Payroll is a complicated business process. Many accountants and accounting practices deem it an unprofitable service and prefer not to add it to their offerings. However, payroll can easily be made profitable with comprehensive payroll outsourcing services.

Payroll outsourcing is the most effective solution for practices seeking to expand their horizons and add to their existing services but struggle with inefficiencies. By outsourcing the right payroll services for accountants, practices can quickly add a new service to their offerings and achieve higher profits.

On this page, we will talk in detail about payroll outsourcing and try to address every question that accountants and practices may encounter on the topic.

In the simplest of words, payroll outsourcing refers to transferring your payroll process into the able hands of experienced professionals who can handle and execute it efficiently.

Many business firms struggle to deal with the complexities of payroll and hand over the job to accountants or accountancy practices. However, practices may not always have the capacity to execute their clients’ payroll effectively. Plus, the added pressure of delivering work right on time during the peak payroll season adds to the woes of accountants.

Payroll outsourcing helps accountants transfer the payroll process, either partly or entirely, to experienced offshore payroll experts. These professionals are up to date with the ever-changing payroll norms and are trained extensively to work on complex payroll requirements.

Accountants can seek the expertise of experienced offshore professionals through payroll outsourcing services and make it a profitable task for their business.

Experts predict, in the next 3 years, 80% of businesses would have outsourced part or whole of their human resource responsibilities to a third-party payroll services provider. Payroll outsourcing is thus a trend to look out for in 2022.

Payroll is not often a readily offered service by accountants as it is a time and resource-intensive activity. But what if we told you that payroll could earn you profits and help you retain clients better?

Businesses nowadays prefer to partner with a single vendor for an entire gamut of services instead of approaching multiple vendors for different tasks. Thus, offering a complete package of services increases your practice’s chance of retaining clients better, ensuring complete client satisfaction, and even adding new clients for greater scalability.

Payroll is an important service that firms look for when partnering with accountants. Thus, payroll is a highly promising add-on service that can drive significant profits for accountants.

As discussed above, adding payroll to your array of services can help you retain your existing clients and ensure better client satisfaction.

When you manage the accounting process for a client, they must regularly share their payroll data with you. This step can be skipped altogether if you manage the client’s payroll function as well, thus reducing their workload.

Isn’t it convenient for customers and clients to find everything under one roof? This is the exact reason the concept of supermarkets was envisaged. When your clients find all critical services, including payroll, with your practice, they do not have to hunt for additional vendors, thus creating a better customer experience.

Payroll is a critical service for practices and can positively transform business. Practices can improve efficiencies, save costs, and earn more profits with the right payroll services for accountants.

Also read: 5 Reasons to Offer Payroll as an Add-On Service to Clients

There are numerous ways in which payroll outsourcing can benefit accounting practices. Some of the most significant reasons firms outsource payroll are listed below.

Top-tier companies providing payroll services for accountants specialise in hiring experienced offshore professionals with complete knowledge of PAYE and the latest payroll software.

Efficiency is critical to the payroll process. A great way for accountants to ensure complete efficiency and accuracy in payroll is to outsource it to trained experts. Outsourced payroll professionals are focused on maximising automation and minimising human work, thus leaving minimal scope for error.

Outsourcing is a proven way for businesses to ensure substantial cost savings. With the massive costs of hiring and infrastructure getting out of the picture, accountants can save big with payroll outsourcing services.

In today’s competitive world, scalability does not come easy. However, with outsourcing, it isn’t a distant dream. Top firms offering payroll services for small business have a robust process and experienced team to manage your clients’ payroll and improve your practice’s capacity to scale quicker.

Like every service, payroll outsourcing, too, has its advantages and disadvantages. Accountants must weigh the pros and cons thoroughly before approaching a firm providing payroll outsourcing services.

Payroll outsourcing gives accountants easy access to highly skilled and trained payroll experts, who are based offshore but work as an extension of your team.

Top companies specialising in payroll services for small business train their professionals to work on the latest software, thus automating several critical tasks and making the payroll process simpler.

Outsourced offshore professionals work dedicatedly for your practice, thus increasing the overall turnaround time for critical tasks.

Important data security standards such as GDPR and ISO 9001 are crucial to the UK payroll outsourcing scenario. With payroll outsourcing, you can be assured of absolute security and privacy of your client’s data.

By outsourcing your payroll to professionals, you can free up your team’s valuable time, which can be invested in self-development activities or innovating value-adding services. Reduced workload ensures a better work-life balance for you and your team.

