Offshore accounting services from India provide businesses worldwide with access to a vast pool of skilled accounting professionals at a lower cost, helping to improve efficiency and allowing companies to focus on core activities.

Services range from basic bookkeeping to complex financial analysis, tax preparation, audit support, and more.

Accounting outsourcing and offshoring to India began as cost-cutting measures, but accountancy practices that create real, sustained value use them for far more strategic ends- to address staffing shortages, or to gain capabilities that they don’t have in-house.

We have found that 80% of those accountants who outsourced their back-office accounting work to us did so to access a global pool of accounting talent and enable faster technology adoption.

In other words, they have moved way beyond cost-cutting.

It is thus clear that offshore outsourcing services India is picking pace in the UK accounting market.

Before we dive into how it has helped our clients, let’s address a key topic – Outsourcing to India: The Offshore Advantage.

Cost savings is the greatest reason accounting firms in the UK offshore to India.

But there are several other benefits of offshoring to India in the contemporary world. Some of them are listed below:

When it comes to outsourcing, India is among the topmost choice for accountancy firms.

Based on our experience with clients, we’ve found that leading accountancy practices use our services to build six strategic capabilities.

Shortage of talent, particularly in the UK, is hampering the ability of practices to grow. Most clients overcome this obstacle by seeking external support in the form of outsourced accounting services in India.

This not only helps them save on costs but also deliver an increased number of accounting jobs at a faster turnaround time.

With the arrival of cloud accounting and business advisory services, accountants need to establish a presence before their competitors do.

Our clients tap into the booming cloud accountancy market by using virtual accountants to do the routine accounting, bookkeeping and payroll jobs.

As a result, they are able to focus on business advisory services and stay ahead of the competition.

One of the greatest benefits of accounting offshoring to India for UK accountants is that practice owners no longer have to refuse work.

By having access to such a large overseas workforce, no tasks become too trivial.

Previously, services such as bookkeeping were viewed as tedious work with minimal return. However, refusing this work meant you could sour the relationship you have with your clients.

No client wants to hear “no we can’t do that”. With outsourcing, you don’t have to say no, and you can still take on all those tedious tasks but not deal with the headaches that come with it.

Bringing out new services ahead of the competition is critical for accountancy practices in a rapidly changing accountancy marketplace.

When clients outsource their back-office compliance activities, it boosts their in-house staff productivity to generate more revenue by selling services such as business advisory and cloud accounting.

Accounting has significantly transformed over the years.

Accountancy practices no longer function the same way as they did before, thanks to the evolution of technology and professional outsourced accounting services.

Offshoring outsourcing services helps firms take up new projects, attract new clients and make their processes more efficient and hassle-free.

It enables accountants to stay away from the growing market competition, thus disrupting the traditional accountancy models.

With administrative tasks being outsourced, practice owners can focus their time and energy where they want to.

The end game is that owners can still maintain a successful practice in addition to having the freedom to spend time with their family and friends.

This benefit is also applicable to the current staff of the practice.

By outsourcing labour-intensive jobs, senior staff get to work on more challenging assignments which eventually creates a happier individual with a healthy work-life balance.

The above points establish that when it comes to outsourcing, saving money is not the only concern.

In fact, an ambitious accounting practice owner tends to look at the success and longevity of their practice and takes advantage accordingly.

The most important thing to remember when working with an offshore team is maintaining regular communication.

Since offshore teams work from different countries in different time zones, it is important to regularly catch up with them, discuss strategies and goals, and share feedback.

When an offshore resource or team joins your practice, ensure to make them feel welcome. Give them a proper introduction, familiarise them with your processes and team, and establish expectations clearly to avoid any miscommunication.

Our client, a UK-based ICAEW member and PCG-accredited Chartered Accountancy firm, was able to increase their productivity significantly by outsourcing to us.

The firm was struggling with high staff turnover and training costs. In addition, they also struggled with practice management and automation. This is when they decided to outsource and partnered with QXAS.

QX devised a detailed 12-month plan to combat the challenges and implemented it using innovative methods.

In turn, the client was able to hire resources at 50% of their in-house costs, improve turnaround time and efficiency and streamline their processes.

Read the full case study here: How we improved productivity of a small UK accountancy practice

As a specialist outsourcing company with accounting, bookkeeping, tax, and payroll services for UK accountants, QXAS is your essential business partner in helping you create a well-rounded practice. For more information about how your practice can start benefitting from outsourcing feel free to get in touch.

Deepika is a seasoned accounting professional with over 13 years of experience spanning the Indian, US, and UK markets. Her expertise covers audit, iXBRL, bookkeeping, VAT, taxation, and both management and statutory accounts preparation and review for limited companies, partnerships, and NRLs. She also brings specialised knowledge in conducting Independent Examinations for not-for-profit organisations, ensuring accuracy, compliance, and value-driven outcomes for diverse clients.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

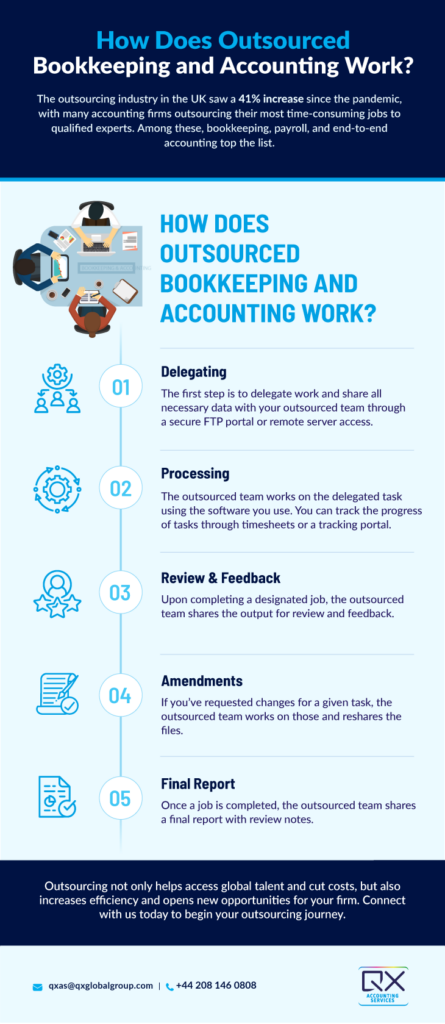

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.