How Outsourcing Accounting Empowers CPA Firms to Scale Efficiently

CPA outsourcing is one of the better ways of reducing the operational costs of your accounting firm, increasing productivity, driving efficiency, and boosting profitability.

You will find all the information you need to make the most of outsourcing accounting services on this page.

- What is Outsourcing?

- Why do organizations outsource?

- What is Accounting Outsourcing?

- Difference between Virtual Accounting and Accounting Outsourcing

- Why Should CPA Firms Outsource Financial Accounting Services?

- Key Challenges Faced by the Accounting Industry

- When Should A CPA Firm Outsource?

- What are the Misconceptions of Accounting Outsourcing?

- How to search for an accounting outsourcing services provider?

- Ten Questions You Must Ask Outsourced Accounting and Bookkeeping Providers

- 1. What is your accounting experience and expertise?

- 2. How long have you been providing accounting outsourcing services?

- 3. Who are your clients?

- 4. What is the amount of work you can take up?

- 5. What are your engagement models?

- 6. How secure is our financial information with you?

- 7. How do we keep track of our work?

- 8. What are your rates?

- 9. Will you provide an onshore manager?

- 10. What is your turnaround time?

- Why Outsource Accounting to QX Accounting Services?

- Qx Accounting Services- The Market Leaders In Outsourcing

- FAQs on Accounting Outsourcing for CPAs and Accounting Firms

- 1. What is accounting outsourcing?

- 2. Why should CPA firms consider outsourced bookkeeping for CPAs?

- 3. When should (and shouldn't) you outsource your accounting services?

- 4. When should I outsource my firm’s client accounting?

- 5. Is it cheaper to outsource accounting?

- 6. How risky is accounting outsourcing?

- 7. What are the benefits and challenges of outsourcing accounting for a company?

- 8. Who benefits from outsourcing accounting?

- 9. How effective is outsourcing accounting?

- 10. Which company is best for outsourcing accounting?

- 11. What should I consider when choosing an accounting outsourcing partner?

Outsourcing accounting involves partnering with an external company or professional to manage core financial functions such as bookkeeping, financial reporting, and tax preparation.

Additionally, outsourcing partners often bring advanced technologies and best practices that might otherwise be cost-prohibitive for smaller firms, enabling them to compete more effectively in the market.

The shift towards accounting outsourcing also addresses challenges such as talent shortages and high turnover rates in the accounting industry.

By tapping into a global talent pool, CPA firms can ensure they have access to the expertise needed to deliver high-quality services to their clients.

Moreover, outsourcing provides a solution for managing peak periods without overburdening in-house staff, thereby enhancing overall firm performance and client satisfaction.

What is Outsourcing?

CPA Outsourcing services involve delegating accounting and bookkeeping tasks to external firms or specialized professionals.

This allows businesses to access expert financial knowledge and streamline operations while reducing in-house costs and freeing up internal resources for core business activities.

Outsourcing is a work engagement model in which a third party performs tasks on behalf of its clients. This means the third-party provider’s employees will perform duties, handle operations, or provide the necessary support either offshore or onshore.

They will be assigned client work as a team or individually and will sit out of the outsourcing provider’s delivery center.

Key Points to Understand About CPA Outsourcing:

- Types: Offshore, nearshore, and onshore outsourcing, depending on the location of the provider.

- Services: Includes bookkeeping, tax preparation, audit support, and more.

- Cost Savings: Reduces the need for hiring, office space, and technology investments.

- Expertise: Access to skilled professionals with specialized knowledge.

- Scalability: Easily adjust the size of your team based on demand.

- Focus: Frees up time to focus on core business activities.

- Efficiency: Providers use advanced tools and practices for better productivity.

Why do organizations outsource?

