The Self Assessment tax season is fast approaching, and it is every accountant’s busiest time of the year. The phones never stop ringing, inboxes overflow, and the pile of paperwork seems endless.

While racing against the clock, have you ever wondered if there’s a more profitable way to handle this annual frenzy? Outsourcing personal tax returns might be the answer you’ve been missing.

In this blog, we’ll dive into the ROI of outsourcing Self Assessment tax returns and share how a UK-based accountancy practice increased its tax season profitability by 33% through outsourcing.

Let’s see how this profitable strategy can transform your firm, save costs, and deliver significant returns on investment.

Let’s start with a simple question: What if you could maintain or even enhance your profit margins while reducing your workload? Sounds like a dream, doesn’t it? This is precisely what Self Assessment tax outsourcing can do for your firm.

Outsourcing isn’t just about cost-cutting. It’s a strategy that can lead to substantial financial gains.

Imagine this: You outsource a low-band tax return preparation for £55*. On the other hand, UK accountants charge anywhere between £126 to £400 per return. Even at the lower end of the spectrum, you’re looking at a profit of £71 per return. And that’s just the beginning.

One of our clients, a Surrey-based accountancy practice, decided to test the waters with outsourcing. They were initially skeptical, worried about quality and data security. But with the tax season looming, they took the plunge and outsourced a portion of their HMRC Self Assessment returns.

The result? They saw their tax season profitability soar by 33%. They could take on more clients without increasing their in-house team’s workload. The outsourced returns were handled efficiently, freeing their staff to focus on client relationships and advisory services.

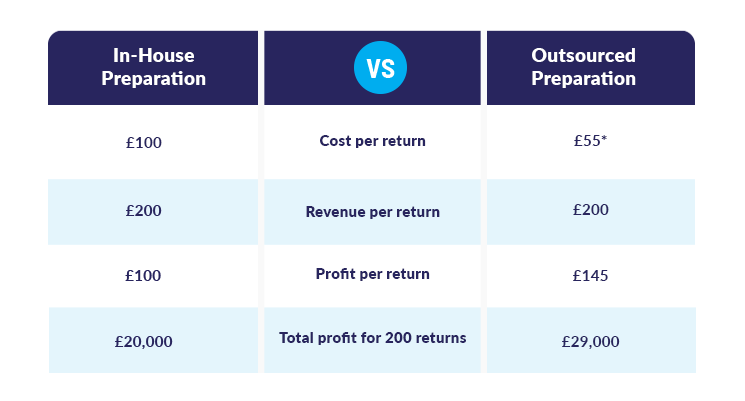

Let’s break down the ROI a bit more. Suppose your firm handles 200 tax returns each season. Here’s a comparative look at the in-house vs. outsourcing scenario:

By outsourcing, you can increase your total profit from £20,000 to £29,000—a staggering £9,000 increase without lifting a finger!

This example demonstrates how Self Assessment return outsourcing can boost your firm’s bottom line without compromising quality or client satisfaction.

Timing is everything, especially when it comes to outsourcing. This year, QX Accounting Services is providing unbeatable pricing, with tax prep starting at just £40*, plus volume-based discounts. Here’s how it works:

By taking advantage of the exclusive offer, you can save money while ensuring your workload is manageable and your team isn’t burning out.

Many accountancy firms hesitate to outsource tax return preparation due to concerns about quality and data security. It’s natural to worry about these aspects, but reputable outsourcing providers like QX Accounting Services adhere to strict quality control and data protection standards.

Our Surrey-based client was initially wary, too. However, they conducted thorough due diligence, choosing an outsourcing partner with a proven track record and strong data security measures. The result was a seamless integration that maintained their high standards of service.

Outsourcing Self Assessment tax return preparation offers benefits beyond cost savings and profit increases:

Let’s summarise the ROI you can expect from outsourcing Self Assessment tax returns:

Still not convinced? Let’s look at this the other way.

Imagine telling your staff that instead of drowning in paperwork this tax season, they’ll have more time for tea breaks and maybe even the occasional pub lunch. Picture the relief and smiles! Outsourcing can help turn that hectic period into a more manageable and even enjoyable time for your team.

The ROI of outsourcing Self Assessment tax returns is clear. It’s a strategy that not only saves costs but also significantly boosts profitability and operational efficiency. Don’t let skepticism hold your firm back from these benefits.

If you’re still on the fence, consider starting small. Outsource a portion of your returns this season or try our no-obligation trial and compare the results. You might find that, like our Surrey-based client, your firm can achieve remarkable profitability and efficiency gains.

So, are you ready to see if your firm is missing out? Give outsourcing a try and watch your profits soar, your team relax, and your clients stay happy. It’s a win-win-win situation!

Ready to take the plunge? Contact us today to learn more about our exclusive pricing and start reaping the benefits of outsourcing your Self Assessment tax returns. Cheers to a profitable tax season!

Dinesh is a seasoned accounting and tax professional with more than 20 years of experience, specialising in UK personal tax. He has a proven track record of streamlining tax processes and building strong client relationships, consistently delivering accurate and compliant taxation services tailored to client needs.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.