Filing tax returns is a resource-intensive process that demands a lot of time and effort. In addition to time-crunch and increasing workload, the skills shortage in the UK has reached critical levels.

A recent study revealed that two-thirds (68%) of SMEs are battling skills shortages, a steep rise from a quarter (24 per cent) from last year. This has affected over 78% of firms, who have reported reduced output, profitability, and growth due to the skills shortage.

If not handled promptly, it will result in a progressive deterioration of the quality of services and may even lead accountants to miss the Self Assessment tax return deadline.

The usual norm is that the tax season is excruciatingly hectic for accountants. It’s the time when they work fingers to the bone making sure their clients meet all the tax deadlines. However, the scale of difficulty is even higher in the post-pandemic world.

In this article, we will discuss the struggles of an accountant and the steps to create an effective Self Assessment tax outsourcing strategy that will help you navigate this tax season smoothly.

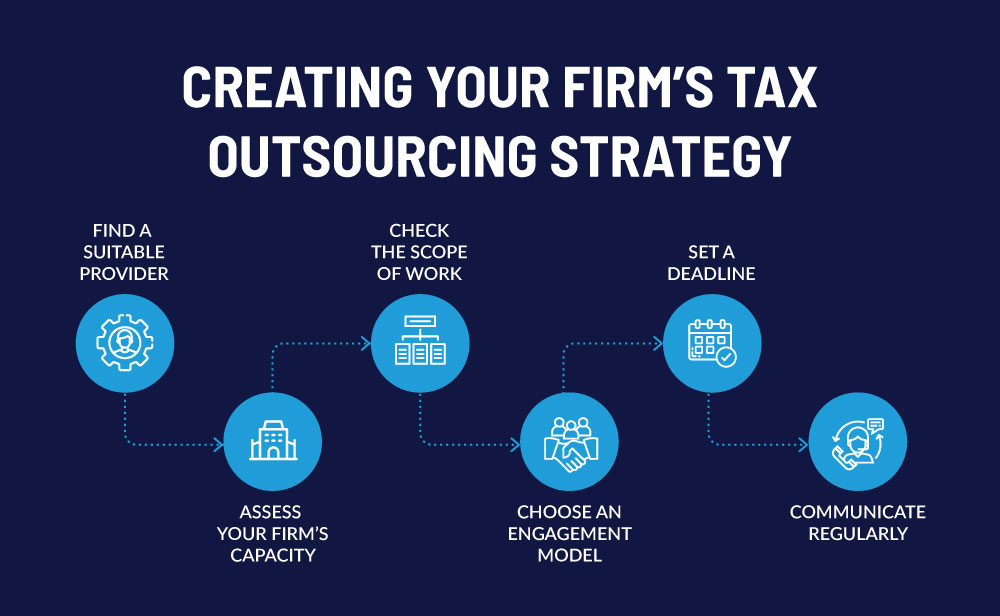

Before hiring an outsourcing company to outsource UK Self Assessment tax return, accountants must have a well-defined tax return preparation outsourcing strategy that helps them reap maximum benefits from the association.

Here’s an outsourcing strategy that you must follow:

Your process must begin with a background check and asking peers for references. Look for the best firms providing tax outsourcing services and start interviewing them. Check their infrastructure, staffing and technological capabilities. Choose a provider that ticks all the boxes in your list and is GDPR compliant.

To manage the outsourcing plan effectively, consider how much time you have and assess the number of clients and workforce available to file those tax returns. Once the workload has been identified, you can choose how to divide that number between the in-house and offshore teams.

A simpler way will be – outsourcing tax preparation services.

Your in-house accountants can utilise the freed-up time to learn more about business advisory services, upskill, learn new technology, and thus explore more revenue streams without adding to the overheads.

Before kickstarting the collaboration, you must check if your requirements align with the scope of the outsourcing firm. You can choose to select the entire set of tax functions or selectively go for a few, like tax preparation for individuals and partnerships, tax summary, property schedules, etc.

Here’s a quick video to help you choose an outsourcing partner for your needs.

