Every business has its distinct way of handling payroll. Over the years, payroll has changed significantly and so has the way businesses perceive it. Unlike traditional times, it is a lot more complicated, involving multiple regulations and calculations.

One of the major reasons payroll is now more difficult to manage in-house is the constant law and compliance changes. Different countries have different regulations with respect to payroll. Some of these include labour laws, state regulations, pension schemes, and statutory compliances.

These regulations are difficult to understand, let alone execute. Many payroll administrators and HR professionals do not fully comprehend them, making it difficult for firms to compute payroll. Moreover, the legislation keeps changing regularly. Therefore, it is important for a company’s payroll team to constantly keep track of the changes and implement them into payroll.

Consequently, outsourcing has become a common practice among businesses and accounting firms. Payroll outsourcing allows accountants to make the process error-free and efficient and create capacity for their firm.

On this page, we will assess modern-day payroll outsourcing challenges, its technicalities and nuances. We will also discuss the hiring and management of payroll teams and the benefits of outsourcing payroll services.

37% of UK employers report that the time spent on performing payroll tasks manually causes stress for them and their team.

Businesses all over the world have undergone a digital transformation over the last few years. With it, the payroll function has evolved significantly.

In the early 1940s, businesses manually recorded employee attendance and leaves in ledgers. This was a time when human resource departments largely depended on manual paperwork. However, even during these times, payroll services outsourcing was a common practice.

By the 1980s, HR professionals had begun using the latest computer technology to simplify payroll processing. Gradually, the payroll industry saw the emergence of computerised software that could automate complex payroll calculations.

The advent of cloud technology in the 2010s was a turning point for the payroll business. It helped accountants save massive volumes of data on secure servers and access it quickly whenever required. It also made data storage safe and secure, significantly boosting global payroll management.

Currently, most enterprise-level processing solutions use cloud payroll technology to store and access data. With technology constantly evolving, businesses are also looking at other technologies such as Artificial Intelligence (AI) to make payroll processing more intelligent, efficient, and hassle-free.

It is, therefore, imperative that technology is the future of payroll. To adopt these changes into their system, accounting firms need highly skilled payroll professionals fluent in the latest technology. However, this can be challenging in the face of a persistent talent crisis. This is the reason outsourcing payroll to offshore destinations like India is gaining pace.

The global coronavirus pandemic changed the way companies function. With many people working remotely or in a hybrid manner currently, payroll management has become increasingly challenging.

According to a 2024 study, 87% of UK businesses have adapted to hybrid working. Additionally, 85% of managers believe that having remote workers will become the new normal for many teams.

In the remote working scenario, it is difficult for HR professionals to record employees’ work timings, attendance, leaves, expenses, and compensation, making this one of the common challenges in payroll processing. While hard copy management is not viable, email coordination is chaotic and unfavourable. This leaves companies with only one solution – to rely on technology and professional payroll administrators.

However, finding and retaining skilled talent is challenging for accounting firms. Additionally, even with the reliance on technology, payroll processing and management isn’t all easy. To begin with, payroll professionals must be highly equipped with their clients’ processes and software.

To add to it, each country has its own set of regulations with respect to payroll computation. So, if you deal with a firm that has a globally spread workforce, you also probably need a dedicated payroll team that functions within specific geographies.

A practical solution to this challenge is to outsource payroll services. Outsourcing helps accounting firms to hire technically skilled and highly experienced resources from any part of the world. These professionals have up-to-date knowledge of all the payroll-related regulations, making it easier for your firm to manage the function.

With outsourcing, you can delegate complex payroll tasks to experts and thus create capacity for your firm to focus on other higher-value services.

Payroll computation is complicated. Since it involves taking into account multiple regulations and performing numerous calculations, it is no longer a job that HR professionals can handle solely. You need skilled payroll experts to understand and process these calculations, making businesses dependent on external support.

Let’s understand some of the basic calculations that are imperative to the UK payroll system. When computing an individual’s payroll, an employer considers their attendance and leaves, usual work hours and furloughed hours, nature of employment such as full-time, part-time or contractual, claims and expenses, and other benefits such as maternity or holiday pay.

Further, the payroll of a salaried individual in the UK includes components such as taxes payable, National Insurance contributions, pension schemes, student and postgraduate loans, etc.

While the former information can be auto-compiled through an attendance and tracking software, the latter involves more comprehension. Since the government’s regulations keep changing constantly, payroll professionals may find it difficult to stay abreast of them.

Often, HR professionals spend considerable time understanding these components, but by the time they master them, the regulations undergo fresh changes. Therefore, it only makes sense for businesses to appoint experts to handle their payroll.

