The Ultimate Guide to Accounting Outsourcing

Accounting firms face a string of challenges in modern times. While staffing and technology have long been subjects of concern for accountants, there’s a need to work toward the greater goal.

Modern accountancy firms now aim to expand operations and service offerings, increase the top line, and generate year-on-year profits from existing services. Core services like payroll and bookkeeping that have long been considered time-intensive and unprofitable, are now evolving. Specialised services such as audit and assurance, and advisory are rapidly gaining momentum, coercing firms into adding them to their offerings.

But all of these goals must be achieved while remaining sustainable, retaining your existing team and preparing for the future. This is where most firms struggle and turn to help.

As your accounting practice grows, accounting outsourcing is the perfect way to reduce costs, increase efficiency, take on more clients and boost profitability.

This accounting outsourcing guide compiles all the information and insights you need to ensure you make the most out of your outsourcing partnership and achieve your goals.

The Basics of Outsourcing

There has been a drastic change in the way we work over the last few years. With the advancement of technology, globalisation, cloud computing, customer expectations, labour costs, and skills shortages, it has now become the norm for many businesses, including accounting practices, to outsource various aspects of their business to specialists in overseas countries like India.

So, what is accounting outsourcing? And why is it relevant?

Simply put, accounting outsourcing refers to an accounting firm hiring a third-party organisation to perform activities or services that are traditionally handled in-house.

Accountants often hire offshore specialists to complete various accounting- and finance-related functions of a practice. In today’s dynamic work environment, it can be exceedingly difficult to manage all aspects of an accounting practice in-house. Routine accounting, tax, and payroll jobs are tedious and time-consuming, which can take away valuable time from boosting business growth and scaling the practice.

Must read: Accounting Outsourcing Vs. Offshoring: What’s Right for Your Firm

Why Do Accounting Practices Outsource

There are several benefits of outsourcing for accounting firms, including:

Cost reduction: Hiring and training new accountants can be pretty expensive. Additionally, expenses like salaries, holiday covers, recruitment costs, etc., add to your overhead costs. With outsourcing, you gain access to highly skilled accountants at affordable rates. In the long term, hiring an outsourcing company can lead to extensive cost savings for your firm.

Quality management: Manual processing can lead to several errors. On the flip side, hiring an outsourcing specialist will ensure that you get high-quality work that’s both accurate and compliant.

Access to skills and resources: Accounting outsourcing companies employ qualified and dedicated offshore workers in various accounting, tax, and payroll functions. Apart from taking on more clients and improving your services, outsourcing gives you freedom from the pressure of recruiting or reducing staff according to the peaks and troughs of the business year.

Greater focus on core business objectives: Outsourcing is an excellent strategic tool for the growth of your practice. In addition to increasing the bandwidth of your existing workforce, outsourcing will allow your staff to utilise their time on client servicing and high-value tasks.

Productivity and service improvements: With offshore staffing, your practice will be able to increase its profitability and operational productivity. Furthermore, you’ll be able to scale your services and your practice without the need for hiring additional employees.

If you are unsure when you should consider outsourcing your accounting firm’s operations, here’s a quick video to guide you.

Accounting and Bookkeeping Services: What Can Be Outsourced?

Outsourcing specialists can handle a variety of accounting and finance functions, including:

- Bookkeeping

- Payroll

- Audit support

- Financial reports

- Management accounting

- Tax preparation

- Year-end accounting

- Making Tax Digital

Turnaround Time for Accounting Outsourcing

Quick turnaround times are one of the most significant benefits of accounting outsourcing. Based on your requirements, a specialist can deliver the allocated work as quickly as 24-48 hours or anywhere from 3 to 7 days.

[bgimage_contentcta title=”Download Now” url=”https://qxaccounting.com/uk/guide/qxas-service-offerings/” bgimage=”https://qxaccounting.com/usa/wp-content/uploads/sites/5/2022/01/MicrosoftTeams-image-193.jpg”]

QXAS Service Brochure

Know more about QXAS US and our services in this brochure.

