The coming years will be crucial for accountancy practices seeking growth in the competitive accounting world.

According to experts, the currently stagnant UK economy may have adverse effects on the country’s accounting and finance industry.

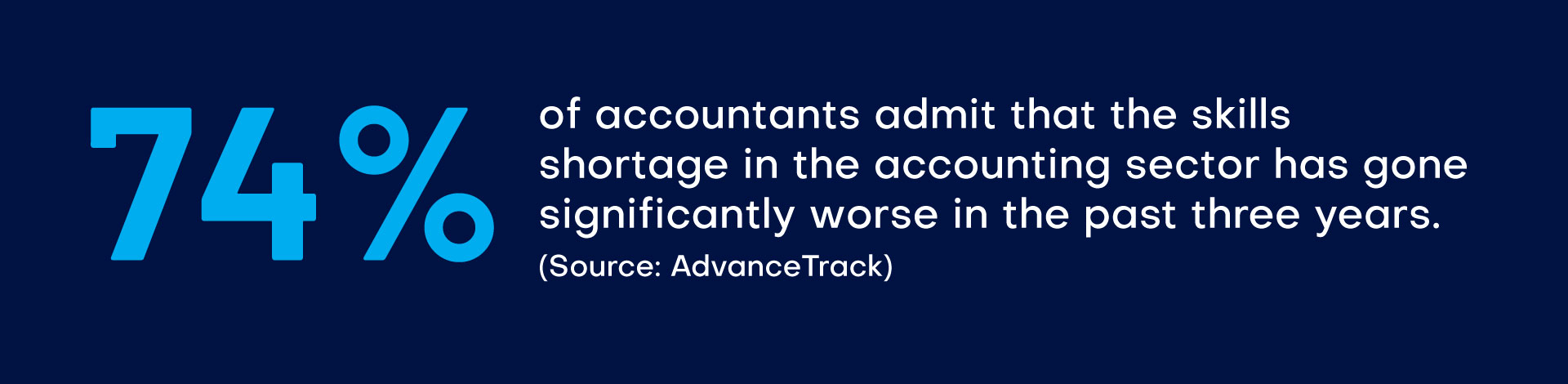

In the face of these challenges, it won’t be an easy ride for accountancy practices to scale and earn profits. Additionally, the skills shortage is still a major issue haunting the accounting world. How can accountants deal with this situation to sustain and grow their practice?

The smartest way to thrive in this situation is by giving your clients exactly what they want. Accounting is no longer just a number-punching job.

Businesses now look at accountants as advisors and partners. So, the key is not to limit your practice but explore new services by outsourcing the core time-intensive functions such as bookkeeping.

As clients look for more strategic support from accountants, outsourced bookkeeping and accounting will play a crucial role in practices’ growth.

Bookkeeping is a crucial accounting task that often takes up a lot of accountants’ time.

This leaves accountants with little capacity to explore new services, understand the market, and meet clients’ changing needs.

However, with outsourcing, accountants and practice owners can free up their internal teams and focus on higher-value services such as advisory, which can get them more business and revenue.

A recent study highlighted the growing relevance of accountancy firms on outsourcing, with a nearly 40% increase in global spend in the last five years. The primary reasons for this surge include talent availability, technological advancements, flexibility, and capacity creation.

To help you understand the importance of outsourced bookkeeping services UK and how it can help scale your practice in 2023, we have put together some valuable tips.

One of the best-known benefits of outsourcing is that it helps boost efficiency within a practice.

When you outsource bookkeeping services to experienced professionals, they apply their knowledge and expertise to reduce the scope for errors in the process.

Outsourced professionals are up-to-date with the standard bookkeeping practices, which means there’s less chance of missing out on data or wrongly recording it.

The greatest advantage of increased efficiency is that you can use the service as an example to prove your expertise to clients when pitching new or additional services.

In the coming years, efficiency will be a crucial factor for accountancy practices as the accounting and auditing world struggles with incompetence.

Outsourcing bookkeeping services for businesses helps accountancy practices adopt the latest technology into their processes cost-effectively.

This makes your bookkeeping service more streamlined, efficient, and error-free. But apart from maintaining your clients’ books, you can revamp your additional services using the same technology.

For instance, suppose you have just adopted cloud technology to manage your clients’ books.

With the guidance and support of an outsourced team, you can implement the same technology for other services, such as accounting and payroll.

All you must do is choose a comprehensive cloud accounting software that will support multiple tasks apart from just the core processes.

This will make your services more organised and efficient, thus saving you significant time and money and helping attract more clients.

Most accountancy practices today outsource bookkeeping services to create capacity for their firm. By delegating the cumbersome bookkeeping process to qualified and experienced experts, practice owners can free up their internal teams to explore new services and opportunities.

A recent report by Clutch highlights that about 15% of the accountants who outsource their services do it to allow their employees to focus on other crucial tasks.

We have already learnt that, in 2024, accounting is more than just a number-based job. It will include a plethora of other services, such as advisory, which require a lot of time and commitment on the part of accountants.

With outsourcing, accountants can focus on upskilling, conduct market research, explore the scope of new services, and have conversations with existing and new clients.

Must Read: Tips to Grow Your Accountancy Practice with Outsourced Bookkeeping

Many accountants and practice owners equate outsourcing with offshoring. This may make them skeptical regarding communication, data security, and turnaround times.

To resolve this issue, top outsourced bookkeeping companies provide the onshore support solution that lets you hire outsourced resources to work from your office while still saving costs.

The onshore support outsourcing model will be highly beneficial for practices in the coming years, dominated by working from office.

Since the recession kicked in, many UK enterprises reverted to the ‘back to office’ work model, giving renewed momentum to the Great Resignation.

But the advent of the Great Return means that your clients will be working from the office, too, and may want to meet with your team in person.

Therefore, having resources readily available to connect will be crucial for accountancy firms. This is where outsourced onshore support comes into the picture.

When you hire dedicated onshore bookkeepers, they manage the entire function for you, creating capacity for your in-house bookkeeping team.

The latter can then connect with clients, meet them personally, understand their requirements, pitch additional services, and strengthen your professional relationships.

Not only does this help you onboard them for the other services you offer, but it also facilitates word-of-mouth publicity, which can, in turn, help you gain more clients.

As the accounting industry gets competitive, outsourcing bookkeeping services for businesses will be important for accounting firms. There’s more to it than just saving costs and making your bookkeeping process free of errors.

With increased efficiency, productivity, and technical expertise, you can set a standard for your services and use it as an example to gain more clients.

Additionally, dedicated onshore support from a leading bookkeeping outsourcing provider such as QXAS can help you serve your clients faster and better by eliminating potential communication gaps and data security threats.

With these USPs, you can scale your practice effectively and maximize profits.

QXAS, a leading accounting outsourcing firm in the UK, provides dedicated outsourced bookkeeping services for growing accountancy practices with diverse requirements.

With over 20 years of experience in the accounting industry, we have helped several accounting firms achieve excellence and higher profits with our customized offshore and onshore outsourcing solutions.

To outsource your bookkeeping needs to us, call us at +44 208-146-0808 or drop an email at [email protected]. For more details, log on to Outsourced Accounting, Bookkeeping, and Payroll Services | QXAS UK (qxaccounting.com).

Hemant is a senior accounting leader with over 20 years of international experience across the UK and Ireland. His expertise spans bookkeeping, VAT, management accounting, and financial reporting in compliance with IFRS. He is recognised for successfully managing process transitions, building and leading high-performing teams, mentoring talent, and driving collaboration in multicultural environments.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.