But the challenge with accounting firms is that time-intensive compliance tasks like payroll take up most of their time. Besides, it is difficult for firms to add more members to their teams in the face of the global talent crisis.

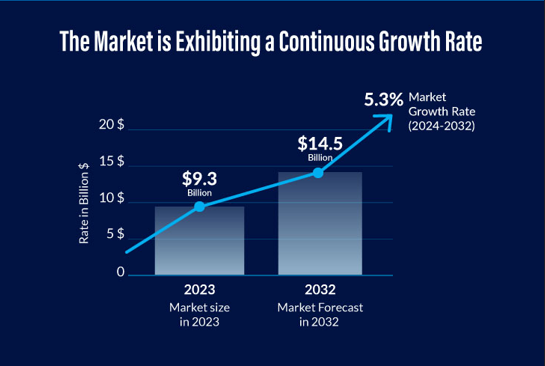

Payroll outsourcing has thus gained tremendous momentum worldwide post the coronavirus pandemic. In 2021, a QXAS survey of sixteen UK accounting firms revealed that as many as 87% of accountancy firms already outsource or plan to outsource their payroll in the coming years.

Outsourcing is the quickest, most effective and economical solution for accountants to delegate their clients’ payroll and get it done by certified experts.

As mentioned above, payroll computation involves a series of considerations and calculations, making it a complex and time-intensive process. In addition, it can seem further challenging if you do not use the latest payroll technology and software.

A recent study reported that 25% of UK PAYE employees have received incorrect paycheques from their employer at some time.

Since many businesses do not have a dedicated payroll team to manage this function, they rely heavily on their human resource professionals to get it done. But these professionals may not be skilled and completely equipped to understand and manage payroll, making it prone to error.

And what happens when there are errors in payroll? You may be confronted by unhappy employees and may also be liable to pay hefty penalties. This is the reason most businesses delegate their payroll work to professional accounting firms.

However, accounting firms often deal with capacity issues and are currently understaffed. Finding and retaining skilled payroll administrators is challenging for these firms in such a situation. This creates additional pressure on existing accountants to manage payroll, preventing them from focusing on skill development and higher-paying services.

Several recent surveys have revealed that accountants are overworked and stressed during the busy payroll and tax seasons. This causes a significant impact on the quality of their work and can result in severe quality and compliance issues.

An easy way to tackle this challenge is to outsource your needs to a reliable UK payroll service provider. Leading outsourcing providers guarantee the best quality services through highly experienced professionals, thus ensuring you never go wrong with your clients’ payroll.

When it comes to computing payroll for a large workforce, there are several challenges. To add to it, if the workforce is spread globally, the challenges only increase. As an accounting firm, you will need to employ competitive measures to ensure you get your clients’ payroll right.

Here are a few ways to tackle the challenges in payroll process without losing focus on your firm.

If you are still using traditional methods to get your clients’ work done, we highly recommend switching to cloud-based software. There are several cloud payroll software companies in the market that provide end-to-end solutions to accounting firms.

If you work with an outsourced payroll service, assess their technical proficiency in advance. Ask them about the software they use and assess if it aligns with your firm’s requirements and goals.

No matter how much you learn about payroll legislation, it will never be enough. The regulations pertaining to employee contributions, loans, insurance, etc., constantly keep evolving.

If you own or manage an accounting firm that takes up payroll work for clients, you will need to always remain abreast with these changing regulations. Additionally, if you deal with clients with operations in several countries, you will need to acquaint yourself with the payroll regulations of those countries as well.

Managing payroll isn’t an easy job. Plus, if you work with multiple clients with a global workforce, you will always be occupied with basic compliance tasks. This can prove to be a roadblock to your own firm’s growth.

Payroll outsourcing services can be instrumental in helping accounting firms effectively manage their clients’ payroll without worrying about staffing and capacity challenges. By delegating your payroll workload to certified outsourced experts, you can free up your team and indulge in skill development, better client servicing, high-profit services, and more.

If yes, your search ends here.

QXAS is a market-leading accounting outsourcing company specialising in professional payroll services for accountants in the UK. We have a dedicated team of over 1000+ accountants and payroll specialists committed to your growth.

We provide offshore as well as onshore FTE solutions for payroll outsourcing, coupled with all-round support. Our engagement models are designed to suit the diverse needs of growth-focused accounting firms at competitive prices.

To hire a payroll specialist for your team or learn how outsourcing can benefit your practice, call us at +44 208-146-0808 or drop an email at [email protected].

Mitul is a highly experienced UK Payroll professional with over 14 years of expertise in payroll processing, compliance, client management, and team leadership. He is recognised for ensuring seamless compliance with UK payroll regulations and building strong client relationships through the delivery of accurate, high-quality payroll services.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.