Will AI Replace Accountants?

Summary:

AI is changing the way accounting work gets done. Routine tasks are becoming faster and more automated, while the real value of accountants is shifting toward judgment, relationships, and strategic guidance. This article explains what AI can and can’t do, how it’s reshaping the profession, and the skills that will help accountants stay relevant in the years ahead.

AI has become a major force in accounting. It handles routine work more efficiently, consolidates information, and simplifies many day-to-day tasks. As a result, many professionals are asking the same question: Will accountants be replaced by AI?

The short answer is no.

AI is undoubtedly the catalyst behind the paradigm shift currently underway in the accounting profession. But it is not replacing accountants anytime soon or later.

Accountants are still needed for judgment, context, and the human relationship that clients rely on. AI helps with speed and accuracy, but it cannot understand goals, interpret complex situations, or offer advice grounded in experience.

This article examines the capabilities and limitations of AI, as well as the skills accountants will need to remain competitive in the years ahead.

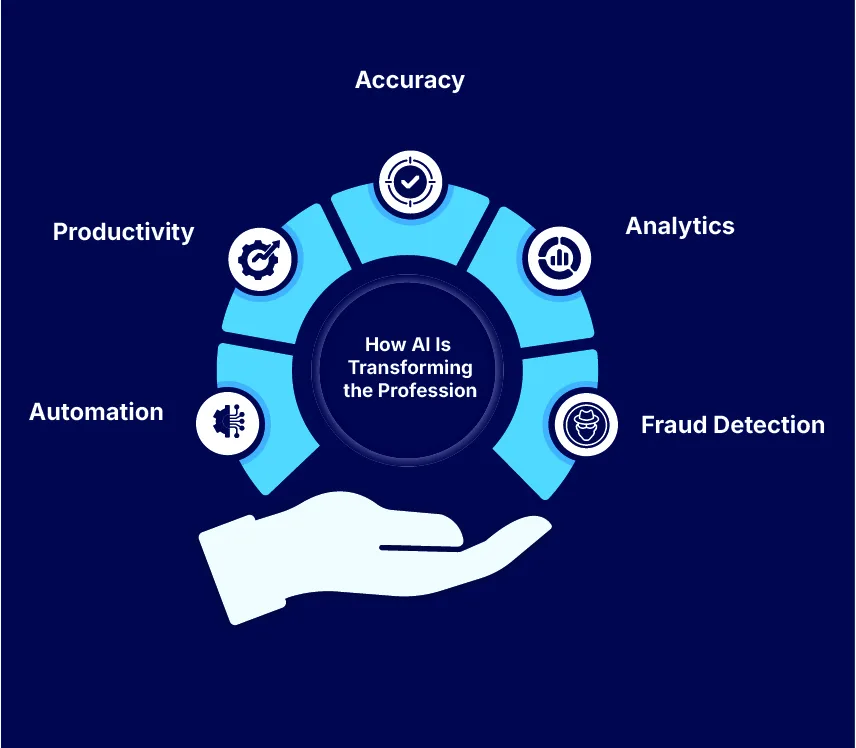

How AI Is Transforming the Profession

AI has evolved into a practical tool rather than a futuristic concept. Many firms utilize it to process information more efficiently, automate manual tasks, and free up resources for more client-focused activities. The adoption rate continues to rise. Globally, 83% of accounting professionals are already using AI, according to the “The State of AI in Accounting 2025” report, and usage is expected to continue growing. Artificial intelligence in accounting is projected to grow by 30% year-over-year through 2027, fueling questions like Will AI take over accounting jobs?

Studies also show that most finance professionals expect AI to add value to their roles rather than threaten them. The reason is simple: the technology handles the volume, and humans handle the decisions. Supporting this sentiment is Gartner, which reports that 80% of CFOs expect to increase their spending on AI over the next few years.

Here are the areas where AI is already reshaping the work:

1. Automation

AI takes on repetitive tasks, everything from data entry to invoice processing. For firms handling large volumes of data every month, this saves hours of manual work and keeps information organized in one system, rather than scattered across separate files or offices.

This gives professionals more time for client conversations, planning, and troubleshooting real issues.

Streamline Peak Season with Tax Automation: Say Hello to ROBO1040

Want to learn how Automation can transform your tax season? Read more in this blog!

Click here!

2. Productivity

Routine work moves faster when automated. Payroll, reconciliations, and tax calculations can be completed more efficiently and with fewer errors. This enables firms to expand their client base without hiring additional staff.

3. Accuracy

AI reviews large amounts of financial data quickly and flags items that look unusual. It finds inconsistencies that may take a human longer to detect. This makes reports cleaner and helps firms stay compliant. Accountants can still review the output. AI simply gives them a better starting point.

4. Analytics

AI tools analyze past activity and highlight trends. This provides firms with insights that support forecasting, cash flow planning, and long-term decision-making. These insights strengthen advisory conversations and create new value for clients.

