Is your accounting firm having trouble finding enough staff to do tax preparation work? Do you get stuck during the busy periods like the 31 January Self Assessment deadline? Are you keeping busy with non-core tasks that don’t allow you to focus on growing your practice?

Outsourcing tax preparation work to India can help UK accounting firms to cut operational costs and improve margins and free up in-house teams to work on higher-value tasks. It also helps firms take on more clients and expand their business without overspending.

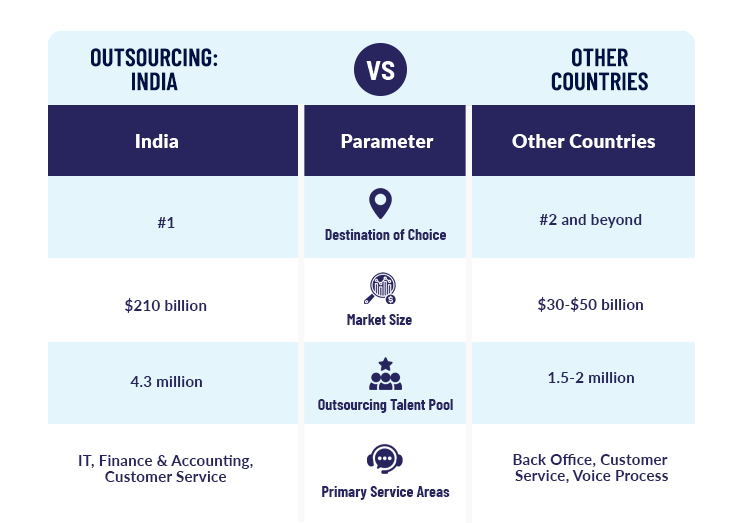

India is the #1 destination of choice for outsourcing among accounting firms in the UK. With a market size of $210 billion, and an impressive talent pool of over 4.3 million, India serves as an ideal destination for accounting firms to find skilled and cost-effective talent working as an extension of their own teams.

If you’ve answered ‘yes’ to any of these questions, it could be time for you to consider outsourcing tax preparation services to India. With the Self Assessment season approaching, keep an eye out for these five warning signs:

Most accounting firm owners tend to get busy at certain times of the year. This means, you have added pressure on top of all the other things you are already concerned about. However, by outsourcing tax work, you don’t have to deal with that headache.

Tax preparation outsourcing to India also saves you the stress of hiring temporary employees, HR concerns and cash flow for having to cover their payroll for short periods of time. The idea is that, even during peak busy periods, your practice should be able to take on more work without it affecting overall business performance.

As an accounting practice owner, you want to be using your time more efficiently. After a few years of setting up and running the business, you want to be in a position to leverage your expertise to do more profitable work.

Many accountants want time to be able to offer higher-margin services, such as business advisory, to their clients. By leveraging tax return outsourcing to India, you allow work to be done by an offshore accounting expert. This enables you to not only continue to offer this service seamlessly to your clients, but also frees up time to be used in a more efficient way.

Focus on the things you’re good at which generate higher revenues than getting bogged down in remedial non-core work.

It’s common knowledge that expanding an operation normally requires substantial investment. The idea is that after you’ve expanded, you’ll cover your investment costs and start earning more than before. What if there was a way to expand your current practice without breaking the bank?

With outsourcing, you can do exactly that. Accounting practice owners have realised that they can now expand their business without having to spend on recruitment and other staffing-related costs. An outsourcing provider can not only do your tax preparation work for a cheaper rate but also a number of other services such as year-end accounts, bookkeeping, VAT, payroll, and management accounts.

Must Read: The ROI of Outsourcing Self-Assessment Tax Returns: Is Your Firm Missing Out?

Many accounting practices are already under financial pressure and face severe competition without having the time to think about improving profitability. However, the very principle of outsourcing tax return preparation to India is that you can hire someone who can do the same quality of work for a lower cost compared to doing it in-house. This means more profits in your pockets.

When you outsource personal tax returns to a qualified outsourcing partner, you effectively utilise their expertise and reap the benefit of lower processing costs.

Discover how a small UK accountancy practice boosted their tax season profitability with outsourcing: Improved Productivity with Accounting Outsourcing | Read Story

Outsourcing tax preparation work to India offers several strategic advantages for accounting firms. Here’s why it makes sense:

Yes, Indian tax professionals are well-versed in UK tax laws and regulations. They undergo rigorous training and possess the expertise to accurately handle UK tax return preparation with compliance and precision.

The main risks include data security and communication challenges. However, these can be mitigated by choosing a reputable outsourcing partner with strong data protection protocols and clear communication processes.

Look for a partner with proven experience in UK tax preparation, robust data security measures, a skilled team, and transparent communication practices. Additionally, ensure they offer flexible services that align with your firm’s specific needs.

Outsourcing tax preparation to India can reduce costs by 40–60% compared to UK rates. It also gives access to skilled tax professionals, helps manage workload during peak seasons, and allows your in-house team to focus on advisory services.

Accounting firms securely share client data with the Indian outsourcing team via encrypted portals. The team prepares tax returns, performs reviews, and sends them back for final approval, while your firm ensures compliance and client communication.

The key benefits of outsourcing tax preparation to India include significant cost savings, access to skilled tax professionals, faster turnaround during peak seasons, reduced in-house workload, and consistent compliance with UK tax regulations.

The risks of outsourcing tax preparation to India include data security breaches, potential errors in tax filings, communication delays due to time zones, and differences in understanding UK tax rules. Choosing a reputable provider like QX mitigates most of these risks.

Yes, it can be compliant if the provider follows GDPR and UK data protection laws, uses encrypted data transfer, secure storage, and signs a Data Processing Agreement (DPA) with the UK firm.

Tax preparation outsourcing to India means partnering with experienced Indian tax professionals who support UK firms with accurate, timely, and compliant tax filing services.

Yes. Most providers offering tax preparation outsourcing in India follow strict international data-protection standards, including GDPR compliance, ISO certifications, and secure file-transfer protocols to keep client data confidential.

Absolutely. Leading outsourcing firms in India use cloud-based systems, task trackers, and real-time communication tools that let you monitor progress, review work, and stay in control of every client file.

Looking for tax preparation help to sail through the busy season stress-free? Get market-leading tax preparation solutions tailored to your firm’s needs with QXAS.

With over 20 years of industry experience, we have worked with some of the top firms in the UK, including TaxAssist Accountants. With a dedicated team of 1000+ certified accountants and tax preparers specialising in UK legislation, we handle your tax preparation work end-to-end, from simple to complex.

Partner with us to streamline your Self Assessment season, free up your internal team, and spend the holiday season without stressing about the piling returns on your desk. Click the button below to schedule a free consultation with our expert.

Establishing outsourcing as a strategic part of your accounting practice lets you tap into a massive talent pool of qualified personnel that can be hired at an economical rate. In fact, most accounting firms that outsource tax preparation to India are able to reduce costs by up to 50% by complementing in-house workforce with highly trained offshore tax professionals.

If you are considering outsourcing to help you get through the tax season, click here or call +44 208-146-0808.

Dinesh is a seasoned accounting and tax professional with more than 20 years of experience, specialising in UK personal tax. He has a proven track record of streamlining tax processes and building strong client relationships, consistently delivering accurate and compliant taxation services tailored to client needs.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.