3 Signs Your Business Needs to Outsource Finance & Accounting

Summary:

As businesses grow, finance and accounting often become pressure points rather than support systems. Staffing gaps, delayed reporting, and limited visibility can quietly slow progress. This article outlines three clear signs that indicate when outsourcing finance and accounting makes sense. And how the right model can strengthen control, scalability, and decision-making.

Fast-growing businesses often hit a point where internal teams struggle to keep up. Hiring becomes harder, workloads become uneven, and finance functions shift to a reactive mode rather than supporting growth.

While these challenges can feel disruptive, they also present an opportunity to rethink how finance and accounting are managed. Finance and accounting outsourcing services are no longer just a cost-control tactic. For many organizations, they have become a way to strengthen financial operations, access specialized expertise, and modernize back-office performance without adding permanent headcount.

It’s no surprise that nearly 60% of businesses now rely on outsourced support, with accounting consistently ranking as one of the most outsourced functions. These finance and accounting outsourcing trends reflect a broader shift in how organizations build scalable, resilient operating models.

The real question is not whether outsourcing works but when it makes sense for your business.

This article outlines three practical signs that indicate it may be time to explore outsourcing finance and accounting services, followed by the key benefits and considerations for next steps.

Sign #1: Growth Is Outpacing Your Finance Team’s Capacity

Rapid growth is a positive challenge, but it remains a challenge nonetheless. If financial oversight doesn’t scale alongside revenue, it’s time to take a closer look.

As transaction volumes increase, financial complexity also grows in tandem. Cash flow management, expense tracking, working capital planning, and margin visibility become more critical. An in-house team that was sufficient at an earlier stage may no longer have the bandwidth or experience to handle these expanding responsibilities.

This is often the point where businesses begin evaluating what is finance and accounting outsourcing and how external support can stabilize operations. A reliable finance and accounting outsourcing provider ensures your finance function evolves at the same pace as the business, without waiting for lengthy hiring cycles or overloading internal staff.

Sign #2: Core Finance Tasks Are Falling Behind

Missed payroll deadlines, delayed invoicing, or slow accounts receivable collections are often early warning signs of strain.

Cash flow is the fuel for growth. When AR follow-ups are inconsistent, or payroll timelines feel tight, it usually points to capacity gaps rather than poor intent. These delays can quickly compound, putting pressure on liquidity, access to financing, and operational confidence.

Many organizations turn to outsourcing finance and accounting services at this stage to bring structure, process discipline, and a dedicated focus to critical tasks. Hence, ensuring timelines are met consistently and cash flow remains predictable.

Sign #3: Financial Data Isn’t Supporting Decision-Making

Your accounting function should do more than keep the business compliant. It should produce timely, reliable data that supports leadership decisions.

If financial records are disorganized, reports are delayed, or leadership lacks clarity on profitability and cash position, the issue is often not effort. Overworked teams tend to prioritize compliance over insight.

This is where finance and accounting outsourcing companies add value beyond execution. They deliver clean financials, standardized reporting, and meaningful insights. So, leaders can act with confidence rather than assumptions.

If your organization is unsure whether now is the right time to outsource finance and accounting, these questions can help clarify the decision:

- Are financial close cycles taking longer than they should?

- Do leaders lack real-time visibility into cash flow, margins, or profitability?

- Is your internal team spending most of its time on compliance rather than analysis?

- Are key people spending time on accounting tasks instead of growth initiatives?

- Are growth plans being constrained by finance bandwidth or systems

If you answer “yes” to 2 or more of these questions, it’s a strong indication that outsourcing finance and accounting services could help stabilize operations and support growth.

Market leading accounting services for CPAs in the USA. Book a no-obligation exploratory call today.

Click here!Why Businesses Turn to Finance & Accounting Outsourcing

When organizations outsource part or all of their finance function, they gain immediate access to trained professionals who bring both scale and specialization. The right finance and accounting outsourcing provider strengthens operations while often costing less than building and maintaining an internal team.