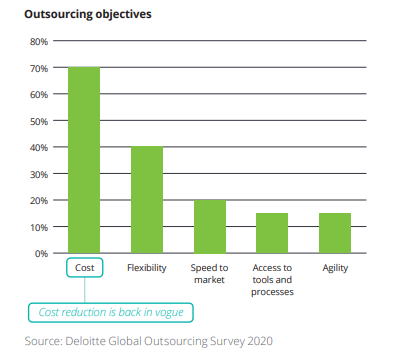

The top outsourcing objective is ‘cost savings’. Organizations/businesses no longer have to hire in-house employees for specific tasks/profiles, which is outsourced, which means the infrastructure costs also go down.

Taken together, there are plenty of cost savings to be experienced because of CPA outsourcing.

The other significant benefit is the flexibility it offers, which essentially means clients can scale their services up or down on a need-based basis. Outsourcing can be a permanent or temporary business practice.

What is Accounting Outsourcing?

Outsourcing accounting involves partnering with an external company or professional to manage core financial functions such as bookkeeping, financial reporting, and tax preparation. These functions can include but are not limited to:

- Analyzing financial statements and costs of operations

- Financial statement analysis

- Cost of operations analysis

- Adjusting entries, that is, expense recording

- Financial review & management reporting

- Industry-specific accounting software skills

- Report compilation

- Sales tax working & return filing

- Cash flow analysis

QXAS Service Brochure

Know more about QXAS US and our services in this brochure.

Download Free Guide

Difference between Virtual Accounting and Accounting Outsourcing

Virtual Accounting: Involves hiring remote accountants to work directly with your firm. They handle tasks like bookkeeping and tax preparation online, acting as part of your team but from a different location.

Accounting Outsourcing: This involves hiring an external firm to take over specific accounting functions or provide a full range of services. This can include both remote and on-site work, often using a team of professionals to manage tasks on a larger scale.

In short, virtual accounting is about remote individual accountants, while accounting outsourcing involves a whole firm taking over your accounting needs.

Why Should CPA Firms Outsource Financial Accounting Services?

There are plenty of reasons why CPA firms should look at CPA outsourcing their clients’ accounting functions:

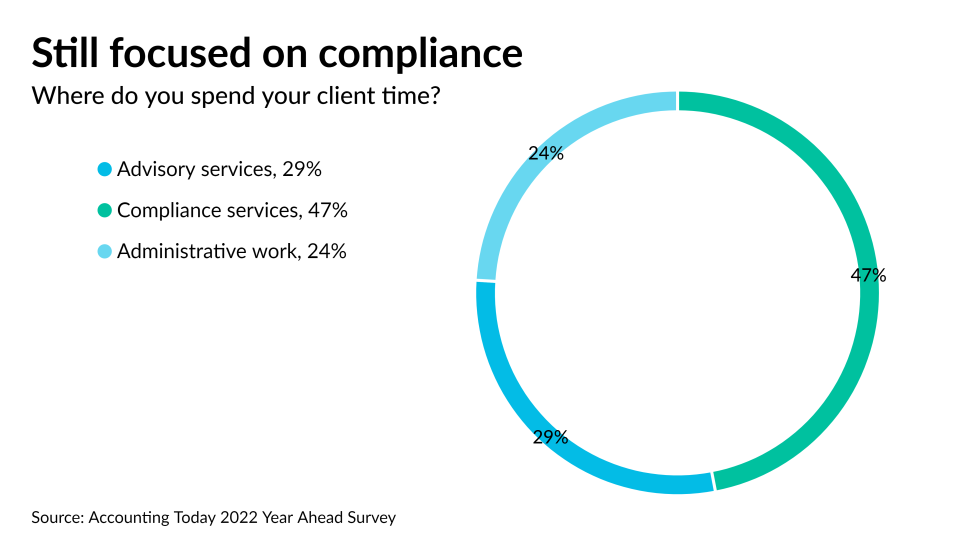

Build Capacity: Take a closer look at the figure. 47% of firms are still focused on offering compliance services.

While most firms talk about moving to advisory services, only 29% of firms are taking on a more advisory role for their clients. One of the reasons for their inability to add advisory services to their portfolio is their lack of resources.

The accounting industry suffers from a severe talent shortage, which means it doesn’t find the time to become advisors to its clients.

Compliance tasks take up most of their time. Scaling its team with outsourced accountants is a pragmatic solution.

