Accounting and finance are huge industries in the UK. These industries have functioned typically for several years, but recent developments have changed the way firms operate and gave the conventional accounting industry a reality check.

According to a study, over 50% of firms will outsource some or all of their accounting tasks by 2030.

Outsourced bookkeeping and accounting is emerging as a key trend in the UK, helping accounting firms stay resilient and succeed in a highly competitive market.

In the current scenario, it has become imperative for accountancy practices to focus on expanding their portfolio and adding value-based services for their offerings to survive the growing competition.

One of the easiest and most cost-effective ways of doing this is to outsource accounting and its core functions.

Bookkeeping is an essential component of accounting. It helps document a company’s financial transactions, which may come in handy during an audit or report preparation.

However, it is also a cumbersome task that takes up most of accountants’ time and prevents them from focusing on additional services. Therefore, several practices now look at outsourced bookkeeping as a plausible solution to their staffing and scalability woes.

There has been a notable rise in practices outsourcing tedious compliance tasks such as bookkeeping to reliable outsourcing providers. According to a study, over 50% of firms will outsource some or all of their accounting tasks by 2030. This number is estimated to grow in the post-pandemic world.

In this blog, we will delve into outsourced bookkeeping scope for accountancy firms and understand how it can benefit them.

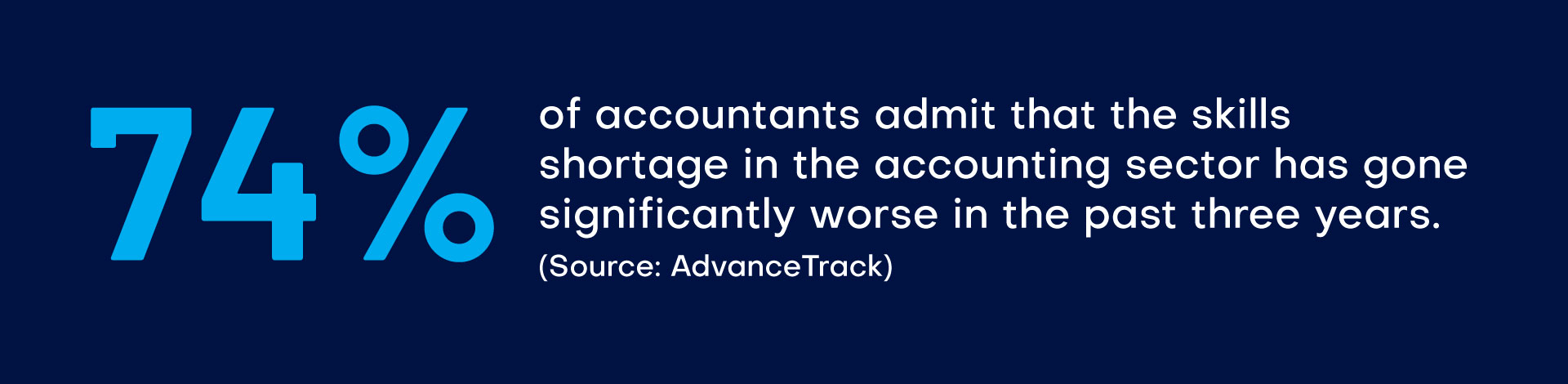

Accountancy practices need no introduction to talent shortage.

Over the years, these firms have struggled to hire skilled accountants and bookkeepers with up-to-date knowledge of the industry and good technical skills.

The impending staffing crisis is further aggravated as new-generation accountants prioritise their health, well-being, and career development over simply doing monotonous jobs.

With accountants moving to work with large accounting firms, small and mid-sized practices struggle to recruit and retain talented resources.

Short-staffed, these firms find it difficult to broaden their scope as most of their resources are occupied with core compliance tasks such as bookkeeping.

Dealing with the staffing challenges while keeping operational costs in check is challenging. An easy and surefire way to deal with this is to outsource bookkeeping services.

Top bookkeeping outsourcing companies employ highly skilled bookkeepers and train them extensively on UK accounting norms. Thus, these companies can effortlessly end the demand and supply gap for your firm.