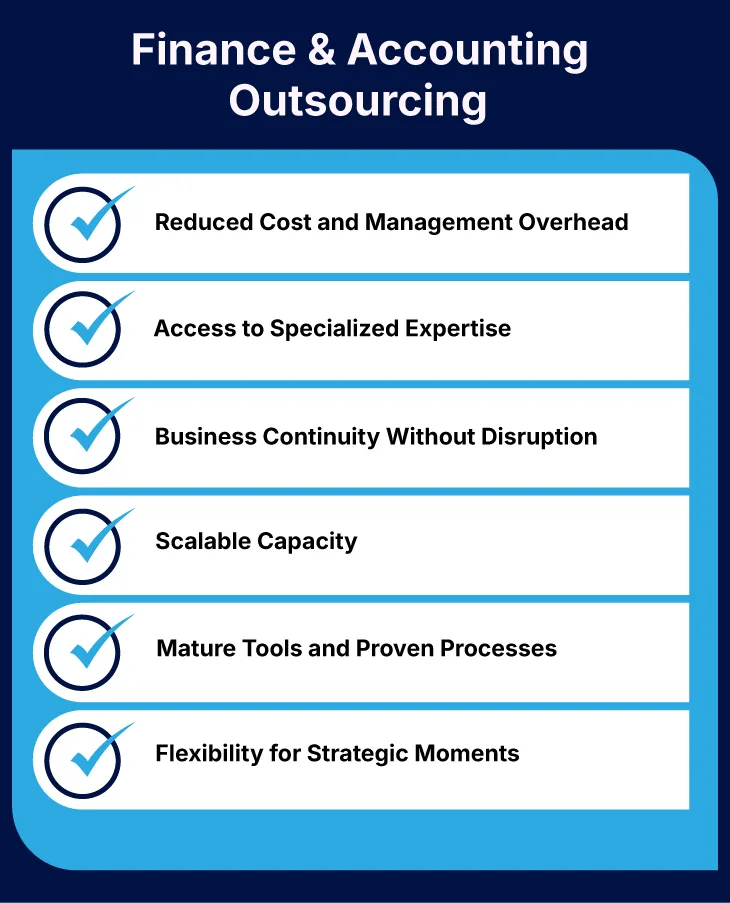

Here’s how outsourcing adds value:

1. Reduced Cost and Management Overhead

Full-time finance hires come with salaries, benefits, training, and system costs. Outsourcing finance and accounting services converts these fixed costs into flexible ones while reducing the time leaders spend managing back-office functions.

2. Access to Specialized Expertise

Every business has unique financial needs. Outsourcing allows companies to tap into expertise across accounting, reporting, compliance, and strategic finance (only when needed). This is a key reason finance and accounting outsourcing services continue to grow across industries.

3. Business Continuity Without Disruption

Employee turnover can significantly disrupt smaller teams. An outsourced model ensures continuity and coverage, maintaining stable finance operations even during internal changes.

4. Scalable Capacity

Outsourcing allows businesses to scale support up or down as demand changes. Whether entering a growth phase or navigating uncertainty, outsourcing finance and accounting services provides flexibility without overhiring or layoffs.

5. Mature Tools and Proven Processes

Outsourced teams bring established workflows, controls, and technology frameworks. This reduces the need for internal investment in tools while improving consistency and accuracy.

6. Flexibility for Strategic Moments

From fundraising and audits to system transitions, outsourced finance leaders can step in with targeted expertise. This ensures a strong and stable support to critical initiatives without long-term commitments.

Final Thoughts

Outsourcing finance and accounting is not just about filling gaps. It’s about building a stronger, more resilient operating model. As finance and accounting outsourcing trends continue to evolve, organizations are realizing that outsourcing is a strategic lever, not a short-term fix.

The impact of outsourcing depends heavily on the partner you choose. Working with a strategic provider ensures that you’re not just delegating tasks, but also improving the end-to-end efficiency of your financial operations.

Providers like QX combine trained accounting talent, structured delivery models, and modern technology to help businesses scale with confidence. With the right finance and accounting outsourcing provider, finance shifts from a constraint to a competitive advantage. Thus, supporting growth from all directions.

FAQs

1.What is finance and accounting outsourcing, and how does it work?

Finance and accounting outsourcing involves partnering with an external provider to manage functions such as bookkeeping, payroll, reporting, compliance, and financial analysis. Instead of building large in-house teams, businesses rely on specialized experts who deliver these services through structured processes and modern technology.

2. Why are more companies using finance and accounting outsourcing services today?

Rising talent shortages, increasing compliance demands, and the need for real-time financial visibility are driving adoption. Current finance and accounting outsourcing trends indicate that companies seek flexible, scalable support that maintains predictable costs while enhancing accuracy and control.

3. How do I choose the right finance and accounting outsourcing provider?

Look for a provider with proven industry experience, strong process controls, modern technology, and a clear communication model. The right finance and accounting outsourcing provider should act as a strategic partner and scale with your business as needs evolve.

4. Are finance and accounting services outsourcing solutions cost-effective?

Yes. Finance and accounting services outsourcing typically reduces costs by eliminating salaries, benefits, software investments, and turnover-related disruptions. More importantly, it prevents costly errors and delays that often occur when internal teams are overstretched.

5. Which businesses benefit most from outsourcing finance and accounting services?

High-growth companies, businesses with fluctuating workloads, and organizations lacking specialized financial expertise see the strongest impact. Many finance and accounting outsourcing companies support firms during growth phases, transactions, audits, or periods of operational change where flexibility and expertise matter most.

Cora Vollmar

Cora Vollmar is a seasoned professional with over 20 years of experience in accounting, operations, talent management, and business development. Her career began in the construction sector, where she quickly established herself as a leader, achieving triple-digit growth with her CPA team. Cora’s extensive experience includes recruiting for finance and accounting roles, developing innovative STEM-driven solutions to address the U.S. talent deficit, and leading capacity panel discussions across the country.

Recognized as a member of one of America’s fastest-growing construction companies by the Inc. 5000 list for three consecutive years, Cora’s expertise and passion for growth are evident in every aspect of her work. She brings a wealth of knowledge and a dynamic approach to QX Global Group, where she is poised to make a significant impact.

When she’s not working, Cora is an avid traveler with a love for exploring new cultures. She has visited Canada, Mexico, the Caribbean, Europe, the UK, and Central America, with plans to visit Ireland in 2025.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Our Latest Insights

Let’s Work Together

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.

Get Your ROI Estimate

Get Your ROI Estimate