This team works as an extension of its in-house team and manages compliance tasks. This frees up time for its internal teams to offer advisory expertise to clients.

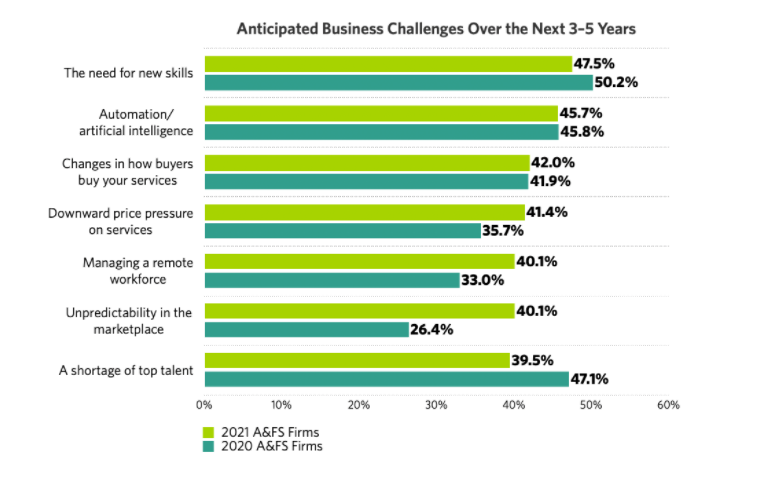

Cost Savings: Post-pandemic, firms are struggling with downward price pressure on services.

It is right up there in the list of the top 10 challenges. Clients will expect your firm to do more with the existing rates or offer discounts on their current rates. As can be imagined, this does not bode well for your firm’s profitability.

The question is – how do you keep generating revenue from your services? The simple answer is to bring down the operational costs.

Unfortunately, the talent shortage means accountants are in great demand, and therefore their salaries are steep.

When you outsource accounting and bookkeeping services, you can hire accountants at far lower rates than accountants who might be on your payroll.

These accountants will be working from a delivery center, which means you are also saving on your infrastructure costs. These savings mean the downward price pressure will not affect your profitability.

Economies of Scale: You can scale your team quickly, affordably, and flexibly without going through a long recruitment and training cycle. Scaling your services means getting the ‘economies of scale advantage. ‘ Get more work done and earn more revenue, ergo more profits.

Scalability also means you can transition from a small firm to a mid-sized firm and beyond. All firm owners aspire to scale their services and thereby grow their firms.

CPA outsourcing services help set the ball rolling in this regard.

Read More: Why CPA firms should look at CPA outsourcing their clients

Key Challenges Faced by the Accounting Industry

Talent Shortage: Difficulty in attracting and retaining skilled accounting professionals due to high demand and competition.

Regulatory Changes: Keeping up with frequent changes in tax laws, accounting standards, and compliance requirements can be time-consuming and complex.

Technological Advancements: The need to adopt and integrate new accounting software and technologies to stay competitive and meet client expectations.

Cybersecurity Risks: Protecting sensitive financial data from cyber threats and ensuring robust data security measures are in place.

Client Expectations: There is an increasing demand for faster, more accurate services and personalized financial advice, which requires firms to constantly improve efficiency and client communication.

Seasonal Workload: Managing peak periods, such as tax season, which can lead to overworked staff and the need for additional temporary resources.

Fee Pressure: Competition and client demands for lower fees can impact profitability, pushing firms to find more cost-effective ways to deliver services.

Remote Work Challenges: Adapting to remote work environments, maintaining team collaboration, and managing client relationships remotely.

Sustainability: Balancing environmental, social, and governance (ESG) responsibilities with profitability as more clients and stakeholders prioritize sustainable practices.

Also Read: How to optimize outsourced accounting and bookkeeping services for your CPA firm

When Should A CPA Firm Outsource?

Accounting firms opt for outsourced accounting services for several reasons.

- During Peak Seasons: Outsourcing helps manage the increased workload during busy periods, like tax season, without overburdening your in-house team.

