The winds of change are blowing through the accounting world, reshaping the way accountants approach tax season. Gone are the days of sifting through piles of paperwork and manual data entry. Welcome to the era of automation and artificial intelligence (AI) – a transformative revolution breathing new life into the once daunting tax season.

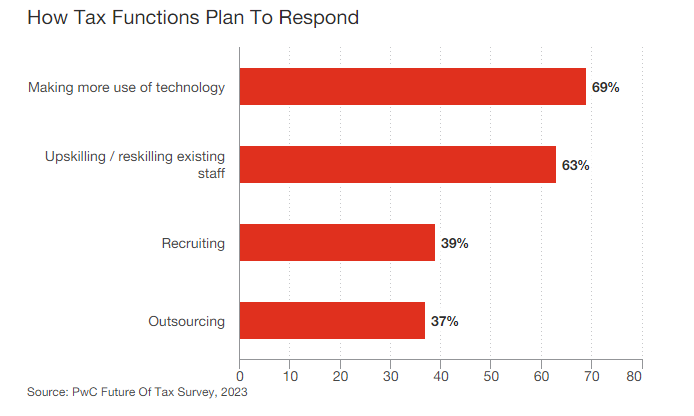

A recent PwC survey on the Future of the Tax Function shows how rapidly corporations and accounting firms are advancing toward technology-enabled tax solutions.

As accountants, you stand at the precipice of a digital frontier, where technology takes the reins and liberates you from repetitive tasks, giving you time to focus on providing exceptional client service. Couple it with outsourcing tax preparation services to India, and you get the sweet nectar of enhanced efficiency, productivity, and profits.

In this blog, we embark on a journey to discover how tax preparation automation and AI are sweeping through the Self Assessment season landscape and how the strategic use of outsourcing can further amplify its potential.

Automation, the silent ally of modern-day accountants, is redefining how tax season is approached. But what is personal tax automation really?

Time-consuming tasks that once bogged down accountants can now be executed with unprecedented speed and precision. From data entry to document organisation, automation tools streamline workflows, enabling you to process more returns in less time.

Embracing automation means leaving behind the days of repetitive drudgery and stepping into a realm where technology becomes your trusted assistant, freeing you to focus on the analytical and advisory aspects of your profession.

If automation is the ally, then AI is the virtuoso in the orchestra of change. AI’s ability to learn from data, identify patterns, and make intelligent decisions has transformed the tax season landscape.

A 2024 Wolters Kluwer report highlighted the accounting industry’s growing inclination toward AI tools to keep pace with technological advancements and industry changes. The study suggests that over 50% of accounting firms consider increasing their usage of AI tools in coming years.

AI-powered tax software can crunch numbers, analyse data, and interpret complex regulations with uncanny accuracy. It not only reduces the risk of errors but also identifies potential deductions and credits that might have been overlooked.

With AI in your corner, you can rest assured that your clients’ tax returns are completed efficiently and optimised to their fullest potential. Many accountants outsource tax preparation services in combination with leveraging cutting-edge technology to see the best results.

As you embrace the power of tax automation and AI, an equally compelling solution lies in strategic outsourcing. The practice of delegating certain tasks to external experts is not just a cost-saving measure but a means to unlock unprecedented efficiency during tax season.

One of the most prominent outsourcing destinations is India, where highly skilled professionals offer specialised tax preparation services at a fraction of the cost. You can outsource tax return preparation to offshore experts and focus on strategic planning, client communication, and growing your practice.

Ready to witness the power of tech and outsourcing? Talk to our experts today.

India has emerged as a global hub to outsource tax preparation services, with a proven track record of delivering exceptional results. Outsourcing to India gives you access to a vast pool of accounting talent equipped with in-depth knowledge of UK tax laws and regulations. The time zone difference also offers an advantage, allowing you to submit work at the end of your business day and receive completed returns the next morning. This unique collaboration fosters an uninterrupted workflow, accelerating your tax season performance like never before.

When choosing a tax preparation service provider, consider the following key factors. First, evaluate the service provider’s experience and expertise in handling tax situations similar to yours. Look for certified professionals with a track record of accuracy and compliance. Second, inquire about the security measures in place to protect your sensitive financial information. Ensure the service follows industry standards and employs encryption and secure data storage practices.

Lastly, consider the cost and level of support provided. Outsource tax return preparation to a provider that aligns with your budget and offers responsive customer support to address any concerns or queries promptly. By focusing on experience, security, and support, you can find a tax preparation service that meets your needs and ensures a smooth and stress-free tax season.

Here’s a quick video to help you choose the right outsourcing partner.

The process to outsource tax preparation services is comprehensive and involves several other steps. By following these steps, you can streamline the tax outsourcing process, optimise efficiency, and focus on higher-value tasks, ultimately leading to a successful tax season.

As accountants, you are at the crossroads of an exciting digital transformation. The fusion of automation and AI in tax season holds the promise of streamlined workflows, improved accuracy, and greater client satisfaction.

However, to unlock the full potential of this revolution, consider the strategic use of outsourcing tax preparation services to India. By doing so, you will not only amplify the benefits of automation and AI but also elevate your professional prowess and redefine the art of tax season success. Embrace the power of technology, harness the strength of outsourcing, and become the trailblazing accountants of the future.

The dawn of a new era awaits!

Deepika is a seasoned accounting professional with over 13 years of experience spanning the Indian, US, and UK markets. Her expertise covers audit, iXBRL, bookkeeping, VAT, taxation, and both management and statutory accounts preparation and review for limited companies, partnerships, and NRLs. She also brings specialised knowledge in conducting Independent Examinations for not-for-profit organisations, ensuring accuracy, compliance, and value-driven outcomes for diverse clients.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.