Accountants, we’re exactly a week away from stepping into the last quarter of the year. Have you met your annual goals yet? How far are you from achieving these targets?

What do you anticipate for the upcoming busy quarter and the coming years?

With 2025 getting closer to the horizon, it’s essential to reflect on the dynamic landscape of the accounting and bookkeeping industry.

This year has seen remarkable changes, and as we inch closer to its end, there are several trends that accounting professionals should be prepared for.

Embracing these shifts will not only keep your firm competitive but also ensure sustained success in a rapidly evolving marketplace.

In this blog, we’ll delve into some of the major accounting and bookkeeping trends, such as outsourcing accounting services, which will be crucial for futuristic practices.

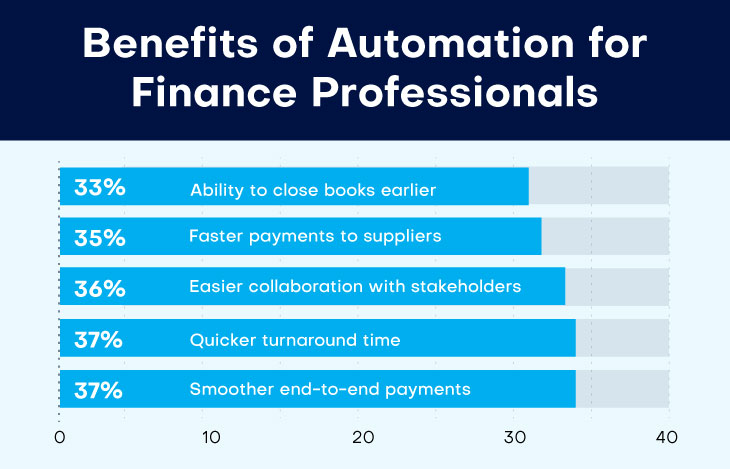

Automation has been a buzzword in the accounting world for some time now, but in 2024, this trend evolved further.

Beyond basic automation of routine tasks, integration of advanced technologies such as artificial intelligence and machine learning took shape, enhancing decision-making processes.

According to a recent study, 90% of finance professionals are happy with their organisation’s adoption of AI technology. Further, about 47% of professionals admit to wanting more automation as it facilitates more time for innovative strategies.

The above technologies can analyze vast datasets, identify patterns, and provide valuable insights, allowing your firm to offer more strategic and proactive advice to clients.

In the coming months, invest in advanced accounting software and platforms that leverage these technologies to stay ahead in the digital transformation journey.

Accounting and bookkeeping outsourcing continues to be a key emerging trend in the accounting sector. Firms are increasingly recognizing the benefits of outsourcing non-core functions to specialized service providers, such as QX Accounting Services.

This not only allows for improved efficiency but also enables your team to focus on high-value tasks such as advisory services and client relationships.

Explore outsourcing options for routine bookkeeping, payroll, and other repetitive tasks to streamline your operations and enhance overall productivity.

Also read: How Much Does it Cost to Outsource Accounting Services?

With the increasing reliance on digital platforms and cloud-based solutions, cybersecurity has become a paramount concern. The May 2024 Cyber Roundup published by ICAEW highlights the gravity of the issue, making it a significant trend for accounting firms to consider.

Accountants must prioritise robust cybersecurity measures to safeguard sensitive client information and maintain trust. Invest in state-of-the-art cybersecurity technologies, conduct regular audits, and educate your staff on best practices to mitigate the risks associated with data breaches and cyber threats.

One cost-effective way to implement top-tier cybersecurity is by partnering with an outsourced accounting services provider.

Outsourcing firms are at the forefront of the cybersecurity revolution and comply with all necessary security standards.

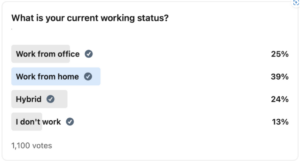

The global shift towards remote work has had a lasting impact on various industries, and accounting is no exception.

A recent Forbes survey of 1,100 respondents highlighted the employees’ growing inclination toward the remote working setup.

In 2024, accounting firms continued embrace flexible working arrangements, giving preference to the hybrid setup over completely remote or office-based roles.

Cloud-based accounting tools and collaboration platforms play a crucial role in facilitating seamless communication and project management across dispersed teams.

Embrace this trend to attract top talent and enhance work-life balance for your staff.

Environmental, Social, and Governance (ESG) considerations are gaining prominence in the business world, and accounting firms are no longer immune to this trend.

In 2024, clients increasingly sought guidance on ESG reporting and sustainability practices.

Stay ahead by integrating ESG considerations into your advisory services and investing in tools that facilitate accurate and transparent reporting on environmental and social impacts. Consider outsourcing accounting services to create capacity within your firm to focus on advisory and sustainability solutions.

In conclusion, the evolving accounting and bookkeeping landscape promises both challenges and opportunities.

By embracing technology, outsourcing strategically, prioritizing cybersecurity, adapting to remote work trends, and integrating ESG considerations, your firm can position itself as a leader in the industry.

As you navigate these trends, remember that staying informed and agile is key to continued success in the ever-evolving world of accounting.

Accounting and bookkeeping outsourcing refers to the practice of delegating accounting and financial tasks, such as bookkeeping, payroll processing, and tax preparation, to external service providers.

This allows businesses to focus on core activities while leveraging specialised expertise for efficient and cost-effective financial management.

Outsourcing accounting services is advisable when your business experiences rapid growth, faces a capacity crisis or seeks cost-effective solutions.

It allows you to streamline operations, access specialised expertise, and focus on core business functions. Here’s a quick video to help you out.

QXAS, a market leader in the outsourcing space, provides tailored outsourced accounting services to accountancy firms in the UK.

We are at the forefront of the accounting revolution, providing next-generation outsourcing solutions that help you scale and future-proof your practice.

Curious to know how our solutions can transform your firm and facilitate profits? Call our experts at +44 208 146 0808 or email us at [email protected] to get started.

Mustufa is a Chartered Accountant with 10 years of progressive experience across Indian, Canadian, and UK accounting domains. He has a proven track record of leading high-performing teams of 60+ members, managing multi-client portfolios, and driving operational excellence with measurable profitability improvements.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.