down the mistake. Automation significantly reduces these errors, ensuring your records are accurate and up to date.

You might be wondering, “What exactly can I automate?” The good news is that plenty of routine tasks in accounting are prime candidates for automation. Here are just a few:

Of course, like anything new, implementing automation comes with its challenges. Here are a few common roadblocks:

Must Read: Preparing Your Team for Accounting Automation: A Practical Guide for Accountants

Automation doesn’t mean accountants are out of a job – far from it. Instead, it transforms the role of an accountant. By automating routine processes, accountants can focus on what really matters: offering advisory services, strategic planning, and insight-driven solutions to clients.

Rather than spending hours on manual tasks, accountants can become trusted advisors, helping clients make informed decisions based on accurate, real-time data. Automation frees up time for value-added services that clients are willing to pay more for.

In fact, firms that embrace automation are likely to see an increase in client satisfaction. With faster turnaround times and fewer errors, clients receive a better service, and that’s something they’ll remember.

Still not convinced? Let’s look at some numbers.

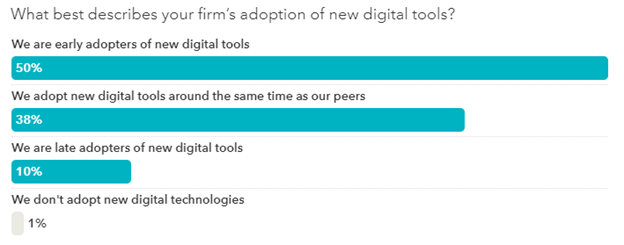

The 2024 Intuit QuickBooks Accountant Technology Survey of 1,046 UK accountants highlights how technology empowers accounting firms with essential tools and support to become the practice of the future.

Per the survey, more than 50% of the respondents plan to invest in AI, automation, blockchain, and machine learning technologies in the next 12 months.

Additionally, 1 in 2 (50%) respondents identified their firm as an early adopter of the latest digital tools.

The above numbers clearly indicate the industry’s growing inclination toward automation, making it essential for firms of all sizes to adopt the latest technology and automate and integrate their processes for maximum efficiency and productivity.

If automation has been on your radar but you haven’t taken the leap yet, 2024 might be the year to do so. With QX’s new, user-friendly tools available, implementing automation has never been easier, even for firms with limited tech experience.

Moreover, as clients become more tech-savvy themselves, they’ll come to expect faster and more accurate services. Firms that embrace automation can meet these expectations and stay ahead of the competition.

The future of accountancy isn’t just about crunching numbers – it’s about using technology to enhance the services you provide. Automation is here to stay, and the sooner your firm adopts it, the better equipped you’ll be to face the challenges of tomorrow.

Accountants willing to leap toward automation often ask, “Where do I start?” This is where QX can help!

As market leaders in outsourcing, we’ve developed a bespoke, user-friendly solution that can automate and integrate almost everything within your practice with one click.

Introducing QX PracticePro, a ground-breaking solution that makes all your software tools “talk” to each other by unifying them onto a single platform. Whether your tech stack is cloud-based or non-cloud-based, QX PracticePro can integrate all kinds of tools seamlessly, minimising errors and maximising efficiency.

Say goodbye to switching between multiple tools and doing everything manually. With QX PracticePro, you can save up to 2000 hours annually and utilise that time for higher-value activities.

In the race to stay competitive, accounting firms can no longer afford to ignore automation. It’s the next big thing in accountancy, and it’s already transforming how firms operate. From saving time and reducing errors to enhancing the quality of work, automation is an investment bound to pay off.

So, what are you waiting for? Embrace process automation today and take your firm from good to great.

Junaid is an experienced accounting professional with over 11 years of expertise in managing UK clients. He specialises in enhancing operational efficiency and profitability for accounting teams and has successfully transitioned client processes to automation using existing tools. His work has helped firms overcome inflationary and resource challenges while significantly improving gross profit margins.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.