What’s an SLA: Need, Benefits & Best Practices

Summary:

Outsourcing accounting can deliver efficiency and scale, but only when expectations are clearly defined. A Service Level Agreement (SLA) plays a critical role in setting standards for delivery, quality, communication, and accountability. This blog explains what an SLA is, why it matters in accounting outsourcing, the key components every firm should include, and the risks of operating without one.

Outsourcing accounting can unlock efficiency, flexibility, and cost control. But without clear expectations, it can just as easily create delays, rework, and frustration. That is why a Service Level Agreement (SLA) is crucial when outsourcing accounting services. It defines how work gets done, how performance is measured, and how accountability is maintained. More importantly, it protects both the firm and the outsourcing partner from misalignment.

This blog covers all the major points around an SLA. Let us decode these one by one.

What Is an SLA (Service Level Agreement)?

An SLA, or Service Level Agreement, is a formal document that outlines the scope, standards, and expectations of a service relationship. In accounting outsourcing, an SLA typically defines:

- What services are provided

- How quickly work is delivered

- What quality standards apply

- How communication and escalation work

- How performance is tracked and reviewed

Most importantly, an SLA protects both sides. It helps firms maintain service quality and predictability, while providing providers with a clear structure to deliver against agreed-upon outcomes.

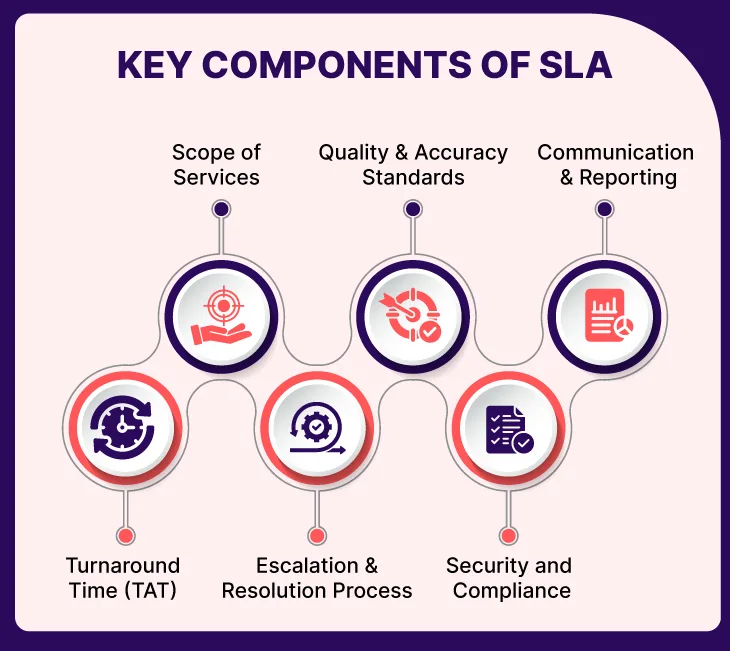

Key Components of an Effective Accounting SLA

1. Scope of Services

Defines exactly what is included and excluded. This avoids scope creep and ensures both sides agree on responsibilities from the start.

2. Turnaround Time (TAT)

Specifies delivery timelines for each task type. This is critical during close cycles, tax season, and reporting deadlines.

3. Quality and Accuracy Standards

Outlines acceptable error rates, review protocols, and rework expectations. Quality becomes measurable, not subjective.

4. Communication and Reporting

Sets cadence for updates, reviews, and performance reporting. This keeps both teams aligned and issues visible from the outset.

5. Escalation and Resolution Process

Defines how and when issues are raised and resolved. Problems are addressed quickly instead of lingering.

6. Security and Compliance

Covers data protection, access controls, and regulatory requirements. This is essential for financial and client data.

Control, Accountability, and Predictable Outcomes

Discover how SLA-driven accounting outsourcing protects quality and turnaround.

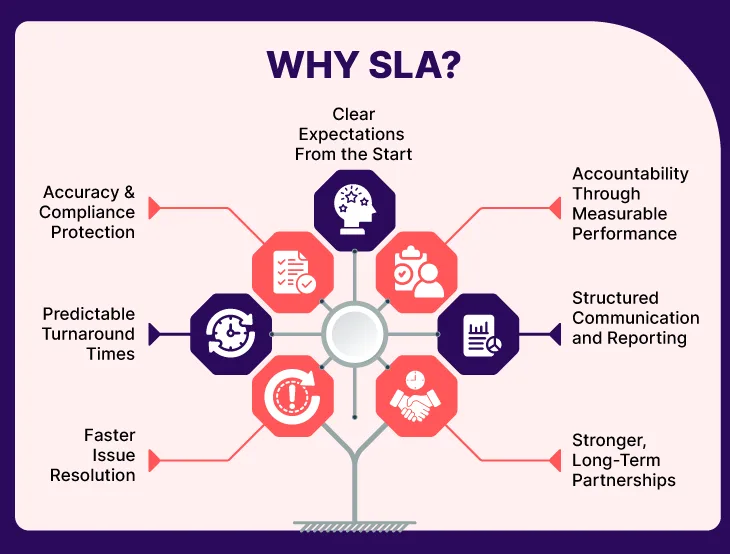

Start the conversation arrow_forwardWhy an SLA Matters in Accounting Outsourcing

Accounting work is time-sensitive, accuracy-driven, and compliance-heavy. Without structure, even small delays or errors can have outsized consequences. An SLA ensures consistency across delivery. It sets clear turnaround times, quality benchmarks, and ownership for every task. This reduces ambiguity and keeps workflows predictable.