5. Fraud Detection

AI is effective at scanning large volumes of transactions and spotting irregular activity. It supports compliance by checking patterns that may indicate risk. This adds an extra layer of protection for both firms and clients.

Where AI Falls Short

AI is powerful, but it is far from replacing the human side of accounting. It offers answers, but it cannot determine whether those answers make sense for a specific client or situation. And most importantly, AI cannot replace the trust, judgment, and perspective that come from working directly with people and understanding their goals.

1. Judgment

Financial decisions are not always straightforward. Experienced accountants rely on judgment developed through years of real-world experience. They know when something “feels off,” even if the numbers look right. AI cannot apply that kind of instinct. It only responds to patterns it has already learned. And this is a major limitation for a profession that works on

2. Creative Problem-Solving

Many financial situations require creative thinking. Each client is unique, and their challenges rarely follow a consistent pattern. AI can process information, but it cannot devise new approaches or tailor solutions to a client’s unique needs. Creativity remains a distinctly human ability.

3. Client Relationship Building

Trust and communication are central to the profession. Clients want someone who understands their goals, their concerns, and their plans for the future. They rely on human reassurance when making financial decisions that have personal or business-level implications.

AI can assist with data. But managing relationships? That can only be done by someone who has a heart, can empathize, and build connections.

4. Adaptability

AI can adjust when it receives new data, but only within the confines of its programming structure.

When a situation falls outside the usual pattern, such as an unclear file, an unexpected issue, or a last-minute change, AI lacks the necessary context to navigate it.

Accountants adapt quickly. They combine experience, judgment, and practicality to respond to real-world situations that do not fit an AI algorithm or model.

5. Ethical Decision-Making

AI follows rules. It does not understand ethical responsibility or professional standards.

Accountants evaluate the spirit of the rules, not only the mechanics. They determine what is appropriate, responsible, and compliant. Ethical judgment remains firmly human.

How Accountants Can Work Alongside AI

AI is not replacing the profession, but it is changing the expectations placed on it. To stay competitive, accountants will need to develop skills that integrate technology, communication, and strategic thinking.

Here are the key areas to focus on:

1. Tech Comfort & Tool Literacy

AI tools will become part of daily work. Professionals will need to understand how these tools function, how to review their output, and when to conduct a deeper analysis. The end goal is confidence, not technical mastery.

2. Data Interpretation

AI can deliver patterns, but clients need someone who can explain what those patterns mean. This is why interpreting results and translating them into practical next steps becomes a core skill.

3. Advisory Mindset

As AI handles more of the routine tasks, the value of the profession shifts toward guidance and planning.

Clients want support with decisions, not just historical records. Professionals who can interpret the numbers and connect them to a client’s future will stand out.

4. Communication

Clients want clarity and straight answers. They rely on professionals who can break down complex information in simple terms and guide them through options. Good communication becomes just as important as technical skill.

5. Understanding Business Context

AI sees data, not further than that. Accountants see the bigger picture: hiring decisions, operational pressures, market conditions, and long-term goals. This contextual understanding is what turns financial data into real advice.

6. Ethical and Professional Judgment

AI cannot make decisions rooted in ethics or professional standards. Professionals who understand compliance, risk, and responsible decision-making remain essential.

Conclusion

AI is reshaping accounting, but it is not replacing the people who do the work. It automates routine tasks, enhances accuracy, and accelerates processes. However, judgment, relationships, creativity, ethical thinking, and understanding the broader business picture remain essential human abilities.

The professionals who adapt, learn the tools, and expand their advisory skills will be the ones who stay ahead. AI transforms from ‘Artificial Intelligence’ to a ‘Transformative Tool’ only when it’s paired with the experience and perspective humans can add.

The future is not one of AI replacing accountants, but of accountants who know how to utilize AI effectively.

Cora Vollmar

Cora Vollmar is a seasoned professional with over 20 years of experience in accounting, operations, talent management, and business development. Her career began in the construction sector, where she quickly established herself as a leader, achieving triple-digit growth with her CPA team. Cora’s extensive experience includes recruiting for finance and accounting roles, developing innovative STEM-driven solutions to address the U.S. talent deficit, and leading capacity panel discussions across the country.

Recognized as a member of one of America’s fastest-growing construction companies by the Inc. 5000 list for three consecutive years, Cora’s expertise and passion for growth are evident in every aspect of her work. She brings a wealth of knowledge and a dynamic approach to QX Global Group, where she is poised to make a significant impact.

When she’s not working, Cora is an avid traveler with a love for exploring new cultures. She has visited Canada, Mexico, the Caribbean, Europe, the UK, and Central America, with plans to visit Ireland in 2025.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Our Latest Insights

Let’s Work Together

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.

Get Your ROI Estimate

Get Your ROI Estimate