Outsourced bookkeeping professionals are based offshore and work out of a delivery centre. These experts are trained extensively to adapt to diverse work cultures and manage complex bookkeeping functions.

They can work as a seamless extension of your time and help your firm grow effectively.

Each year, the competition in the global business world grows severely. Accountants with small and mid-sized practices constantly struggle to beat large firms and scale their practice.

To add to it, the growing staffing issues have further slowed down small practices’ efforts to attract new clients and retain the existing ones.

According to a Sage survey of accountants and bookkeepers, 82% of accountants agree that clients demand more today than five years ago. The pressure to provide more at lower prices and survive the ever-growing competition is real and exhausting. Therefore, it has become imperative for growth-focused practices to broaden their scope and add new services to their portfolio.

Adding new services, however, is a highly time and resource-intensive process.

Since accounting firms struggle on both fronts, outsourced bookkeeping for small businesses can be a viable solution.

Outsourcing your bookkeeping function helps free up your in-house team and thus generates capacity.

Your team can then focus on value-based services such as advisory and legal, which are in huge demand by clients.

Clients prefer working with a single provider to teaming up with multiple vendors for different services.

When you offer a complete package of services, coupled with value-based additions such as advisory and legal, your chances of attracting new clients increase manifold.

Value-based services can earn good profits for an accountancy firm. Further, adding new clients guarantees a steady flow of income throughout the year.

Thus, outsourced bookkeeping can help practices cut unnecessary costs, build capacity, earn profits, and scale effectively.

Must Read: An Accountant’s Guide to Outsourced Bookkeeping Services

Outsourcing helps put an end to accountancy firms’ staffing and scalability issues. But if you plan to use outsourced bookkeeping services as a medium of cost savings, the offshoring versus onshoring debate is critical for you.

Hiring onshore professionals may be convenient for a practice in terms of collaboration and communication. However, if we are to focus on cost savings, offshoring is the most effective solution.

Offshore outsourcing helps accountants save big on labor costs as opposed to onshoring. This is the primary reason accountancy firms in the UK outsource bookkeeping services to India.

In addition to competitive pricing, Indian accountants and bookkeepers are known for their up-to-date industry knowledge, technical expertise, and unparalleled dedication.

QXAS is a leading outsourcing company specialising in dedicated outsourced bookkeeping for accountants and accountancy practices. We offer customised staffing solutions for growth-focused practices and help increase their capacity to scale.

Our undying passion for growth and commitment to excellence has helped us grow from a 5-member startup to a leader in accounting outsourcing. Our values and dedicated team of experts are what set us apart. Here’s how QXAS can help scale your business.

To learn more about our services, call +44 208 146 0808, drop us an email at [email protected], or log on to Outsourced Accounting, Bookkeeping, and Payroll Services | QXAS UK (qxaccounting.com).

The scope usually covers recording transactions, bank reconciliation, managing accounts payable and receivable, preparing VAT returns, generating financial reports, and supporting year-end accounts for clients.

Start by listing the tasks you want handled, like data entry, reconciliations, or VAT returns, and set clear timelines and deliverables. Define responsibilities, reporting frequency, and communication methods to avoid confusion later.

Onshore providers usually focus on local clients, offering personalised service and face-to-face communication. Offshore providers, while more cost-effective, often handle higher volumes of work remotely with a stronger focus on process efficiency and scalability.

It should be detailed enough to outline all tasks, responsibilities, deadlines, and deliverables. A clear scope helps avoid misunderstandings and ensures both parties know exactly what’s expected.

For small businesses, the scope typically includes bookkeeping, payroll processing, VAT returns, management accounts, and year-end financial statements. Some providers also handle tax filing and cash flow reporting.

Hemant is a senior accounting leader with over 20 years of international experience across the UK and Ireland. His expertise spans bookkeeping, VAT, management accounting, and financial reporting in compliance with IFRS. He is recognised for successfully managing process transitions, building and leading high-performing teams, mentoring talent, and driving collaboration in multicultural environments.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.