A significant disadvantage of payroll outsourcing is that it creates a complex communication channel. When you contract your clients’ payroll to an outsourcing firm, you may face issues communicating every detail your client shares with you, thus posing the risk of losing critical information.

While outsourced payroll experts take care of your clients’ end-to-end payroll processes, accountants may sometimes need to make last-minute changes or minor corrections to reports. However, with outsourced payroll, this may not always be feasible.

When an accounting practice outsources its clients’ payroll, they share the latter’s critical data with the outsourcing partner. The privacy and security of this data become the outsourcing firm’s responsibility, and even the slightest oversight in this regard may lead to critical data risks or leaks.

To minimise the risks associated with outsourcing and get the best out of the partnership, accountants must conduct thorough research before finalising an outsourcing partner. Payroll outsourcing is a highly profitable solution for small and mid-sized accounting firms when done the right way.

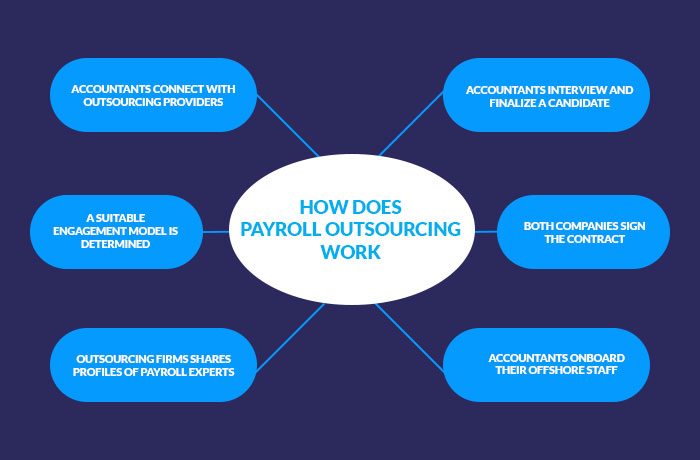

Payroll outsourcing isn’t a one-step process. Some accountants may believe that all they must do is find a firm to outsource to, and the latter takes care of the rest. However, outsourcing one’s payroll is a more detailed and coordinated process.

Let’s look at the detailed steps for an accountant or practice to outsource their payroll needs.

Business is risky. Irrespective of the industry, business always involves risk and so does outsourcing. Payroll outsourcing has proven to be a profitable decision for most accounting practices, but it does not come without certain risks.

For accountants and accounting firms to make the right decision about payroll outsourcing services, it is important to understand and assess its risks.

As discussed earlier, data privacy can be a significant risk for practices when they outsource their clients’ payroll as it involves highly confidential financial data and personal information. Even the slightest oversight or error in this regard can put your clients’ data out in the open and at critical risk.

To avoid this, we recommend that accountants conduct thorough checks and ensure that their outsourcing partner complies with necessary security standards such as GDPR for data protection and security.

Yes, we earlier said that outsourcing helps you keep your clients happy and satisfied at all times, and it is indeed true. However, some clients may not agree with the idea of their accountant or practice outsourcing their work to another firm and sharing their confidential data with a third party. This may lead to discontent on the part of the client.

Practices that are willing to outsource their clients’ work to a payroll outsourcing services provider need to be vigilant while doing so. If you think your clients may not be happy with the idea of outsourcing, you must have a detailed conversation with them and win their trust to ensure a smooth outsourcing transition process.

With great risks come great successes! Outsourcing is one such risk that is worth taking as it ensures loads of benefits. However, it is important to outsource the right way and to the right UK payroll outsourcing partner that understands your requirements and tailors its services to provide you with the best.

