Let’s face it payroll is both crucial and cumbersome. As an accountant, you know how much time goes into ensuring salaries are accurate, taxes are calculated, and deadlines are met. However, one small oversight can lead to penalties, disgruntled clients, and damaged reputations.

HMRC levies a penalty of £100 per 50 employees each month for delays in submitting P11D(b). Whether it’s a late submission or a miscalculated tax code, payroll errors can cost your firm and clients dearly. The financial hit can sting, but the loss of trust? That’s harder to recover.

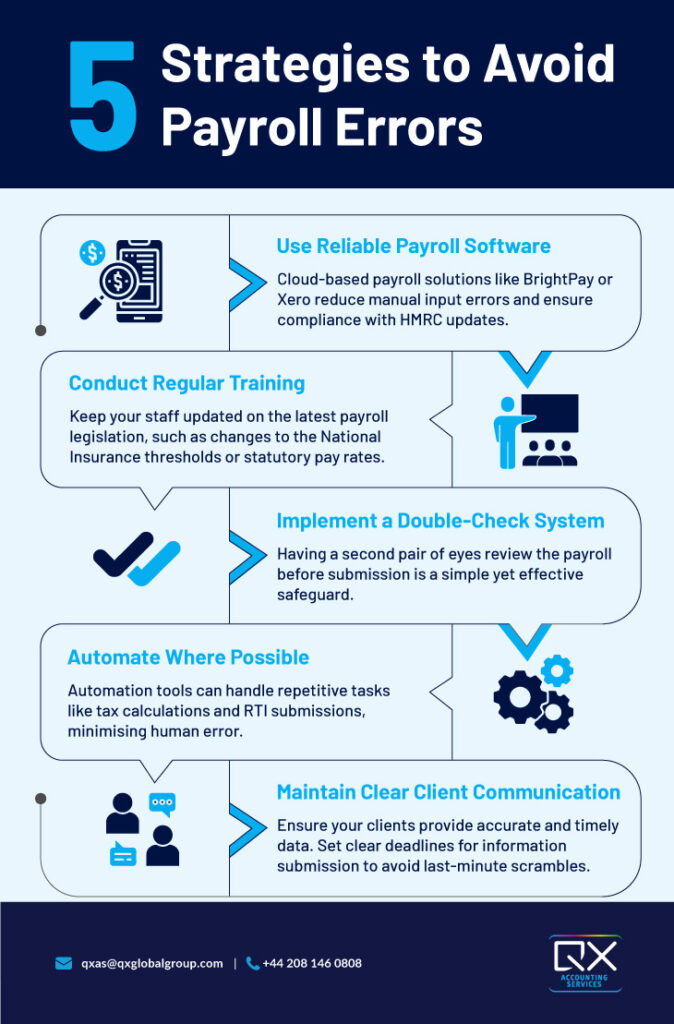

If payroll gives you headaches, you’re not alone. But there are ways to avoid costly mistakes and sail through the payroll season with confidence.

Payroll mistakes aren’t just embarrassing; they’re expensive. The fines from HMRC can add up, but the hidden costs—client dissatisfaction, wasted time, and employee turnover—are just as damaging.

Consider this: correcting a payroll error costs an average of £72 per payslip. If you’re managing payroll for 50 employees, that’s an extra £3,600 per payroll cycle—money you could have reinvested elsewhere.

If payroll feels like a constant uphill battle, payroll outsourcing could be your answer.

Here’s why it works:

With the payroll season approaching fast after the January 31 tax deadline, it’s the perfect time to plan your capacity. HMRC’s rules and regulations aren’t getting any simpler, and with the recent changes to Employment Allowance and NIC in the Autumn Budget, your clients will rely on you to keep them compliant.

Outsourcing payroll services lets you hit two birds with one stone error-free payroll and a more focused team. Why not start now and give yourself the peace of mind to tackle the upcoming season head-on?

QX Accounting Services is a reliable accounting outsourcing company specializing in payroll services for accounting firms. As a market leader in the outsourcing space, we bring focused expertise in the latest UK regulations, giving you access to 1,100+ certified accountants and payroll experts.

Trusted by 350+ accountancy firms across the UK, our payroll outsourcing services are fast, accurate, and reliable. Our bespoke solutions have helped top accountancy firms achieve remarkable outcomes in terms of year-on-year revenue growth, streamlined processes, and 40% greater accuracy without overwhelming their internal teams.

Here’s why QXAS is a partner of choice for leading accountancy firms:

Call us today at +44 208 146 0808 or email us at [email protected] to learn how QXAS can support your firm with payroll capacity planning.

Payroll doesn’t have to be a constant source of stress for accounting firms. By avoiding common pitfalls, using the right tools, and outsourcing payroll services when necessary, you can transform it from a problem to a profit centre.

Mitul is a highly experienced UK Payroll professional with over 14 years of expertise in payroll processing, compliance, client management, and team leadership. He is recognised for ensuring seamless compliance with UK payroll regulations and building strong client relationships through the delivery of accurate, high-quality payroll services.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.