Tax Workflow for Accounting Firms: Best Practices and Automation Tips

Summary:

Tax season puts consistent pressure on accounting firms. Volumes rise, deadlines tighten, and manual workflows struggle to keep up. This blog explains how a modern tax workflow works, supported by automation that enables firms to reduce errors and scale efficiently. You’ll learn best practices for structuring tax return preparation workflows, where automation delivers the most value, and how tools like QX ROBO1040 support a more predictable, efficient tax season.

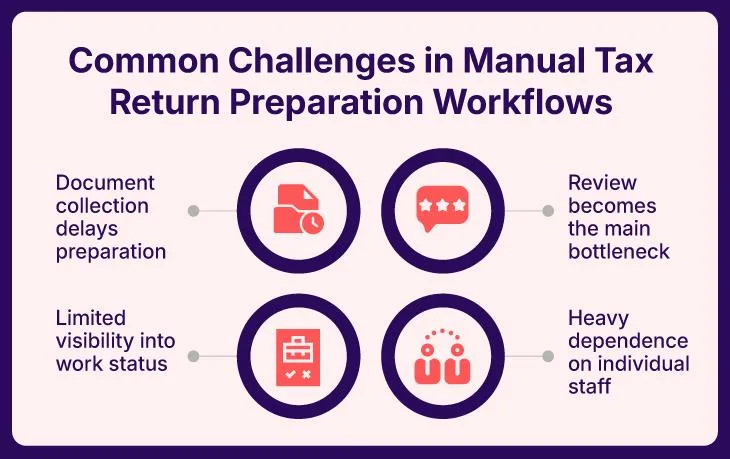

Tax season puts accounting firms under intense pressure every year. Return volumes rise sharply. Deadlines get tighter. Review queues grow longer. At the same time, firms are facing talent shortages, higher client expectations, and limited room for error.

Need of the hour? A well-designed tax workflow, supported by automation, ensures that work flows smoothly and reviews don’t pile up later. In fact, 29% of accounting firms now automate more than half of their tax workflows, reflecting the rapid adoption of tax workflow automation as a competitive standard.

As firms handle more work with fewer resources, relying on manual processes is no longer a sustainable approach. This is why tax workflow automation has become a critical part of modern tax operations. This holds true not just during peak season but throughout the year.

What Is a Tax Workflow Automation?

Tax workflow automation refers to the use of technology to streamline and standardize the process of preparing, reviewing, and filing tax returns.

Instead of relying on emails, spreadsheets, and individual habits, automated workflows define critical areas of the process that define the effectiveness of the overall framework. This includes:

- How returns are routed

- At what stage do data checks happen

- Where and how errors are flagged

- How progress is tracked

In a modern tax return preparation workflow, automation handles repeatable steps, including data extraction, basic validations, form population, and status tracking. Accountants remain responsible for judgment, review, and client communication.

The goal is simple: to remove friction from the process while maintaining control for professionals.

Best Practices for an Efficient Tax Workflow

If you observe closely, an efficient tax workflow is the result of deliberate process design, clear ownership, and the right use of automation. Firms that perform well during busy season follow a few core practices that keep work moving smoothly, reduce review pressure, and maintain consistency as volumes increase. The best practices below form the foundation of a scalable, automation-ready tax workflow.

1. Standardize the Tax Return Preparation Workflow

Every return should follow the same defined stages, which include data collection, preparation, review, and filing. Standardization reduces confusion, improves handoffs, and ensures consistent quality across teams.

2. Centralize Client Data Collection

This is often overlooked but is one of the most critical steps. Secure portals and automated reminders replace scattered emails. This speeds up intake and ensures preparers start with complete, organized data.

3. Build Early Validation Into the Process

Automated checks catch missing information and inconsistencies before returns reach the review stage. This reduces late-stage surprises and protects reviewer time.

4. Separate Preparation and Review Clearly

Preparation focuses on accuracy and completeness, while review focuses on compliance and judgment. Clear role separation improves accountability, significantly shortening multiple review cycles.

5. Track Progress in Real Time

Workflow dashboards indicate the current status of each return. With better visibility, managers can rebalance workloads before delays escalate.

When Tax Workflow Meets Automation

This is where magic happens!