- To Access Specialized Expertise: If your firm needs skills or knowledge that your current team lacks, outsourcing provides access to experienced professionals in specific areas, such as international tax or audit support.

- To Reduce Operational Costs: Outsourcing can lower costs by eliminating the need for additional full-time staff, office space, and training, making it a cost-effective solution for growing firms.

- When Expanding Services: If you’re looking to offer new services without investing heavily in hiring and training, outsourcing allows you to quickly expand your offerings.

- To Improve Efficiency: Outsourcing routine or time-consuming tasks allows your team to focus on core activities and strategic growth, enhancing overall efficiency.

- Facing Technology Gaps: If your firm lacks the latest tools and technology, outsourcing to a provider with advanced systems can improve accuracy and streamline processes.

- Dealing with High Turnover: If your firm is struggling with employee turnover or shortages, CPA outsourcing provides a stable, reliable resource to maintain continuity in client services.

Read More: Payroll Outsourcing for CPA Firms: When to Make the Switch

What are the Misconceptions of Accounting Outsourcing?

Different accounting firms look at CPA outsourcing differently. Some are already using outsourcing to take care of accounting functions, others are ambivalent about outsourcing (sitting on the fence), and others see outsourcing negatively.

They foresee a range of problems with outsourcing. Let us take a look at them and address them or, to be more specific, bust these myths:

Outsourcing Results in Job Losses

This is a very genuine concern. But, if you properly approach your outsourcing strategy, you won’t have to worry about your employees being worried about losing their jobs.

From the get-go, make your in-house team of accountants a part of this decision. It would help if you made it very clear to them that outsourcing commoditized and time-consuming compliance tasks will only be a boon rather than a bane.

It would also help if you pointed out that outsourcing will free up valuable time and resources and enable the in-house team to focus on high-margin, high-value tasks like advisory services.

They will also have more time to develop their skill sets. It is essentially a win-win for everyone.

Losing Control of Accounting Tasks

This is, again, a cardinal misconception. Outsourcing accounting firms, that is, CPA firms that outsource accounting services, are not losing visibility of their outsourced tasks.

Reputed outsourcing firms strictly follow agreed-upon Service Level Agreements (SLAs), which means you can exercise as much (or as little control) as you wish. You can also track your work, its status, and any other information you might require.

Therefore, monitoring your work and its progress is not a problem. In addition, outsourcing providers also sign NDAs, which means your work information is sacrosanct.

Lack of Data Security

In a world where ransomware attacks are rife and accounting firms are on the radar of cybercriminals, there is a genuine fear amongst CPAs about data security.

Outsourcing means critical financial information is shared with outsourcing providers, and you should only share it if these firms show proof they comply with data compliance laws.

The firm you work with should be SOC 2 Type II compliant, at the very least. If you do the due diligence, you will find outsourcing providers implementing the security controls you are looking for.

You Can’t Trust Outsourcing Services

How do you trust the assurances of accounting outsourcing companies? Good question. Everyone will say they are the best in business.

Well, are they? Their professed successful record of accomplishment needs to be evaluated, and one of the better ways of doing this is by asking for client references.

This is tricky because a reputed outsourcing provider has signed strict NDAs with clients, which might prevent them from sharing client details.

However, most of them will give you a free trial that will help you test their mettle. This is one of the better ways of ensuring you can build trust in the skillsets you will put to work on your accounting tasks.

Cultural Non-Alignment Will Create Problems

Nothing can be farther from the truth. A modern outsourced accounting services provider focuses on hiring accountants with good communication and interpersonal skills.

They are good at their jobs and can blend in seamlessly with a firm’s in-house team.

They are trained to do so and, more importantly, work independently without any micro-management whatsoever.

What’s more, as an accounting firm that wants to add outsourced accountants to your team, you are the one who will judge the merits and demerits of the accountants before you choose them to work on your accounting tasks.

Therefore, you can select the person who you believe suits your firm’s work culture best.

Now, let’s be honest here. Such problems are a worry if you work with just any outsourcing provider and not the best outsourced accounting services provider.

