Virtual Accounting Vs Outsourced Accounting: Key Differences

The accounting industry has been facing a persistent staffing shortage, making it harder for firms to find and retain skilled professionals. Staffing shortages have pushed many firms to explore virtual accounting vs. outsourced accounting as solutions for managing workloads efficiently. With large corporations and outsourced accounting firms offering better pay and career growth opportunities, many accountants are moving toward these roles, leaving small and mid-sized firms struggling to compete for talent.

Waiting for the perfect hire isn’t a viable solution for firms looking to scale. Staffing challenges can slow down operations, impact client service, and hinder business growth. One proven way to address this issue is outsourcing, which allows firms to delegate accounting tasks to skilled third-party professionals, ensuring efficiency and cost-effectiveness.

However, many CPA firms often confuse virtual accounting vs. outsourced accounting. While both offer remote accounting support, they operate differently. Understanding these distinctions is essential to choosing the right model for your firm’s needs.

We have a prospective and proven effective solution for you – OUTSOURCING!

Outsourcing basically refers to outsourcing your work to third-party professionals who are skilled at doing it effectively. Accounting outsourcing has several benefits and is, therefore, a rising trend in the financial industry.

However, many CPA firms get confused between the terms ‘Virtual Accounting’ and ‘Outsourced Accounting’. While the two are often used in the same context and do have quite a few similarities, there are some underlying differences that need to be noted and understood.

What is Virtual Accounting?

Virtual accounting simply refers to accounting tasks that are carried out virtually, that is, via the Internet. Virtual accountants can be resources employed by a CPA firm or belonging to a third party, often working remotely from their homes.

The trend of virtual accounting has been on the rise globally, particularly since the onset of the COVID-19 pandemic. In order to keep up with the growing workload and challenges of accounting, several CPA firms have now been allowing their accountants to work virtually.

Benefits of Virtual Accounting

There are numerous benefits of virtual accounting, which have largely come to light only recently. Some of them include:

- Comfort and convenience of work

- Reduced office-based operational costs

- Better turnaround time on critical tasks

- Improved work-life balance for accountants

What is Outsourced Accounting?

Outsourced accounting refers to accounting tasks carried out virtually by accountants employed and managed by a third party. These accountants are based remotely, often even across borders, and work out of a delivery centre.

Outsourced accounting services are in huge demand worldwide owing to their numerous benefits. To scale their firms quickly without incurring a significant increase in costs, many CPA firms have been turning to experienced and reliable accounting outsourcing companies.

Benefits of Outsourced Accounting Services

Outsourced accounting not only offers all the benefits of virtual accounting but, in fact, adds more to the funnel. Some of them include:

- Reduced stress and hassle for CPA firms

- Significant cost savings and higher profitability

- Faster turnaround times

- Reduced to no operational hassles

- Highly skilled and experienced accountants

- Use of the latest technology and software

- Assured data security and confidentiality

Virtual Accounting Vs Outsourced Accounting: What are the Differences?

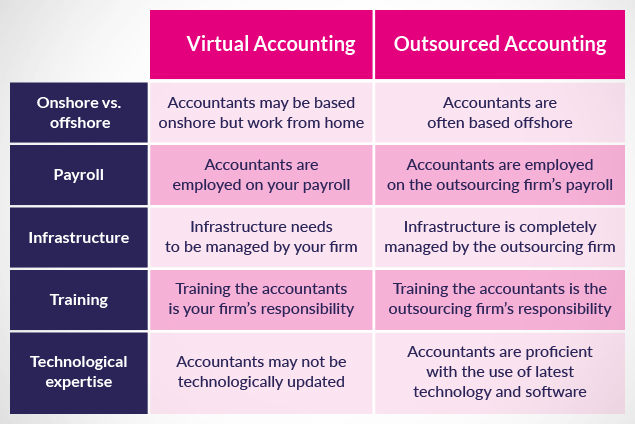

Upon comparing Virtual accounting Vs outsourced accounting, both may seem more or less the same, as they both refer to accounting tasks carried out virtually. However, there are a few underlying differences between them that CPAs need to understand in order to choose the right work model for their firm.

To begin with, all outsourced accounting is virtual accounting, but all virtual accounting may not be outsourced accounting. Here are the key differentiators between the two models.

- Payroll: In virtual accounting, the accountant working for you can be employed by you, whereas in outsourced accounting services, the accountant is employed by the outsourcing company. The latter is, therefore, not on the CPA firm’s payroll but is remunerated by the outsourced accounting firm instead.

