Payroll outsourcing gained immense momentum in the UK accounting sector in the aftermath of the global coronavirus pandemic.

The outsource payroll cost is typically between £2 to £25 per employee per month, but this can vary depending on your company size, pay frequency, and the specific services you need. Smaller companies often pay a higher per-employee rate, while larger companies can get a lower rate. Some providers also offer a per-payslip model.

Leading outsourcing providers like QX Accounting Services also provide volume-based discounts and may charge on a per-FTE basis.

As more and more accountancy practices in the UK turn to outsourcing their payroll, accountants have one question at the very top of their minds: How much do UK payroll outsourcing services cost?

There are a number of firms in the market providing outsourced payroll services for accountants and small businesses.

However, most of them do not display fixed pricing on their website as it is customised for each client based on their specific requirements.

Let’s look at the factors that determine and affect the costs of payroll outsourcing services in the UK.

There are several types of payroll outsourcing models that outsourcing firms commonly offer. The pricing for payroll varies depending on the type of client payroll you are outsourcing. Generally, there are two pricing models:

This is appropriate for simple payroll with the same salary details/amount every month.

This is designed for more complex payroll requirements, such as where your client has different types of employees (part-time/full-time), changing pay frequency (for example, weekly/fortnightly), or variable pay amounts.

Besides, some outsourcing providers also charge based on an FTE or per-payslip requirement.

You get a dedicated full-time employee working exclusively on your payroll needs. This model is particularly suitable for a long-term association.

In this model, the outsourcing company charges you for each payslip that they process. This model qualifies for a volume-based discount and is suitable for a temporary/short-term requirement.

| Same Salary Model | Variable Salary Model | FTE Model | Per-Payslip Model |

|---|---|---|---|

| Simple payroll processing with the same salary details/amount every month | Complex payroll processing, such as changing payroll frequency | Dedicated full-time expert working on your payroll needs | Pricing based on number of payslips processed. Includes volume-based discounts. |

Before you decide to go for payroll services outsourcing and begin looking for a service provider, understand your client’s payroll requirements thoroughly.

If you have been handling their payroll for some time now, you must already know their needs.

If you have landed a new client or recently added payroll as an add-on service to your portfolio, speak to your client to understand their exact requirements in detail.

While the outsourced payroll cost depends on the above engagement models, the exact pricing can be determined only based on your specific needs.

The cost of outsourcing payroll depends on several crucial factors. To make it easy for you, we have listed individual elements below:

The fee for setting up payroll with a supplier will vary according to your accounting firm’s size and requirements. For a new company set-up, typical charges start at £10.00 per company as a one-off cost.

Another important factor determining the final payroll outsourcing prices is the per-payslip cost. This cost varies depending on the number of payslips your accounting firm processes.

Typically, you could expect to pay between £4 to £6 per payslip. Many outsourcing companies generally offer a discount when there are more payslips to process each month.

Several accountants providing payroll services to clients also offer Auto-Enrolment services.

If you are not one of them, this is an excellent opportunity to start offering it with minimal overhead investment. Outsourcing Auto-Enrolment costs are made up of three components:

An important component of UK payroll is year-end filing. HMRC has made the year-end filings very simple for each time payroll is processed.

However, the primary concern is to ensure you submit your final FPS and/or EPS on time. You could expect to pay £20.00 per EYU (£10.00 for client set-up and £10.00 for processing).

It may not always be easy to determine whether to outsource your payroll needs. But here are some statistics to help.

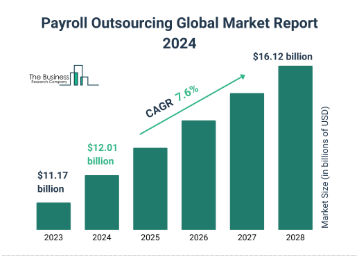

The payroll outsourcing market size has grown strongly in recent years. Research suggests it will grow from $11.17 billion in 2023 to $16.12 billion in 2028 at a CAGR of 7.6%.

The below video can help you assess your firm’s outsourcing readiness effectively.

QXAS is a leading payroll outsourcing provider in the UK with 20+ years of industry experience and a dedicated team of trained payroll specialists.

To help accountants evaluate our payroll services risk-free, we offer a free trial and complete data protection guarantee. We usually provide the following reports: payslips, FPS, P30, and P32.

To learn more about the free trial or explore our services in further detail, please get in touch with us and one of our team members will be happy to call you back.

To make the maximum profits from payroll, moving to an outsourced model is essential.

It is a straightforward way to turn a low-margin service into something that churns a profit while also minimising the time you spend on it and the investment you need in terms of software and hiring specialist staff.

Typical outsourcing of payroll in the UK costs about £4–£10 per employee per month for standard services. For fully managed, comprehensive services it can go up to £12–£25 per employee/month, depending on complexity. Some companies like QXAS also provide FTE/PTE payroll services.

For a small UK business, outsourcing payroll typically costs around £4–£12 per employee per month, plus any one-off setup fees.

As a rough monthly benchmark: many small firms pay about £50–£200 flat per month for outsourced payroll services, depending on employee count and service scope.

The cost depends on factors like the number of employees, pay frequency, and level of service required. Extras like pension management, year-end reporting, and compliance support can also increase the price.

Setup fees usually cover onboarding, data migration, and system configuration. Some providers also charge a small per-employee setup fee or extra for integrations like BACS payments.

Outsourcing payroll in the UK typically costs around £4–£12 per payslip, depending on service level and complexity.

Mitul is a highly experienced UK Payroll professional with over 14 years of expertise in payroll processing, compliance, client management, and team leadership. He is recognised for ensuring seamless compliance with UK payroll regulations and building strong client relationships through the delivery of accurate, high-quality payroll services.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.