Making Tax Digital (MTD) isn’t just a compliance requirement. It is arguably the most transformative shift the UK accountancy profession has seen in decades. For firms ready to adapt, MTD offers a platform to deepen client relationships, expand service offerings, and fundamentally change how accountancy practices generate revenue and deliver value.

With just a few months left before the official launch, let’s explore why MTD matters as a revenue driver and where the biggest opportunities lie. You’ll also learn how QX Accounting Services can support you through the whole implementation process, and answer some key FAQs tailored for owners, partners, directors, and decision-makers at UK accounting firms.

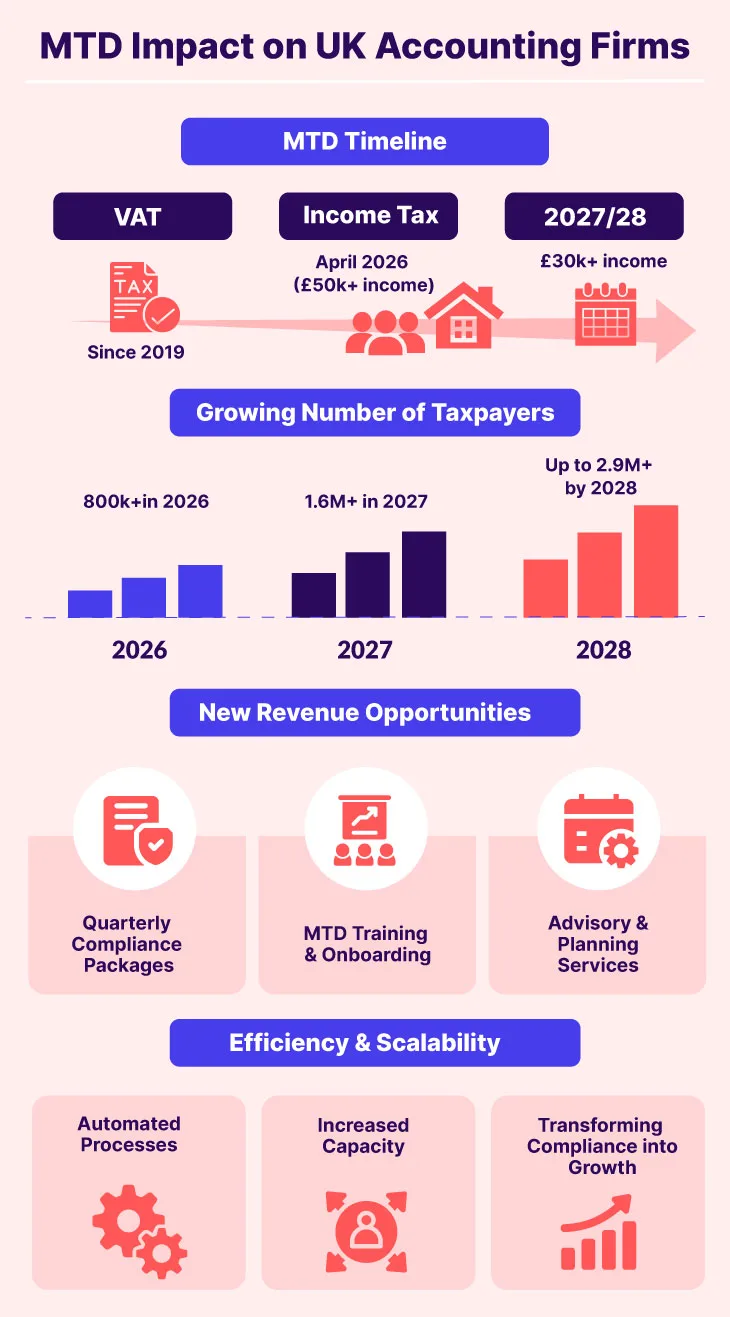

MTD began as a government initiative to modernise the tax system, requiring digital record-keeping and quarterly submissions for VAT and, soon, Income Tax. Beyond reducing errors and speeding up submission, its deeper purpose is to embed real-time financial data into how businesses and their advisers operate.