So, how do you go about searching for the best provider?

How to search for an accounting outsourcing services provider?

The easiest step is to look into your inbox. You might have received numerous emails from outsourcing providers pitching their outsourcing services.

The natural reaction is to think of them as spam and delete them to clear your inbox. Nevertheless, there is a chance that some names have stayed with you or that you have saved some of these emails.

Even if you haven’t saved these emails, there is a good chance that you will receive these emails regularly. Keep an eye out for them

The second step in the search process is entering search terms like ‘CPA outsourcing’, ‘accounting outsourcing services,’ ‘best accounting outsourcing providers, USA,’ and so on.

Google will throw numerous results at you. The key here is to look at the service providers’ websites and do some digging. Look up if they have won some recognition in their field and look at their testimonial section.

Also, talk to your peers and check whether they can refer you to a CPA outsourcing provider offering accounting services.

This is one of the better ways of searching for the best outsourced accounting services. You do not have to worry about the quality of services, as people you trust have already worked with them and can vouch for the provider’s services.

The ideal way of searching for an outsourcing provider is by creating a top ten list of providers you want to reach out to and then talking to them.

Get a clear idea about their experience, expertise, engagement models, and charges. Try to get client references and talk about the scope and scale of accounting works they have managed to date.

The idea here is to ask the right questions to get the answers you want.

Also Read: What is a Virtual Outsourced Accounting Staff and How to Find the Perfect Match?

Ten Questions You Must Ask Outsourced Accounting and Bookkeeping Providers

The questions are listed in no particular order, and all of them are important if you are going to work with the right outsourcing provider:

1. What is your accounting experience and expertise?

This is the most critical question that your firm should ask. You must understand the levels of expertise and skillsets of the outsourced accountants working on your project. Also, make sure they have the requisite experience in the kind of work you send their way.

2. How long have you been providing accounting outsourcing services?

The answer to this question helps you understand the number of years the provider has spent in US accounting outsourcing. This is important because a provider that has spent many years in the accounting domain has fine-tuned the operational processes to ensure no glitches and work is delivered on time, without any quality compromises.

3. Who are your clients?

You will find client testimonials on the website of the outsourcing provider. Please go through it and get in touch with the clients to clarify the quality of the provider’s services. You can also ask the outsourcing provider for clients’ names. But, it would help if you remembered that sometimes NDAs signed with clients might stop them from taking names.

4. What is the amount of work you can take up?

There might be a scenario wherein you need to send more accounting work to the provider. What if the outsourcing firm cannot take up this work? In this scenario, you might have to say no to your clients, which might bring down your reputation a notch. So, it is advisable to ask this question to know whether the CPA outsourcing firm can scale up the association with your firm when needed.

5. What are your engagement models?

Typically, firms offer two main engagement models: ad-hoc and Full-time Equivalent (FTE). The former is the right choice if you want to outsource some accounting tasks and do not know whether the flow of work coming your way will continue unabated. The latter is a good choice when you have regular work flowing in, which demands a substantial number of person-hours.

6. How secure is our financial information with you?

This is, again, a critical question that needs answering. Check whether the provider has implemented the necessary security controls and is compliant with the required compliance frameworks such as SOC 2, GDPR, ISO 27701, and others.

7. How do we keep track of our work?

The best-outsourced accounting outsourcing companies have set processes to help clients keep track of their work at all times. They are sent regular progress reports, and many times, these outsourcing firms use custom tracker apps to ensure clients are up to speed 24×7.

8. What are your rates?

The rates might vary from one provider to another but do not fall into the age-old trap of evaluating a provider purely on pricing. Other parameters include security, accreditations, expertise, experience, turnaround time, and more. Yes, always get a quote and compare it with another provider. However, never lose sight of the other parameters

9. Will you provide an onshore manager?

If you are working with an offshore accounting outsourcing firm whose delivery centers are located offshore, it is advisable to ask this question. The onshore manager becomes your point of contact, who you can reach out to in case of any problems you might be facing.

10. What is your turnaround time?

This is an important question. You must understand the TAT and whether it can be speeded up according to your requirements.

