Accounts Payable is no longer just an operational task.

For UK accounting firms in 2026, it’s a cost centre, a capacity drain, and often the quiet reason teams feel stretched all year round.

With operational costs touching the skies, most leading accounting firms are looking at outsourcing as a strategic shift. But how does Accounts Payable outsourcing actually work? And how do you find the right provider from a bunch of Accounts payable outsourcing companies out there?

This guide is designed specifically for partners and owners at UK accounting firms who are actively exploring AP outsourcing.

In this blog, we’ll cover:

Let’s start where most firms feel the pain.

Accounts Payable looks simple on the surface. In practice, it’s one of the most disruptive processes inside an accounting firm.

Recent industry data shows that over 60% of mid-sized UK accounting firms now outsource at least one core finance process, with Accounts Payable often being the first to move offshore or nearshore.

AP involves:

Now layer on the reality of the UK market in 2026:

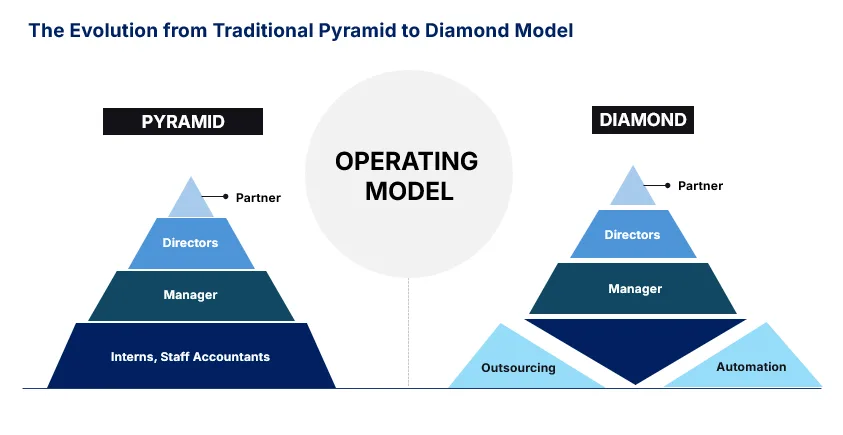

For most accounting firms still relying on the traditional Pyramid Model, delivery is largely supported by the bottom layer of accountants and the middle layer of managers. The real problem arises during peak periods, when the top layer is pulled into delivery as workloads rise and deadlines close in.

This is where the traditional model stands outdated and problematic.

The key shift?

Partners looking to outsource in 2026 are no longer looking for generic BPOs. They want partners who understand how UK accounting firms actually work.

This list focuses only on providers that work primarily with UK accounting firms, not large enterprise BPOs serving end-clients directly.

Best overall AP outsourcing partner for UK accounting firms

QX Accounting Services is market leader in outsourcing and is purpose-built for UK accounting practices. Their Accounts Payable outsourcing services help firms offload invoice processing, supplier reconciliations, payment runs, and AP query management, all delivered by teams trained on UK workflows and compliance.

QX operates as an extension of the firm, not a third-party vendor, which is why many UK practices rely on them for long-term capacity and scale.

USP: Partner-centric outsourcing model designed specifically for UK accounting firms.

Pros:

AP outsourcing tailored to accounting practices

AcoBloom provides Accounts Payable outsourcing that fits neatly into UK accounting firm workflows. Their services cover invoice processing, reconciliations, and payment support across common cloud accounting platforms.

They focus on reducing administrative load while improving processing efficiency and control.

USP: Workflow-friendly AP outsourcing for cloud-based UK practices.

Pros:

Outsourced AP and bookkeeping for UK accountants

Stellaripe offers Accounts Payable and Accounts Receivable outsourcing as part of broader accounting support for UK practices. Their services include invoice handling, supplier reconciliations, and payment processing.

They position AP outsourcing as a way to improve cash flow visibility and back-office efficiency.

USP: Combined AP and bookkeeping support for growing firms.

Pros:

Accounts Payable and receivables management

Finex Outsourcing includes Accounts Payable management within its wider accounting and reporting services. Their AP support helps UK firms manage invoice cycles, supplier tracking, and timely payments without overloading internal teams.

USP: Practical AP support integrated with day-to-day accounting.

Pros:

Payables with modern workflows

Corient provides accounting outsourcing services tailored to UK accountants, including Accounts Payable tracking, vendor management, invoice processing, and cash flow oversight.

Their approach blends human review with process automation to improve accuracy and turnaround times.

USP: Balance of automation and hands-on accounting support.

Pros:

AP as part of outsourced accounting support

Integra Global Solutions offers Accounts Payable outsourcing as part of its broader bookkeeping and accounting services for UK firms. Their teams support invoice processing, ledger maintenance, and reconciliations as part of routine accounting workflows.

USP: Integrated AP support within full accounting outsourcing.

Pros:

When Accounts Payable outsourcing is done properly, the benefits go well beyond simply lowering costs. Most firms don’t outsource AP because they want to save a few pounds per invoice. They do it because AP quietly drains time, attention, and energy across the firm.

In-house, AP work tends to sprawl. A bit here, a bit there. Someone picks it up between jobs. Someone else fixes it at month-end. Partners get pulled in when something goes wrong or a supplier starts chasing. Over time, it becomes a constant background distraction.

Outsourcing changes that dynamic. With a dedicated AP team handling the day-to-day work, firms start to see real operational improvements, not just financial ones.

Most UK accounting firms experience:

But arguably the biggest gain is less tangible.

Outsourcing AP creates predictable capacity. Partners know invoices will be processed, payments will be run, and queries will be handled without constant oversight. That reliability is hard to achieve in-house, particularly during busy periods or when staff turnover hits.

In 2026, that kind of predictability is becoming just as valuable as cost savings.

Not all AP outsourcing providers are built the same, and this is where many firms go wrong. On paper, a lot of providers can “do Accounts Payable”. In reality, very few understand how AP actually sits within a UK accounting firm.

Before selecting an AP outsourcing partner, it’s worth asking a few direct questions:

Ultimately, the right AP outsourcing partner shouldn’t feel like a vendor you have to manage. They should feel like part of your firm – reliable, aligned, and quietly getting the job done in the background.

1. Is AP outsourcing suitable for smaller practices?

Yes. Many firms start with a small AP workload and scale as confidence grows.

2. Will clients know AP is outsourced?

Clients do not know about outsourcing until you choose to tell them. Most outsourcing providers work under your firm’s branding, so you need not tell your clients about it.

3. Is data secure when outsourcing AP?

Reputable providers use secure portals, restricted access, and UK-aligned data protection standards.

4. Does AP outsourcing work with cloud accounting software?

Yes. Xero, Sage and QuickBooks are commonly supported.

In 2026, Accounts Payable outsourcing isn’t about cutting costs alone. It’s about building a more resilient, scalable accounting firm.

The providers listed above work with UK accounting firms, not around them. And among them, QX Accounting Services stands out for its accounting-first approach, scalability, and long-term partnership model.

If AP is slowing your firm down, outsourcing it may be one of the smartest operational decisions you make this year.

Get custom pricing or a risk-free trial. Share your requirement below.

Get Started

Mustufa is a Chartered Accountant with 10 years of progressive experience across Indian, Canadian, and UK accounting domains. He has a proven track record of leading high-performing teams of 60+ members, managing multi-client portfolios, and driving operational excellence with measurable profitability improvements.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.