[/bgimage_contentcta]

Cost of Accounting Outsourcing

One of the main benefits of accountancy outsourcing is cost savings. Managing accounting functions in-house can become extremely costly. There are several costs involved, such as recruiting, hiring, training, and so on. Outsourcing will take away all these additional costs and offer significant savings in the long run.

Furthermore, it’s a known fact that accounting is a highly time-consuming and administrative heavy task. Managing routine tasks in-house will take away most of your time and efforts. By outsourcing this function, you and your employees will have more time on your hands to focus your efforts toward higher-value tasks, like advisory services.

How much will it cost?

The cost of outsourcing your accounting function will differ based on the outsourcing model you choose. One of our most popular models is the dedicated resource model which allows an individual or a team to work exclusively for your firm.

The cost of outsourcing depends on a number of factors, including the engagement model you choose. Let’s take a look at each of these models in detail.

Full-Time Employee (FTE) or Dedicated resource model: A dedicated employee is assigned to you at a fixed fee per month if you opt for this model. Your practice will be billed a fixed amount at the end of each month. Choosing this model will allow your practice to have more control and will enable you to better plan and manage work for the dedicated FTE. Additionally, it’s more economical than hourly rates, especially if you have high volumes of work.

Block-of Hours model: This model is quite similar to the pay-as-you-go model, but the difference is that you can buy a pre-paid block of hours (300, 500, 600, 900, 1200 hours, etc). The hours used will be deducted from the total number purchased. This model will enable your practice to receive larger discounts as you opt for a larger block of hours.

Must Read: Accounting Outsourcing vs. Offshoring: A Synonym Check Could Save Your Accounting Firm

The Focus on Quality

Quality is of utmost concern for any practice when outsourcing their accounting function. The outsourcing partner needs to ensure quality and accuracy when delivering results. Therefore, it’s essential to start your outsourcing journey by choosing the right provider.

Here are a few steps you should consider following while choosing an accounting outsourcing provider:

Spend more time on the selection process: Your outsourcing relationship might end up being long term, so you must choose the right partner for your practice. One way to do this is to assign one project to multiple outsourcing companies and compare the quality of work to decide on the best fit.

Do proper background research: The internet is the best place to find potential outsourcing partners. Search for the best accounting outsourcing companies online and do an in-depth search about them. Find work samples, check for online reviews, check for awards and get to know their market reputation among other things.

Get to know how they work: An experienced and efficient outsourcing company will have standardised processes in place to ensure excellent quality and faster turnaround times. Have a detailed discussion regarding their processes and workflows to better understand how you can collaborate.

Discuss how mistakes will be resolved: It’s human to err, but mistakes can be costly. Ensure you have a detailed discussion regarding how the company will rectify mistakes and how long it will take to make any corrections. This discussion will help you both set realistic expectations.

Provide clear briefs: When handing over a job, it’s pertinent that you provide clear and detailed instructions about what you’re looking for. Provide the outsourcing company with all the necessary details needed to do the job and confirm whether they’ve understood the requirement before allowing them to proceed with the job.

Communicate regularly: Communication is key for any business collaboration to succeed. Speak to your outsourcing partner at the onset of your relationship and discuss how you’ll communicate regularly. Choose your communication medium and agree on regular updates on specific days/weeks.

It’s important to note that the outsourcing team will have a learning curve to speed up your requirements and standards. Therefore, it’s a good idea to oversee the initial jobs you share with them and provide requisite feedback. Once you’re confident with the quality and timeliness of the jobs being done, you can take a backseat and allow your partner to take over the different accounting jobs you want to be completed. However, ensure that you and your team are available to resolve any queries the partner may have and provide regular feedback.

Accounting and Bookkeeping Software and Tools

Nowadays, accounting practices need to equip themselves with the right tools and technology to succeed in the competitive UK market. Without the right tools, your practice will find it challenging to meet deadlines and offer excellent service to clients.

