Summary:

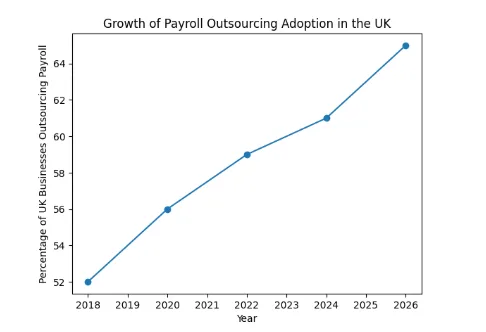

61% of accounting firms now outsource their payroll, up from around 56% just a few years ago, as complexity and compliance costs rise.

Payroll in the UK is more demanding than most clients appreciate. Constantly evolving tax codes, auto-enrolment updates, NIC changes, pensions, Real Time Information (RTI) submissions and GDPR make up for increasing payroll complexity every year.

For accountants, this isn’t just an operational burden; it’s a strategic decision point. Do you keep payroll in-house with all its risks and costs? Or do you elevate it into a managed payroll model that drives efficiency, accuracy and client trust?

If your firm isn’t thinking beyond basic payroll processing, you’re leaving time, margin, and client value on the table. This guide helps you understand why managed payroll should be part of your firm’s services, and how to implement it well.

Managed payroll service refers to a fully outsourced or co-managed payroll service where a specialist provider takes end-to-end responsibility for payroll on behalf of your firm and your clients. Unlike a standalone service that simply runs payslips, a managed model incorporates:

In practice, this means your firm doesn’t just send data out and hope for compliance. You partner with a provider that embeds expertise and governance into every pay run.

Over 60% of companies in the UK are expected to outsource payroll by 2025.

Your clients want accuracy, compliance and scalable solutions, not spreadsheets and admin overhead. Offering managed payroll transforms your firm from reactive processor to trusted business partner.

Typical payroll can take hours of non-billable time per client each month. Outsourced payroll services can cut administrative time dramatically, letting your team focus on advisory, business planning, and client relationships, where firms make real margin.

Mistakes cost money. HMRC penalties for incorrect or late submissions are real, and complex pensions/auto-enrolment errors are increasingly common. Managed payroll providers keep up with regulation, reducing the risk your firm picks up the tab later.

A managed payroll model scales across clients and payroll sizes, from micro-businesses to larger employers, without bumping up headcount or training overheads. Many firms embed payroll into a value-added suite, increasing recurring revenue.

Payroll data is among the most sensitive data an organisation holds. Providers invest in advanced, secure platforms that many firms could never justify in-house, improving automation and reducing errors.

| Area | In-House | Managed Payroll |

|---|---|---|

| Compliance risk | High | Low |

| Staff dependency | Critical | Minimal |

| Review controls | Inconsistent | Built-in |

| Scalability | Limited | High |

| Client experience | Variable | Standardised |

For accounting firms considering a partner rather than a vendor, QX’s Managed Payroll Solution combines process rigour with communication clarity.

Every payroll run goes through a two-person review process. One specialist prepares and calculates, another independently verifies before submission, dramatically reducing slip-ups and giving you audit quality assurance.

Your firm gets a named specialist, not a call centre. This person becomes familiar with your clients’ setups, quirks and deadlines, cutting turnaround times and improving service consistency.

Instead of email threads and ticketing chaos, QX uses structured communication workflows with SLAs, status dashboards, and weekly checkpoints. This clarity reduces back-and-forth and surprises.

Data handling is built on secure cloud infrastructure with encryption, access controls, and audit logs that support GDPR and best-practice UK compliance frameworks. You retain control while QX manages execution.

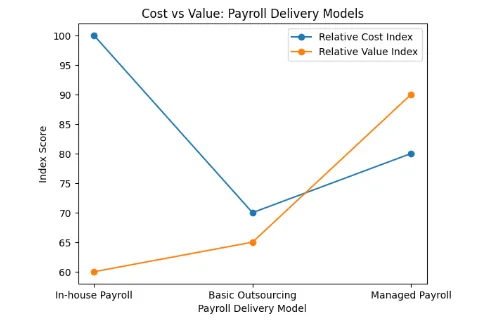

Compare the cost of managing payroll in-house vs. outsourcing it to QX.

Calculate Now

Firm: A mid-sized UK accounting practice with 150 payroll clients.

Challenge: Rising payroll errors, overrun deadlines during peak months, and diminishing team morale due to manual handling.

Before Managed Model:

After Partnering with QX Managed Payroll:

The firm transitioned payroll from a cost centre to a strategic service line in under 90 days.

A: Outsourcing often means running payslips only. Managed payroll means governance, compliance, performance oversight, and communication frameworks built around the service.

Absolutely, you keep the client interface and advisory role; the managed provider delivers execution and compliance support.

Reputable managed providers use encrypted, GDPR-compliant systems with restricted access, audit logs, and secure transmissions, often exceeding in-house capabilities.

Managed services aren’t the cheapest per payslip, but the ROI comes from time saved, penalties avoided, and revenue unlocked through value services.

Best practice is structured onboarding: data cleansing, parallel runs for one cycle, clarity on change management, and client communication.

Managed payroll is no longer a luxury; it’s a strategic imperative. Accounting firms that adopt it:

Today’s payroll landscape demands specialised execution. If your firm still treats payroll transactionally, you’re missing out on efficiency, profitability and compelling client outcomes.

Adopting a managed payroll model, especially with a partner that emphasises review, communication and security, can reposition payroll from a cost centre to a core part of your firm’s offerings.

Book a free consultation with our expert to get any questions answered!

Mitul is a highly experienced UK Payroll professional with over 14 years of expertise in payroll processing, compliance, client management, and team leadership. He is recognised for ensuring seamless compliance with UK payroll regulations and building strong client relationships through the delivery of accurate, high-quality payroll services.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.