- Onshore Vs offshore: The second difference between both the models is based on onshoring and offshoring. In virtual accounting, your accountants may work remotely but may be based in the same location or country as your firm. In outsourced accounting services, however, the accountant or team working for you may be based offshore and work out of a delivery centre.

- Training: When your accountants work virtually, training them adequately becomes your firm’s responsibility. In outsourced accounting, however, this responsibility falls completely on the shoulders of the outsourcing firm.

- Technology: As discussed earlier, virtual accounting can merely refer to a CPA firm’s accountants working virtually. Therefore, if a firm is struggling to integrate the latest technology into its processes, virtual accounting can barely help improve the situation. On the contrary, outsourced accounting services provide experts with sound knowledge and experience of the latest technology, which can help a firm grow quickly.

- Expertise: When your in-house accountants work virtually, they may not bring along additional expertise unless they upskill or are trained on new processes. But even if you do so, it means additional costs for your firm. Outsourcing accounting and bookkeeping services, on the other hand, ensures that you work with accountants who bring exceptional expertise and industry knowledge to the table so that you can assign even complex accounting tasks to them and be assured of their timely completion. Besides, outsourced accounting firms regularly train their accounting professionals so that they seamlessly adapt to the work of clients.

- Infrastructure: In the case of virtual accounting, since the accountants are employed by you, it is your firm’s responsibility to manage their infrastructure and pay them additional benefits. On the other hand, the infrastructure for outsourced accountants is completely managed by the outsourcing firm.

Virtual accounting is thus an effective way for CPA firms to manage their everyday functions, but when it comes to quick growth and scalability, it is accounting business process outsourcing that takes the cake. When you outsource your needs with a trusted accounting outsourcing company, you get an assurance of quality, expertise, and end-to-end data security. By partnering with the right firm, CPAs can easily drive significant cost savings, survive the ever-growing competition, and scale effectively.

What is the Definition of Virtual Accounting?

Virtual accounting is a modern approach to traditional accounting that leverages technology to perform accounting tasks. In essence, virtual accounting refers to accounting activities carried out over the Internet. This method allows accountants, whether they are part of a CPA firm or a third-party entity, to work remotely, often from the comfort of their homes. The rise of virtual accounting has been particularly noticeable since the onset of the COVID-19 pandemic, as firms have had to adapt to the increasing workload and challenges of accounting in a remote work environment.

What is the Importance of Virtual Bookkeeping?

Virtual bookkeeping plays a pivotal role in the modern business landscape. It offers the comfort and convenience of managing financial records without the need for a physical presence. This approach reduces office-based operational costs and provides a better turnaround time on critical tasks, leading to improved work-life balance for bookkeepers.

Moreover, virtual bookkeeping allows businesses to access a wider pool of talent, not limited by geographical boundaries. This means businesses can leverage the expertise of seasoned professionals from across the globe. Furthermore, virtual bookkeeping services often come with the latest technology and software, ensuring efficient and accurate financial management.

Virtual bookkeeping is not just a trend but a strategic move towards efficient, cost-effective, and advanced financial management, making it an integral part of business operations in today’s digital age.

Must Read: Top 10 Outsourced Accounting Services for CPA Firms in 2025

Best outsourced accounting services with QXAS

QXAS is a leading accounting business process outsourcing firm providing custom-made accounting solutions to growth-driven CPA firms. With a team of 1000+ accountants working dedicatedly to make the qualms of accounting a seamless process for CPAs, QXAS specializes in a wide range of accounting functions. We take pride in being an enterprise of QX Ltd, one of West India’s fastest-growing accounting outsourcing firms.

Why QXAS?

- First SOC 2 Type II compliant accounts outsourcing company in India

- Fully compliant with ISO 27001 for information security and ISO 9001 for quality

- Highly efficient, resolute, and experienced accountants

- Achieved 100% score on all audits conducted by the British Standards Institution (BSI)

Vishal Shah

With 13 years of experience in accounting and bookkeeping, Vishal Shah leads QX’s accounting operations, managing a 65+ member team. He specializes in process efficiency, quality control, and client delivery across industries, including SaaS, real estate, and workforce management. Vishal’s leadership drives scale, speed, and client satisfaction for CPA firms.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Our Latest Insights

Let’s Work Together

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.

Book a Virtual Meeting

Book a Virtual Meeting  Get Your ROI Estimate

Get Your ROI Estimate