You’ll easily find a variety of different accounting tools in today’s market. Some of the major software packages that accountants use include Sage, IRIS, Zoho Books, FreshBooks, CCH, VT Software, Xero, Thomson Reuters, QuickBooks, TaxCalc, FreeAgent and MoneySoft.

When searching for an accounting outsourcing partner, it’s a good idea to choose someone who works with all major accounting and payroll software systems. An accounting partner who has the right technical expertise and staff training facilities will be an asset to your practice. Additionally, look for someone who is technology agnostic and can support existing accounting software that you use.

An outsourcing partner who is capable of adopting new technologies and delivering results with new software within concise time frames can be extremely useful to your practice in the long run.

Getting Started with Outsourcing

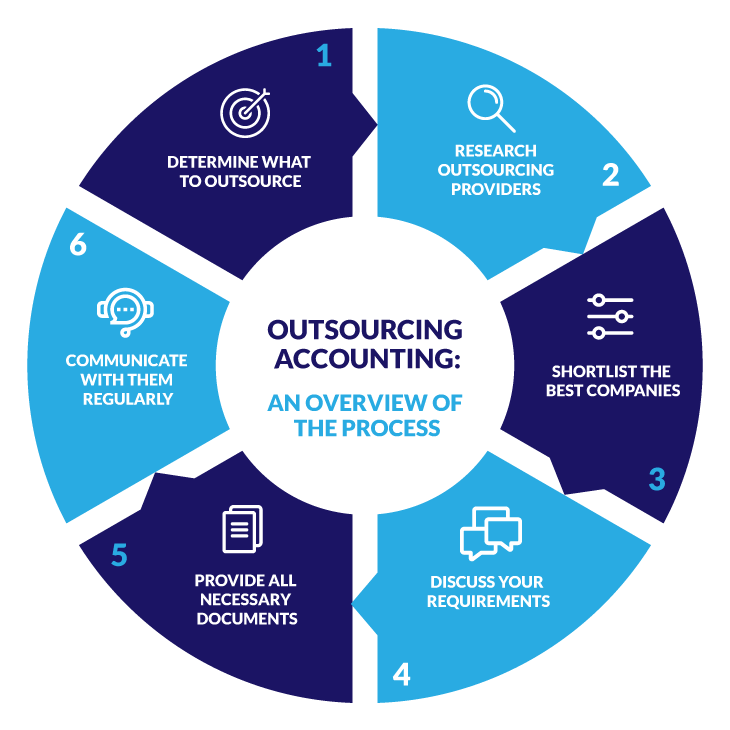

The idea of outsourcing your accounting function to a specialist can seem challenging. A lot of accountants outsourcing for the first time often ask us, “How does accounting outsourcing work?” Here are some tips to help you understand the process and get started:

- Discuss what parts and how much of your accounting you want to outsource. It’s possible to outsource just certain processes or the entire function.

- Do your research. Go online and find companies that match your requirements. Check out their references and ratings before making a final decision.

- Shortlist specialists and reach out to them for additional information and quotes. Ensure you ask all the pertinent questions related to your needs. It’s also a good idea to verify their qualifications. Check whether they are recognised by institutions like ICAEW, ICAS, or CIMA.

- Now, you’re ready to start working with your shortlisted specialist. Connect with them and discuss your requirements in-depth before creating SLAs and a contract. Review the final documentation and fees before signing the dotted line.

- Provide the specialist with all the relevant information and documents required to do the job, such as bank statements, bills, invoices, receipts, credit notes, purchase orders and previous years’ accounts. Many specialists offer a checklist of items they require to do the job.

- Regularly communicate with your specialist and review their work once ready.