Top companies providing tax preparation outsourcing offer varied pricing and engagement models for accountants to choose from.

There are three modes of co-sourcing to meet each client’s specific needs. They are:

You must have a knowledge transfer session with your outsourcing partner. Discuss the current tax projects you are managing, or better yet, fill in a checklist. Once you have answered all the important questions, share your existing process with the outsourcing team.

Tell them about the software you want them to use, the reports you want them to provide, and set a deadline.

Once an appropriate model is chosen, the outsourcing team will allocate the required resources.

Must read: How to Expand Your Client Base This Self Assessment Tax Season

Here’s a 6-step process that tax outsourcing companies in India follow:

Ensure that you stay connected with your outsourcing partner through the entire process. Earlier, it was not an easy task, but today, leading outsourcing firms have apps that allow accountants to review work from any corner of the world.

For instance, the QXAS Job Tracker mobile app allows accountants to see task progress, raise queries, and much more.

To sum up, here’s how you can create a successful tax return outsourcing strategy for your firm.

According to Accountancy Age, 67% of accountants in the UK are all set to outsource some aspects of their services to remain competitive.

In an age where the role of an accountant is not limited to just filing tax returns, accountants need to do more in a limited period. Tax preparation outsourcing is critical in managing this excessive workload during the busy tax season.

Here’s why you must have a solid strategy to outsource tax preparation services for the 2022 Self Assessment season:

The digital tax initiative (MTD) announcement was a massive change for businesses. UK accountants spent their entire year working with clients to help them get prepared for Making Tax Digital.

Many such developments are on the horizon. To integrate them well into the client’s business ecosystem, accountants must be well-acquainted with them. With tax preparation outsourcing, you can focus on ‘what’s next?’ rather than the mundane, compliance-driven tasks.

Businesses are facing difficulties maintaining their cashflows and generating revenues. They not only need assistance with their tax returns but also with managing their overall businesses.

When you outsource UK Self Assessment tax return, you can take on more work, evolve your service offerings, and become the advisors your clients have always wanted. You can focus on advising your clients in several areas, such as legal, technology, and any business changes needed for a better future.

Data accuracy is of utmost importance for tax compliance, and tax preparation outsourcing helps prepare more taxes accurately. Accurate data enables you analyse and interpret numbers better, facilitating better value for your clients.

Also, the expanded service portfolio helps accountants attract more clients.

Must read: The ROI of Outsourcing Self-Assessment Tax Returns: Is Your Firm Missing Out?

We hope this guide helps accountants create a productive Self Assessment tax outsourcing strategy for their firm. Accountants mustn’t think that outsourcing is just a temporary solution but a strategy that would help their firm grow in the long run.

An accountant must consider making outsourcing an indispensable part of their firm’s workflow. It helps expand your clientele and grow your practice without worrying about the workforce’s size.

In a competition-driven economy, Self Assessment return outsourcing helps accountants stay a step ahead with the strategic support and streamlined processes delivered by an outsourcing partner. A reliable outsourcing partner like QXAS can help your firm grow with its customised services and commitment to TAXellence.

QXAS, a market leader in outsourcing and a trusted partner to 500+ accounting firms, provides comprehensive tax preparation support at specialised prices during the tax season. Our team comprises 100+ highly experienced and trained tax preparers who work on your preferred software and can handle any level of complexity. Read our complete scope of work here: Personal Tax Outsourcing Services

We are a 100% GDPR-compliant outsourcing firm with 20+ years of industry experience. Discover what our customers say about us: Client testimonials

We also provide a risk-free FREE TRIAL (up to 10 hours/2 tax returns) to help you assess our services without any commitment. Getting started with us is easy. Simply chat with our tax experts at +44 208-146-0808 or drop an email at [email protected].

Dinesh is a seasoned accounting and tax professional with more than 20 years of experience, specialising in UK personal tax. He has a proven track record of streamlining tax processes and building strong client relationships, consistently delivering accurate and compliant taxation services tailored to client needs.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.