It also creates accountability. When expectations are documented, performance can be measured objectively instead of debated subjectively. Not to forget, an SLA also aligns outsourcing delivery with business priorities. The work supports deadlines, peak seasons, and reporting needs rather than operating in isolation.

1. Clear Expectations From the Start

An SLA clearly defines what work is included, how it will be delivered, and the expected standards. Both sides are aware of their responsibilities from the outset. This reduces confusion and prevents scope creep as work scales.

2. Accuracy and Compliance Protection

Accounting errors can quickly turn into compliance risks. An SLA sets clear accuracy thresholds and review standards. This ensures that outsourced work consistently meets regulatory and internal quality expectations.

3. Accountability Through Measurable Performance

Without an SLA, performance is often judged subjectively. A service level agreement establishes measurable benchmarks, including turnaround time and error rates. This makes performance transparent and easier to manage.

4. Predictable Turnaround Times

Timely delivery is critical in accounting workflows. An SLA defines turnaround times for routine work and peak periods. This helps businesses plan confidently and avoid last-minute delays.

5. Structured Communication and Reporting

Poor communication is a common challenge in outsourcing. An SLA establishes a clear communication cadence, reporting formats, and designated points of contact. This keeps teams aligned and reduces the need for back-and-forth communication.

6. Faster Issue Resolution

Issues are inevitable, but delays are not. An SLA outlines escalation paths and response timelines. This ensures problems are addressed quickly before they affect delivery.

7. Stronger, Long-Term Partnerships

Consistent service builds trust over time. An SLA reinforces reliability and stability in the outsourcing relationship. It allows outsourcing to evolve from a cost decision into a long-term strategic partnership.

What Happens Without an SLA or Service Level Agreement?

Without an SLA, expectations remain informal and often misaligned. Turnaround times slip because priorities are unclear. Quality issues increase because standards are not documented. Communication becomes reactive instead of structured.

Problems surface late, escalations lack clarity, and accountability is hard to enforce. Over time, outsourcing starts to feel unpredictable rather than supportive.

Final Thoughts

An SLA, or Service Level Agreement, is the backbone of a successful accounting outsourcing arrangement. It brings clarity, control, and consistency to the relationship. However, an SLA only works when it is designed, monitored, and enforced correctly. This is where a strategic partner matters.

At QX, SLAs are based on real delivery metrics, including turnaround time, accuracy, communication, and outcomes. Combined with structured workflows and strong governance, this ensures outsourcing runs smoothly, even during peak periods.

If you want outsourcing to be predictable, scalable, and reliable, start with the right SLA and the right partner. Connect with QX to see how a well-defined SLA can turn outsourcing into a long-term advantage.

FAQs

1. What is an SLA in accounting outsourcing?

An SLA (service level agreement) is a formal document that defines performance standards, turnaround times, quality benchmarks, and responsibilities between an accounting firm and its outsourcing provider. It sets clear expectations and accountability from day one.

2. Why is a service level agreement important when outsourcing accounting?

A service level agreement ensures consistent delivery, predictable turnaround times, and measurable quality. Without an SLA, firms risk delays, miscommunication, and inconsistent output, particularly during peak periods such as tax season.

3. What should an SLA include for outsourced accounting services?

An effective SLA should cover the scope of work, turnaround times, accuracy thresholds, communication protocols, escalation paths, data security standards, and reporting frequency. These components protect both parties and reduce operational risk.

4. Can an SLA be customized for different accounting workflows?

Yes. A strong service level agreement should be tailored to specific workflows such as bookkeeping, AP/AR, payroll, or tax preparation. Custom SLAs ensure the outsourcing model aligns with your firm’s processes and client commitments.

5. How does an SLA help improve outsourcing outcomes long term?

An SLA creates transparency and continuous improvement by tracking performance against agreed benchmarks. Over time, this helps firms optimize delivery, maintain quality, and build a more reliable outsourcing partnership.

Cora Vollmar

Cora Vollmar is a seasoned professional with over 20 years of experience in accounting, operations, talent management, and business development. Her career began in the construction sector, where she quickly established herself as a leader, achieving triple-digit growth with her CPA team. Cora’s extensive experience includes recruiting for finance and accounting roles, developing innovative STEM-driven solutions to address the U.S. talent deficit, and leading capacity panel discussions across the country.

Recognized as a member of one of America’s fastest-growing construction companies by the Inc. 5000 list for three consecutive years, Cora’s expertise and passion for growth are evident in every aspect of her work. She brings a wealth of knowledge and a dynamic approach to QX Global Group, where she is poised to make a significant impact.

When she’s not working, Cora is an avid traveler with a love for exploring new cultures. She has visited Canada, Mexico, the Caribbean, Europe, the UK, and Central America, with plans to visit Ireland in 2025.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Our Latest Insights

Let’s Work Together

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.

Get Your ROI Estimate

Get Your ROI Estimate