Must read: The Definitive Guide to Recruiting Outsourced Accountants for Your Accountancy Practice

Communication with the Offshore Team

Communication is key when it comes to accounting outsourcing. Efficient communication leads to meaningful collaboration and consultation with your specialist. It’s important to keep the lines of communication open throughout your relationship with the specialist.

When discussing your requirements, it’s a good idea to ask about communication styles, standards, frequency and methods so that you can gain the most out of this partnership. Additionally, consider having a dedicated resource (SPOC) who will communicate with the specialist and share all the relevant information and documentation.

Next, ensure that you get job updates regularly. You can schedule weekly, fortnightly, or even monthly meetings with the specialist to understand how your tasks are being handled. Remember to use these meetings to iron out any issues and to figure out ways to improve your association.

Here are three easy tips of how to improve communication between your practice and choose the right accounting outsourcing partner:

Have a single point of contact (SPOC): It’s always a good idea to have one person who will be the designated go-to contact for any queries or information required by the outsourcing partner. This person will be considered the SPOC and will be the sole individual who collects and collates the information required by the outsourcing team. The SPOC will also ensure that there’s no break in communication and all queries are resolved quickly and efficiently.

Schedule updates: Regularly schedule update calls with both your in-house teams and your outsourcing partner. The in-house team can give you a briefing regarding the status and quality of incoming work. The outsourcing team, on the other hand, can brief you on the current status of jobs, seek feedback, and discuss any issues they might be facing. You can decide how often you want to hold these update meetings, whether it’s weekly, fortnightly, or monthly.

Integrate the outsourcing team with your company: The outsourcing partner will essentially become an integral part of your practice. So, it’s a good idea to consider them just as you would your in-house staff. Have regular meetings, share positive feedback, and get their input where necessary. The more integrated they are with your practice, the better the final results.

Frequently Asked Questions about Outsourcing

1. Why should I outsource my accounting function?

When you outsource your accounting function, you’ll be able to better focus on your core business operations. Outsourcing specialists employ highly qualified professionals and their expertise at a significantly lower cost.

Some of the main benefits of accounting outsourcing include overcoming staffing shortages, building scalable teams, reducing the cost of operations, optimising processes and improving the service quality.

2. What are the main benefits of accounting outsourcing?

- Time and cost savings: Accounting outsourcing can bring in significant cost savings. In-house management involves a lot of overhead costs, such as recruiting, hiring, training, and so on. Outsourcing will take away all these additional costs and offer savings in the long run. Managing tedious and repetitive accounting functions in-house will take away most of your time and efforts. By outsourcing this function, you and your employees will have more time on your hands to focus your efforts toward higher-value tasks, like advisory services.

- Latest tools and technology: Accounting outsourcing companies are often up-to-date with the latest tools and technology. In fact, many providers often have dashboards that can monitor various accounting-related data. It can be quite costly to purchase and manage these tools in-house. With outsourcing, you’ll gain access to the best accounting tools in the industry at no additional cost.

- Enhanced security: If security is a concern for you, then choose an accounting outsourcing provider that adheres to global security protocols. Most providers will employ multiple server locations and data encryption on state-of-the-art systems to store and protect data.

- Scalability: It can be challenging to scale your practice without proper support. Furthermore, recruiting, hiring, and training accounting specialists can be expensive each time you expand your practice. With outsourcing, you’ll be able to effortlessly scale your practice without the need for hiring in-house staff. Outsourcing specialists can take on more work at a short notice, which will significantly benefit your business as it scales up.