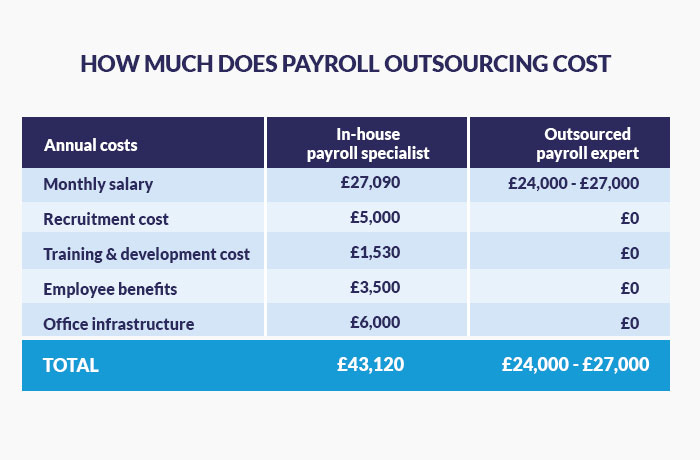

After we have listed the pros, cons, steps, and risks of payroll outsourcing, the most important question remains – How much does payroll outsourcing cost? How much does payroll outsourcing cost? Outsourcing payroll services can help you improve your firm’s efficiency and save big on operating costs, but accountants and practices must consider the cost of outsourcing before they make the right decision.

Outsourcing payroll offshore is a viable and cost-effective solution for accountancy practices, as opposed to hiring an in-house resource. Let’s look at the average cost difference between the two using the below estimates taken from Payscale.

Hiring an in-house resource comes with several additional costs as seen in the above image. This can seriously elevate the total cost spent on a resource by your firm. On the other hand, with outsourcing you just have to pay the resources’ salary and can omit the overheads, thus significantly cutting down your total spends on a resource.

The exact cost of payroll outsourcing depends mainly on three factors – the volume of the work that needs to be outsourced, the reputation of the outsourcing company, and the engagement model that you choose.

Let’s take a look at each of these factors.

An accounting practice may want to outsource their clients’ end-to-end payroll process, while another firm may outsource only a part of it. An accountant may have a capable team handling their existing clients but may need to outsource the payroll for their newly acquired clients. In all the above cases, as the requirements of the accounting firms change, so does the pricing.

When an accountant approaches a payroll outsourcing services provider, the latter assesses the exact requirements of the practice and offers dedicated payroll experts accordingly. These experts may have varying amounts of experience and skills. Further, the pricing structure changes based on the number of resources required by the accounting practice.

This is an important and decisive factor for payroll outsourcing. Accountants often make the mistake of looking at a company’s rate card first and considering their reputation second.

A practice cannot simply make its outsourcing decision based on high or low prices. A low-cost outsourcing service may not provide you with extensively trained resources. Further, it also increases the risks associated with the service and makes it unworthy.

Accountants and accounting firms need to look at a company’s experience, reputation, testimonials, and certifications before signing a contract with them. These factors significantly impact the pricing structure for payroll outsourcing, but a company with a strong reputation can positively transform your business in the long run.

A significant decider of the final pricing structure for payroll outsourcing services is the engagement model. Top-tier UK payroll outsourcing companies specialise in two types of engagement models: the Full-Time Employee (FTE) and the Ad-hoc models.

As the name suggests, this model ensures that a dedicated full-time employee is designated to work exclusively for your practice. This model is ideal for practices with a consistent volume of work and a potential long-time outsourcing association. The outsourcing company typically bills the accounting practice monthly against the resource(s).

The Ad-hoc model is designed especially for accountants who do not have a consistent workflow or many clients. These practices can outsource offshore payroll experts on an ad-hoc basis as and when required. The outsourcing company typically bills the accounting practice hourly against the resource’s time.

To get the best payroll outsourcing deal, accountants must be clear and specific about their requirements. Many top-tier UK payroll outsourcing firms also provide exclusive discounts and offers to ensure a seamless outsourcing experience for accountants.

Also read: Payroll Outsourcing Services in the UK: How Much Do They Cost?

It is not always easy to make this decision. In fact, many accountants often struggle with this question.

There are several indicators of the right time to outsource payroll services for accountants. Here, we will highlight some of the most significant ones to help practices make the right decision.

Staffing woes can be frustrating. The accounting industry has battled the staffing challenge for years. Further, with the onset of the Great Resignation, the problem has only gotten worse. Small accounting practices find it challenging to hire and retain experienced professionals. For this reason, several accountants are often stressed and overworked.

Payroll outsourcing services are a boon to small and mid-sized practices. Outsourcing firms provide accountants easy access to highly experienced and trained professionals who can work as an extension of their team and seamlessly blend with their processes.

If your accounting practice’s focus is on cost savings, there cannot be a better alternative for you. With payroll outsourcing, you can hire skilled offshore professionals at much lesser prices than in-house hiring.

Plus, the outsourcing company pays and manages these professionals, so you do not have to provide them additional employee benefits or incur any training and infrastructure costs.