Here’s what this shift translates to in practice:

Rather than annual touchpoints, quarterly compliance becomes the norm. This naturally increases adviser-client interaction, creating space for deeper conversations about business performance, cashflow planning, and proactive tax strategies – services that firms can monetise beyond traditional compliance.

Digital records offer insights that historic, year-end figures simply can’t. With access to real-time numbers, accountants can identify trends, risks, and opportunities much earlier, enabling proactive advice that clients are willing to pay a premium for.

Nearly 800,000 self-employed individuals and landlords with qualifying income over £50,000 will enter the MTD regime from April 2026, with millions more to follow by 2028 as thresholds reduce. That’s a significant expansion in the addressable market for accountancy practices.

MTD pushes clients onto cloud accounting platforms and forces a move away from spreadsheets or manual processes. Firms that master digital workflows can serve more clients with the same headcount, improving margins and scalability.

Explore what’s changing under MTD and the resource models that can pay you off.

Watch Now

Making Tax Digital opens up several revenue pathways for forward-thinking accounting firms:

Instead of annual service fees, accounting firms can offer structured quarterly reporting, review, and advisory plans. These can be tiered: e.g. Bronze (core compliance), Silver (compliance + quarterly review), Gold (full advisory + tax planning).

Many businesses are unaware of or unprepared for MTD. Research shows a significant portion of sole traders haven’t even heard of MTD, and many feel unprepared for the transition. Offering onboarding support and training is an obvious revenue stream.

With better data comes better advice. Once clients are on digital systems, you can upsell services like cashflow forecasting, management reporting, financial strategy, and tax optimisation.

For firms that lack in-house capacity or specialised teams, outsourcing components of MTD compliance (like quarterly submissions or digital bookkeeping) to partners like QX can free up internal staff to focus on higher-value work.

At QX Accounting Services, we believe MTD should be a growth engine, not a burden. Here’s how we support UK accounting firms through the transition and beyond:

From digitising client records to preparing and submitting quarterly data, we ensure your compliance process is seamless. Our experts stay ahead of HMRC updates so you don’t have to.

We help you communicate the value and requirements of MTD to your clients. Whether it’s training webinars, support documentation, or tailored client onboarding, we make digital transition easier.

Firms can leverage QX’s teams for bookkeeping, quarterly reporting, MTD compliance and preparation of management accounts, retaining clients while expanding into advisory roles.

Our technology-enabled delivery includes automated workflows, dashboards, and analytics that empower your practice to offer proactive insights, not just compliance.

By combining best-in-class processes with UK-compliant expertise, QX helps you transform an administrative mandate into recurring revenue and stronger client relationships.

A: From April 2026, self-employed and landlords with qualifying income over £50,000 will need to comply with MTD ITSA requirements. This expands further in 2027/28 as thresholds fall and more taxpayers enter the regime.

A: HMRC expects up to 2.9 million individuals with self-employment or property income to join MTD between 2026 and 2028, significantly enlarging the potential client base for advising firms.

A: Surveys suggest many practices still feel unprepared, with around 42% reporting low readiness for MTD changes, pointing to a service gap firms can fill.

A: Yes, digital record-keeping improves accuracy, reduces errors, and provides real-time insights that help businesses manage cashflow and make informed decisions.

A: By packaging quarterly services, leveraging technology, and outsourcing non-strategic work (e.g., submissions and bookkeeping), firms can protect margins while offering higher-value advice.

Making Tax Digital isn’t just a regulatory milestone; it is a catalyst for change. For accounting firms that seize the opportunity, MTD can become a foundation for recurring revenue, deeper client engagement, and a stronger strategic offering.

At QX Accounting Services, we’re here to help you navigate this transformation, turn compliance into competitive advantage, and build a future-ready practice.

Download our MTD ITSA service brochure to learn more or book a free consultation with our expert to get any questions answered.

Paresh Agarwal is Senior Manager (Operations) at QX, where he plays a pivotal role in driving operational excellence and business performance. As an MTD (Making Tax Digital) expert at QX, he brings deep knowledge of digital tax compliance, process optimisation, and strategic leadership. With a strong focus on enhancing operational frameworks and supporting client success, Paresh consistently delivers efficient, technology-led solutions for accounting and tax operations.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.