3. Which accounting functions can I outsource?

- Bookkeeping

- Payroll

- Financial reports

- Management accounting

- Tax preparation

- Year-end accounting

- Making Tax Digital

4. What skills or qualifications should I look for in an accounting outsourcing partner?

- Relevant experience

- Use of industry-standard tools and software

- Certifications/Accreditations of employees

- Flexibility

- Transparent communication

- Standard security measures

- Attention-to-detail

- On-time delivery

5. What data security measures should I expect from an accounting outsourcing partner?

- Compliance with geography-specific standards like GDPR and SOC

- High data security standards that comply with standards like ISO 27001

- These standards will ensure that most security loopholes are plugged and will include:

- Security against potential data breach

- Enterprise Access System for employees

- Secure remote access (VPN)

- Access cards and biometric login for all employees

- Confidentiality and Non-Disclosure Agreements for employees

- In-house CISO and DPO

- All employees trained on data protection and security awareness

- 24*7 monitoring of work premises

- Anti-Virus Protection and Back-Up Drive Managers for workstations

- Enterprise-level malware protection at gateway and email server

- IT systems compliant with the UK government-backed CyberEssentials scheme

6. What technology and software can I expect from a specialist partner?

An experienced accounting outsourcing partner will have the capability to work with all major accounting and collection software systems. They are up-to-date with the latest technologies and adapt to them within very short time frames.

Some of the major software packages you should look out for include:

- QuickBooks

- Sage

- Xero

- FreeAgent

- IRIS

- Zoho Books

- TaxCalc

- MoneySoft

- VT Software

7. Can I outsource specific tasks, or do I need to outsource the entire function?

It’s entirely up to you which functions you wish to outsource. You can either outsource the entire accounting function or outsource certain key functions. Depending on your requirements, the outsourcing partner can tailor their offerings according to your needs.

The accounting outsourcing partner works closely with your in-house team to get the tasks done and deliver as per defined SLAs. This means that it is easy for your business to outsource just specific accounting tasks that are non-optimum to be done in-house.

8. What will my clients think?

For many practices, concerns surrounding their clients’ views on outsourcing often hamper the idea of outsourcing their accounting function. However, it’s important to note that accounting outsourcing is a norm these days with companies across the globe embracing this practice.

Generally, clients may have a few concerns surrounding outsourcing. But, in the end, clients are usually pleased with this method as long as it offers them quality work at great prices.

Some potential client concerns include the following:

- Offshoring local jobs

- Concerns regarding work quality

- Worries about data security

- Worker conditions overseas

It’s important to speak to your clients regarding any concerns they may have and assure them of quality and efficiency with regards to their jobs. You could start by explaining the benefits of outsourcing some or all parts of a client’s accounting function to a specialist.

As you may already know, outsourcing has several benefits, such as lower costs, faster turnaround times, accuracy, and superior quality. A brief discussion regarding these benefits will definitely assuage any clients’ concerns. Additionally, outsourcing specialists today are extremely particular about quality and data security. Most specialists focus on offering great quality with utmost security measures in place to ensure data security.

Must read: Does Outsourcing Accounting Services Make You Lose Clients?

9. What will my staff think?

Primarily, your staff may be concerned regarding job security. Therefore, it’s essential to speak to them regarding their positions and expect changes moving forward. Make them understand how outsourcing supports, not replaces teams.

One of the biggest benefits of accounting outsourcing is the amount of time it frees up for a practice to focus on higher-value tasks like advisory services or upscaling. With the outsourcing specialist handling mundane and repetitive tasks, your staff will be able to spend more time working with clients, upskilling, and handling matters that require more time and expertise.

10. What are the potential drawbacks and pitfalls of partnering with an accounting outsourcing provider? Can they be avoided?

- Hidden costs: If your agreement doesn’t cover any additional costs or services, you might be faced with the dilemma of paying more than what you agreed upon. Therefore, it’s important to iron out any issues you may face at the start of your business relationship. The business agreement should outline the exact details of what both parties expect from each other and the exact services that the specialist will provide to your business.

- Concerns regarding security and confidentiality: It could be daunting to share confidential data and intellectual property with an outsider. There may even be concerns over your data being compromised. It’s important to put in place safeguards when sharing such data with a specialist. You can avoid potential issues by including a protective clause in your business agreement and highlighting the repercussions if there’s willful misuse of data. You can also have a separate non-disclosure agreement with the partner.

