The digital transformation wave has taken the corporate world by storm, and accounting is no exception. Gone are the days when accountants relied on conservative methods and endless paperwork to record and maintain data.

In 2024, with groundbreaking technologies revolutionising business, digital is the new way of life.

The paradigm shift of the global accounting industry towards digitalisation in recent years is evident from a 2023 recent survey by Top 10 accountancy firm Johnston Carmichael.

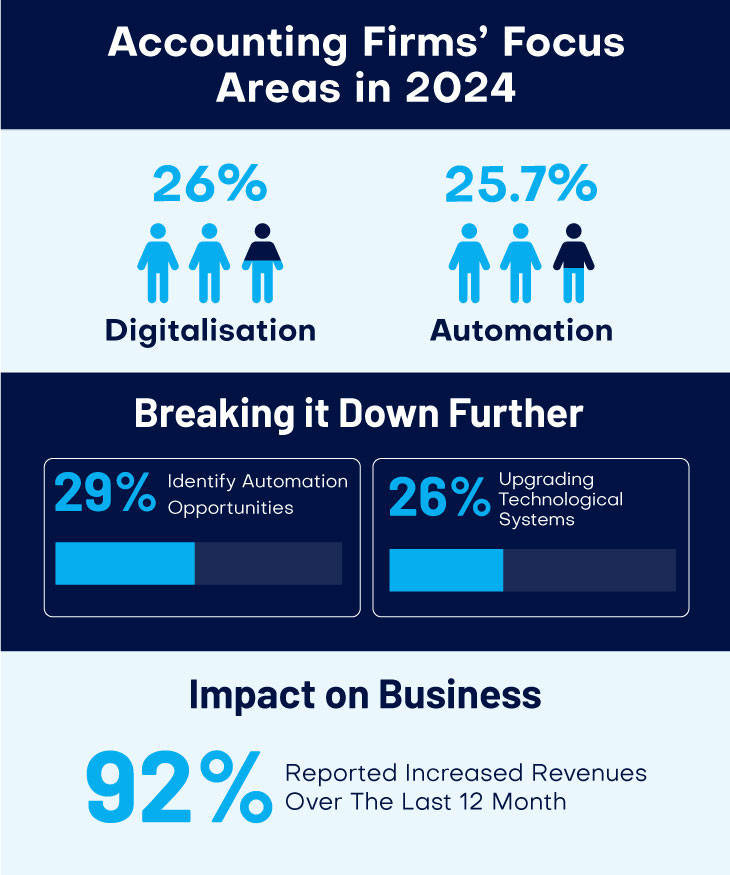

The research revealed that 26% (more than a quarter) of the respondents plan to focus on digitalisation in the next 12 months, followed closely by automation (25.7%).

The above numbers clearly show that digitalisation is the global future of accounting.

Recognising the potential and need for a digital revolution in the accounting world, the HMRC, too, has begun taking steps in that direction. With the imminent launch of the Making Tax Digital (MTD) initiative, it is only wise for accountants to switch to the modern paperless way of working.

Let’s face it – bookkeeping is a dreary job. Keeping track of every transaction, managing and filing receipts, and keeping the books updated at all times is not only cumbersome but also time intensive.

However, with technology and digitalisation, this tedious task is now set to undergo a revolution. Paperless bookkeeping is a simple and highly efficient way of maintaining your books minus the hassle of managing and retaining every transaction receipt for future use.

There are several handy digital tools that let you upload, track and review business records anytime, anywhere, for your convenience. One such example is MyWorkpapers, an intelligently crafted end-to-end paperless accounting and bookkeeping tool.

Paperless bookkeeping software is very simple to use.

We get it – digitalisation is a newer trend, and your staff may not welcome the idea at first. One of the biggest reasons for this is the long-held misconception that technology kills jobs. While changing your team’s outlook is a task in itself, training is also a time-consuming process.

One of the surefire ways to deal with this challenge is to outsource your bookkeeping. Alongside the ongoing technological revolution, outsourced bookkeeping services constitute a rising trend in the post-pandemic world.

A 2024 study revealed that the number of accountancy firms choosing to outsource their accounting and bookkeeping services grew notably in the last five years, with about a 40% increase in global spend and a 20% surge in interest.

Outsourcing offers a specific advantage to accounting firms aiming to integrate the latest technology into their processes. Outsourced staff is skilled and extensively trained to work on multiple bookkeeping tools and software so that you do not have to bear the additional costs and hassle of training your internal teams. This not only ensures higher efficiency but also increases turnaround times and your firm’s capacity to scale.

Several recent studies have also shown that accountants and accounting practices in the UK prefer to outsource bookkeeping to India owing to its cost-effectiveness. Hiring offshore accountants and bookkeepers in India not only helps you save big on their salaries but also offers the advantage of unmatched technical and communication skills.

The accounting industry is currently battling several challenges all at once. On the one hand, accountants are facing a massive shortage of skilled personnel to join their team, while on the other hand, the competition to attract clients and drive business is augmenting each day.

It’s no secret that, in 2024, accountants find it difficult to keep up with the growing demands of clients. Amidst this challenge, the last thing you want to do is spend time on cumbersome core tasks and miss out on growth opportunities.

Adopting digitalisation is a great way to simplify tedious tasks such as bookkeeping. Additionally, you can also opt for bookkeeping outsourcing in India to reap the benefits of offshore outsourcing for your firm.

It is a well-known fact that technology and outsourcing yield the best results when put together. To facilitate this advantage for accountants in the UK, QXAS has partnered with MyWorkpapers to provide a smart, technxologically fueled accounting outsourcing solution. The solution aims to take the tedium out of accountants’ jobs and facilitate greater productivity and efficiency.

To learn more about our services or avail evaluate our accounting and bookkeeping solutions risk-free, reach out to us at +44 208-146-0808 or drop an email at [email protected].

With a rich experience of curating content for various industries, Pooja believes in the power of words in marketing and building brands. She enjoys experimenting with different forms of content and is currently on a mission to add value to the accounting industry through her detailed and researched write-ups.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.