The secret to client retention is efficiency. But to ensure consistent efficiency in a task as cumbersome as payroll, you need experienced and trained professionals.

If your firm has been struggling with consistency and efficiency, it may be the right time for you to outsource to a firm providing payroll services for small business.

Do we need to mention how difficult it can be for small accounting practices to climb their way up in the competitive market and scale their business? Accountants have struggled in this area for years.

If you are one such accountant looking to add payroll to your service offerings to scale your business, outsourcing can be the right solution.

There are several payroll outsourcing providers in the market. Each of these companies provide a range of services, varied expertise, and exclusive offers to accountants and practices. But how do accountants ascertain which is the right partner for them? Let us help you with that.

When you choose a payroll service provider to team up with, there are several factors that accountants and accounting firms must consider. Some of them are listed below.

Accountants must look at the industry experience of an outsourcing firm to gauge the expertise of their resources and the quality of their work.

Payroll outsourcing can be an excellent opportunity for small practices to integrate the latest technology into their processes. Therefore, accountants must assess their outsourcing partner’s technical expertise beforehand.

Effective communication is key to a lasting partnership. An outsourcing firm with a transparent communication channel can make the entire process simpler for your practice.

Accountants and accounting practices must essentially look at the data privacy measures of a payroll service provider beforehand. Top-tier firms have a robust system to ensure complete protection and privacy of their clients’ data.

This may seem unnecessary but is, in fact, extremely important. Client testimonials are representatives of an outsourcing firm’s ethics and principles and vouch for their resources’ expertise and quality of work.

Now that you know how to find the right payroll service provider, it is time to devise a robust strategy for outsourcing the right way.

Here are a few tips to help accountants devise a comprehensive payroll outsourcing strategy.

The first step to devising a strategy is planning. This is the most crucial step for any business as it helps determine the exact outsourcing requirements for the firm. As discussed, accountants need to know their precise needs before signing a deal with a payroll outsourcing services provider.

The planning process involves gauging your firm’s existing and potential workload, considering their staffing capabilities, considering the internal budget and outsourcing costs, evaluating the number of resources to be outsourced, and much more.

Once the planning part of the process is complete, accountants must move on to research. While planning is primarily internal, research is an external process. Research pertains to searching and analysing the right payroll outsourcing partner. We have already discussed the factors that accountants must consider while finding the right payroll services provider.

The assessment phase is another significant part of your payroll outsourcing strategy. While planning and research are critical, accountants must also assess the impact of outsourcing on their firm before finalising the decision. This stage includes weighing the pros and cons of outsourcing, assessing the cost savings and profits, and analysing the risks involved.

Outsourcing payroll services for small business can be highly profitable if you have the right strategy. Thus, accountants need to spend adequate time devising a functional strategy to outsource their payroll requirements.

Also read: How to Create an Efficient Payroll Outsourcing Strategy for your Firm?

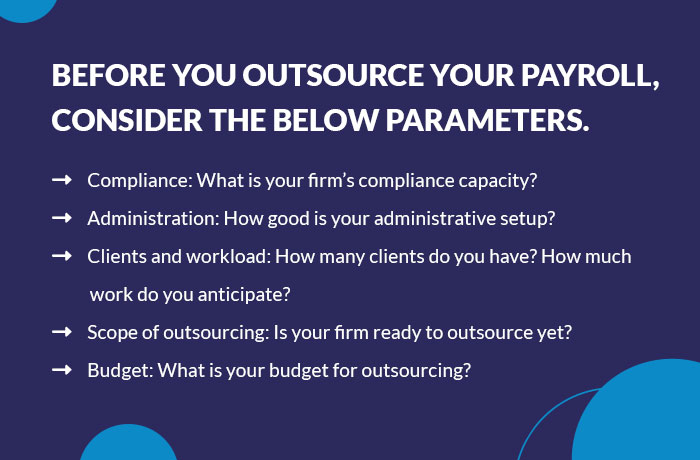

By now, you are aware that there are several things that accountants must consider before making their payroll outsourcing decision. We get it, there is a lot of information to be weighed, and it might be confusing.

To help make the process simpler, here’s a quick payroll outsourcing evaluation checklist for small and mid-sized firms.

Analyse your firm’s internal compliance capability and the average time your team spends on it.

Take a look at your practice’s administrative setup and its costs.

Perform an internal audit to determine the number of existing clients your firm handles and the scope to add more. Analyse the volume of work for each client and assess your internal team’s capacity to handle the workload.