11. How much experience should an accounting outsourcing partner have?

It’s a good idea to go with an outsourcing partner who is experienced and has been in business for quite some time. Additionally, you should also vet the qualifications and accreditations of the staff. You can use customer references from previous clients to decide whether the outsourcing partner is a match for your business.

12. Are there any data security measures that I need to put in place?

As you are sharing important financial data, it is important to have proper data security measures in place. Enforce standard procedures to share your financial information in a secure manner.

For the UK, look for outsourcing partners that comply with ISO information security standards, the UK Data Protection Act, GDPR, and/or any other relevant standards.

Lastly, it’s critical that client data is stored in highly secure servers with limited access on a need-to-know basis. So, feel free to ask your provider about how they manage these details.

13. What are some of the key factors I should consider while evaluating a potential outsourcing partner?

Ensure you conduct proper due diligence before onboarding an outsourcing partner. Some of the key factors you should look into include:

- Business experience: How long have they been in business?

- Qualifications & Expertise: Does the team have accreditations, certifications, frequent upskilling?

- References: Speak to former clients and learn about their experiences with the specialist

- Business model: Is there a conflict of interest? What is their revenue model? Do they offer flexibility?

- Internal controls: Are they up-to-date and compliant with legal and regulatory compliance requirements? Do they follow strict security measures? Are their employees trained on data security?

Why Choose QXAS

QX Accounting Services is a market-leading outsourcing provider of audit, tax, accounting and consulting services to entrepreneurial growth-focused accounting practices globally. Our core purpose is to empower the growth and transformation of accounting firms with our highly qualified team of accountants, auditors, tax professionals and consultants.

With our support, your practice will be able to function more efficiently, free up staff to focus on higher-value tasks and drive profitability by reducing costs.

QXAS is a part of QX Global Group with over 3500 employees based in our delivery centres in the USA, India, and our UK head office. Our accountants are trained to UK accounting standards and are proficient in the use of Sage, Xero, QuickBooks, TaxCalc, and other popular accounting software.

We have worked with over 500 accounting firms across the UK, including some Top 20 industry leaders, and have a CSAT score of 95%.

We are India’s first accounts outsourcing company to be GDPR compliant via the British Standards Institution’s BS 10012:2017 framework. We are also fully compliant with ISO 27001 for information security, and ISO 9001 for Quality. All our processes and work centres are Cyber Essential and ISO 27001 certified.

Our Values

Our day-to-day functioning is guided by our PRECISE values, which dictate how we act, make decisions, and work with each other, our clients, all our stakeholders and all our ventures.

- P stands for PASSION: This represents the passion we have for our work and the desire to do it right the first time.

- R stands for RESPECT: This is how we treat and consider our colleagues and clients.

- E stands for ETHICS & INTEGRITY: We work with utmost honesty & conduct every action in an ethical way.

- C stands for COLLABORATION: We work closely with our clients to align with their goals & achieve mutual success.

- I stands for INNOVATION: We focus on early trials and faster success.

- S stands for SELF-AWARENESS: This is regarding our skills, capabilities and behaviours.

- E stands for EXCELLENCE: We strive to deliver the best for our colleagues and clients.

Get a Risk-free Trial Today

We will take up one job based on your requirements so that you can evaluate our service without any commitment. You can learn more about our risk-free, no-obligation trial here.

Contact Us

You can also easily reach out to our team of experts at [email protected] or call +44 208 146 0808 for any of your accounting outsourcing queries. Additionally, you can also learn more about how to contact us here.

Pooja Kshirsagar

With a rich experience of curating content for various industries, Pooja believes in the power of words in marketing and building brands. She enjoys experimenting with different forms of content and is currently on a mission to add value to the accounting industry through her detailed and researched write-ups.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Our Latest Insights

Let’s Work Together

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.

Book a Virtual Meeting

Book a Virtual Meeting  Book an In-person Meeting

Book an In-person Meeting