Why Outsource Accounting to QX Accounting Services?

- Strategic talent sourcing to manage the skill shortage

- Labor cost arbitrage savings

- Lean six-sigma led standardized and efficient processes

- Actionable metrics and measurements

- Improved SLAs and TAT

- Technology transformation

- Interconnected systems reduce data and effort duplication

- Automated repetitive, time-intensive tasks

- Increased accuracy and efficiency

- Technology-led scalable operations

Qx Accounting Services- The Market Leaders In Outsourcing

- An award-winning company that is both SOC 2 and GDPR Compliant

- Compliant with ISO 27701, a global privacy compliance framework

- ACCA-approved Gold Employer

- Accredited to the highest level of certification under the Cyber Essentials Plus scheme

- ‘Leader’ category on the 2021 Global Outsourcing 100 list, an annual award by IAOP®

- ISO 27001 compliance for security and ISO 9001 compliant for quality management

- A steady stream of qualified bookkeepers through the QX Academy

- Stay on top of all accounting jobs with the QX Tracker App

- Flexible engagement models catering to all requirements, whether big, minor, temporary, or permanent

FAQs on Accounting Outsourcing for CPAs and Accounting Firms

1. What is accounting outsourcing?

Accounting outsourcing is when a CPA firm delegates some or all of its accounting tasks (such as bookkeeping, financial reporting, or tax preparation) to an external service provider. This lets the in-house team focus on higher-value advisory work rather than routine compliance and data-entry tasks.

2. Why should CPA firms consider outsourced bookkeeping for CPAs?

Outsourced bookkeeping for CPAs gives access to specialized bookkeepers, reduces staff hiring and training costs, allows firms to scale quickly during peak periods, and frees internal resources for advisory services. It addresses talent gaps and helps firms stay efficient.

3. When should (and shouldn’t) you outsource your accounting services?

Outsourcing should be used when costs need to be reduced, efficiency improved, or specialized skills obtained. If quality is not controlled or if it compromises client relationships, you can switch to a better outsourcing service provider.

4. When should I outsource my firm’s client accounting?

Consider outsourcing client accounting when your firm faces peak workloads, need to streamline processes or requires access to advanced technology and specialized expertise.

5. Is it cheaper to outsource accounting?

Outsourcing can be more cost-effective than maintaining an in-house team, as it reduces overhead costs such as salaries, benefits, and training while providing scalable solutions.

6. How risky is accounting outsourcing?

Risks include potential data security breaches and loss of control over processes. Mitigate these by choosing reputable, experienced outsourcing partners with strong security protocols.

7. What are the benefits and challenges of outsourcing accounting for a company?

Benefits include cost savings, improved efficiency, and access to expertise. Challenges involve managing quality control, ensuring data security, and integrating outsourced services with existing operations.

8. Who benefits from outsourcing accounting?

CPAs, accounting firms, and businesses of all sizes benefit from outsourcing by gaining specialized skills, reducing operational costs, and enhancing service quality and efficiency.

9. How effective is outsourcing accounting?

When done correctly, outsourcing accounting can be highly effective, leading to increased accuracy, faster turnaround times, and improved overall financial management.

10. Which company is best for outsourcing accounting?

The best company for outsourcing accounting depends on your specific needs. Look for providers with a strong reputation, industry experience, robust security measures, and positive client reviews.

11. What should I consider when choosing an accounting outsourcing partner?

Consider their expertise, security measures, technology, cost structure, and client testimonials. Ensure they align with your firm’s culture and can meet your specific accounting needs.

Vishal Shah

With 13 years of experience in accounting and bookkeeping, Vishal Shah leads QX’s accounting operations, managing a 65+ member team. He specializes in process efficiency, quality control, and client delivery across industries, including SaaS, real estate, and workforce management. Vishal’s leadership drives scale, speed, and client satisfaction for CPA firms.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Our Latest Insights

Let’s Work Together

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.

Book a Virtual Meeting

Book a Virtual Meeting  Get Your ROI Estimate

Get Your ROI Estimate