Evaluate what tasks need to be outsourced and how many resources you would need. Also, speculate which outsourcing engagement model would suit your company the best.

Practices must consider both internal and external budgets before outsourcing. Internal budget refers to the costs spent on hiring, training, and infrastructure for in-house employees, while external budget pertains to outsourced payroll services for accountants.

A quick analysis of the above points will help practices to understand their firm’s standing and decide their requirements accordingly.

Also read: Planning to Outsource Payroll? Keep This Ultimate Payroll Outsourcing Evaluation Checklist Handy

Once you have signed the contract with an outsourcing partner providing payroll services for small business, you have already gotten half the job done. By now, most of the difficult part has been completed. Yet, there is one job that remains – Onboarding.

A smooth onboarding process can kickstart a healthy outsourcing association for your firm. However, it may not always be as easy as it sounds.

Although your outsourced offshore professionals will work dedicatedly to blend with your system and processes, practices must essentially provide undivided support and guidance to them.

Here are a few things accounting practices must do to ensure a smooth outsourcing onboarding process.

Communication is the most crucial factor in ensuring a seamless onboarding process. Your outsourced professionals are trained experts, but they need a base to begin their work. Communicate with your offshore team regularly and help build the required base for them.

Give your outsourced experts a background of your firm and introduce them to your team. Brief them about your systems and processes. Explain how your internal teams work and how your clients like their reports made. Communicate your clients’ requirements thoroughly to help them adapt to your ways and ensure maximum efficiency.

When you have a team of offshore professionals working for you, transparency is a key factor. Be transparent with your outsourced payroll experts about the changes in your firm and internal teams. These professionals have already been trained extensively on UK payroll outsourcing regulations but re-educate them on important norms and standards.

This will help the outsourced experts gain clarity about your practice and the nature and requirements of your clients. It will only drive additional value for your firm in the long run.

An employee can function and thrive in their role when given regular constructive feedback. The same norm applies to outsourced professionals as well.

Outsourced payroll experts are based offshore and may not regularly interact with your management team. Therefore, it is essential to provide them with regular feedback that can help them change or improve their ways, customise their services, and stay motivated at all times.

QXAS is a global outsourcing company specialising in dedicated payroll outsourcing services for accountants and accounting practices. Our highly professional and extensively trained payroll experts are committed to making payroll simpler and profitable for your business.

QXAS is the accounting outsourcing division of QX Global Group, one of West India’s fastest-growing accounting outsourcing companies. We began our operations as a mere 5-member startup in 2003 and have grown to be market leaders in accounting outsourcing. With a rich experience of 12+ years, we have built a robust team of knowledgeable accounting and payroll professionals, making us one of the top UK payroll outsourcing companies.

QX thrives upon the core values of Quality and Excellence and is committed to making outsourcing a seamless experience for global clients. Our commitment to excellence was reinstated in 2022 when QX earned a 100% score in all audits conducted by the British Standards Institution (BSI).

Payroll outsourcing for accountants means hiring an external provider to manage payroll processing, tax deductions, and compliance. Accountants share employee data securely, the provider runs payroll, submits HMRC reports, and delivers payslips, while the firm reviews and approves the output.

Payroll outsourcing saves time, reduces errors, and ensures HMRC compliance. It also frees in-house staff to focus on advisory work and provides access to expert payroll professionals.

Payroll outsourcing cuts staffing and software costs, reduces errors that could lead to penalties, and speeds up processing. This lowers overhead and lets your team focus on higher-value services, boosting overall profitability.

Accountants should watch for data security breaches, inaccurate payroll processing, missed HMRC deadlines, and poor communication. Choosing a reputable provider with strong compliance and reporting standards like QX mitigates most risks.

Choose a payroll outsourcing provider with UK payroll expertise, strong data security, and HMRC compliance. Ensure their pricing is transparent and their system integrates with your firm’s workflow. Check client support and scalability before deciding.

Potential legal and compliance issues while outsourcing payroll include ensuring accurate tax and National Insurance deductions, timely RTI submissions, GDPR-compliant data handling, and adherence to UK employment and pension regulations. Mistakes can lead to penalties or fines.

There are several reasons why QXAS can be the ideal payroll outsourcing partner for your accounting firm.

To learn more about our services, call +44 208 146 0808, drop us an email at [email protected], or log on to Outsourced Accounting, Bookkeeping, and Payroll Services | QXAS UK.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.