Let us get one thing clear first. Tax workflow automation is not about replacing accountants. It is more about supporting them. Automation strengthens the tax return preparation workflow by handling:

- Data extraction from source documents

- Standard calculations and validations

- Form population and consistency checks

- Early error detection

This enables professionals to devote more time to reviewing quality, planning, and client conversations.

Tax workflow automation tools also create predictability. Firms understand what capacity looks like and can plan confidently, rather than reacting under pressure.

Still managing 1040s workflows manually?

QX ROBO1040 helps accounting firms move returns faster, without losing control or accuracy. Explore more today.

Click Here! Practical Automation Tips for Accounting Firms

Automation works best when it is applied thoughtfully. Though it’s true that many firms struggle because they attempt to automate everything without first fixing workflow gaps or defining ownership. The most effective approach is to automate where manual effort is highest, and consistency matters most.

These practical tips focus on utilizing automation to strengthen day-to-day tax operations, improve control, and eliminate avoidable bottlenecks.

1. Automate Intake and Follow-Ups

Document requests and reminders should run automatically. This removes one of the biggest causes of prep delays.

2. Prepare Returns for Review, Not Rework

Automation ensures returns reach reviewers clean and complete. Reviewers spend less time fixing basics and more time applying expertise.

3. Reduce Repetitive Rework Loops

By flagging issues early, automation enables teams to resolve problems once and for all. This improves turnaround time and significantly reduces redundancy.

4. Use Automation to Plan Capacity

With standardized workflows and real-time tracking, firms can forecast workload more accurately. This reduces burnout and last-minute staffing decisions.

Tools like QX ROBO1040 are redefining tax workflow automation. Firms using ROBO1040 report up to 40% gains in filing efficiency. This is purely driven by fewer touchpoints, lesser manual intervention, early error detection, and smoother reviews.

Tax Workflow Automation as a Competitive Advantage

Tax workflow automation is quite often treated as a busy-season efficiency play. But it is not the true picture. Tax workflow automation is something leading firms are now chasing with all their might. It is shaping how firms compete.

Here’s what firms with automated tax workflows are achieving:

- Handling higher volumes without adding headcount

- Delivering faster, more consistent turnaround

- Reducing burnout and staff turnover

- Protecting margins as demand increases

Manual processes scale linearly. More returns require more hours. Whereas, Tax workflow automation breaks this link by increasing output without matching cost increases. Over time, this operational stability becomes a clear differentiator in the market.

Advanced tax workflow automation tools, such as QX ROBO1040, are designed to support high-volume 1040 preparation.

By automating repeatable prep steps and enforcing consistent workflows, ROBO1040 helps firms reduce review bottlenecks and improve turnaround without disrupting existing tax processes.

The result is a smoother, more predictable tax return preparation workflow throughout the year, especially during peak season.

Final Thoughts

A strong tax workflow is built on structure, consistency, and visibility. Tax workflow automation strengthens all three.

Firms that invest in automation move away from reactive firefighting and toward controlled, scalable delivery. They protect their teams, enhance the client experience, and create opportunities for growth.

The future of tax operations belongs to firms that design workflows for scale, not stress. Ready to start this conversation. Connect with us today!

Cora Vollmar

Cora Vollmar is a seasoned professional with over 20 years of experience in accounting, operations, talent management, and business development. Her career began in the construction sector, where she quickly established herself as a leader, achieving triple-digit growth with her CPA team. Cora’s extensive experience includes recruiting for finance and accounting roles, developing innovative STEM-driven solutions to address the U.S. talent deficit, and leading capacity panel discussions across the country.

Recognized as a member of one of America’s fastest-growing construction companies by the Inc. 5000 list for three consecutive years, Cora’s expertise and passion for growth are evident in every aspect of her work. She brings a wealth of knowledge and a dynamic approach to QX Global Group, where she is poised to make a significant impact.

When she’s not working, Cora is an avid traveler with a love for exploring new cultures. She has visited Canada, Mexico, the Caribbean, Europe, the UK, and Central America, with plans to visit Ireland in 2025.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Our Latest Insights

Let’s Work Together

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.

Get Your ROI Estimate

Get Your ROI Estimate