Cost Benefit Analysis of Hiring a QuickBooks Bookkeeper

Summary:

Hiring a QuickBooks bookkeeper is not just an operational decision; it’s a financial one. This blog breaks down the real costs involved and weighs them against the benefits businesses gain from increased accuracy, efficiency, cash flow visibility, and informed decision-making. If you’re evaluating whether to manage bookkeeping in-house or bring in QuickBooks expertise, this cost benefit analysis will help you make a practical, informed choice.

Managing finances is critical for any business, but bookkeeping often becomes a challenge as operations grow. More transactions mean more complexity, and small errors can quickly affect cash flow and reporting.

QuickBooks helps simplify accounting, but the software alone is not enough. Without the right expertise, businesses often struggle to maintain accurate and up-to-date financial records.

This is where hiring a QuickBooks bookkeeper becomes a practical decision. This blog breaks down the costs involved and weighs them against the benefits, helping business leaders decide if bringing in QuickBooks expertise is worth the investment.

What Is QuickBooks Bookkeeping and Why It Matters

QuickBooks bookkeeping involves recording and organizing financial transactions using QuickBooks software. This includes income, expenses, reconciliations, invoicing, payroll entries, and basic reporting.

The goal goes beyond compliance. Accurate bookkeeping creates clarity. It shows how the business is performing and supports better decisions. Many small businesses manage their books internally at first. Over time, this approach often results in delays and errors. Reports arrive late. Tax issues surface unexpectedly or more.

A dedicated QuickBooks bookkeeper helps prevent these problems. They ensure consistency, accuracy, and timely reporting.

Understanding the Costs of Hiring a QuickBooks Bookkeeper

A proper cost-benefit analysis starts with understanding all related costs. Here is a breakdown of all the relevant ones.

Direct Compensation

Hiring a full-time bookkeeper comes with salary costs. Benefits, payroll taxes, and overhead add to that total. These expenses can be significant for small and mid-sized businesses. Outsourced bookkeepers usually charge a fixed or usage-based fee. This often reduces long-term financial commitment.

Software and Tools

QuickBooks subscriptions are a separate cost. In some cases, add-ons or reporting tools may also be needed. An experienced bookkeeper often recommends the right tools upfront. This avoids trial-and-error spending later.

Training and Onboarding

New hires need time to learn company processes. During this phase, productivity is limited. Outsourced bookkeepers usually arrive trained. They follow established workflows, requiring less onboarding time.

Management and Oversight

Even experienced bookkeepers require some supervision. Reviews and check-ins are still needed. That said, structured processes reduce the time spent managing day-to-day bookkeeping work.

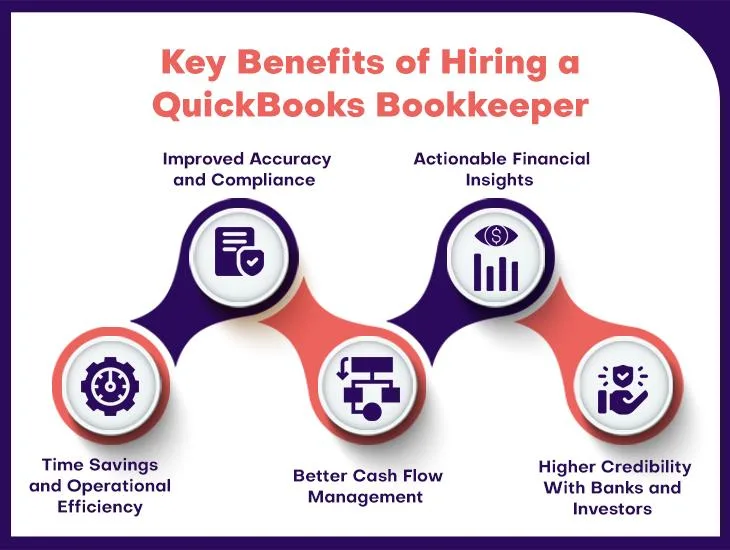

Key Benefits of Hiring a QuickBooks Bookkeeper

While costs are real, the benefits often outweigh them over time.

1. Improved Accuracy and Compliance

Errors in bookkeeping can lead to penalties and rework. They also create unreliable financial reports. A skilled QuickBooks bookkeeper reduces these risks. Transactions are recorded correctly. Reconciliations happen on time. Reports are clean and audit-ready.

2. Time Savings and Operational Efficiency

Bookkeeping consumes more time than most owners realize. Reconciliations, follow-ups, and reporting add up quickly. Delegating this work frees leaders to focus on growth. Sales, hiring, and strategy get the attention they deserve.

3. Actionable Financial Insights

A bookkeeper does more than record data. They turn numbers into reports. Profit and loss statements, balance sheets, and cash flow summaries arrive regularly. These reports support better planning and budgeting.

4. Better Cash Flow Management

Poor cash flow is a major reason businesses fail. Many issues stem from delayed invoicing or missed collections. Accurate bookkeeping improves visibility. Businesses can track receivables, manage payables, and plan for upcoming expenses with confidence.

5. Higher Credibility With Banks and Investors

Clean financials build trust. Lenders and investors expect accurate, organized records. A QuickBooks bookkeeper ensures documentation is ready when needed. This supports financing, audits, and growth conversations.

The cost of a QuickBooks bookkeeper is visible. The cost of poor bookkeeping is not, until it shows up as cash flow stress, reporting delays, or missed opportunities.

Cora Vollmar, VP-Growth, QX Accounting Services

That’s where most businesses misjudge the equation.

Tips for Accurate Cost Benefit Analysis

Before deciding, this is what you should take in consideration:

- List all direct and indirect costs of hiring vs outsourcing

- Estimate time savings and productivity gains

- Project potential error reductions and compliance risk mitigation

- Consider growth plans and whether financial scalability is needed

Wrapping It Up

Hiring a QuickBooks bookkeeper is not just about reducing administrative workload. It is about gaining financial clarity, improving accuracy, and creating a system that supports better decisions as the business grows. When bookkeeping is done right, leaders spend less time fixing issues and more time planning ahead.

The real value lies in working with a partner who understands both the software and the business behind the numbers. A provider like QX supports companies with experienced QuickBooks professionals, structured processes, and scalable delivery models. This ensures that bookkeeping stays accurate, timely, and aligned with business goals, without the cost or complexity of building a large in-house team.

With the right expertise in place, QuickBooks becomes more than a tool. It becomes a reliable foundation for financial control and sustainable growth. Interested in exploring more? Contact us here.

FAQs

1. Is hiring a QuickBooks bookkeeper worth the cost for small businesses?

For most small businesses, yes. The cost of hiring a QuickBooks bookkeeper is often lower than the hidden cost of errors, delayed reporting, and missed insights. When books are inaccurate or outdated, decisions are made on incomplete information. A skilled bookkeeper ensures your financial data is reliable, timely, and usable, which directly supports better cash flow management and planning.

2. What is the biggest financial benefit of hiring a QuickBooks bookkeeper?

The biggest benefit is accuracy with consistency. Clean books reduce the risk of tax penalties, rework, and last-minute fixes. Over time, this improves reporting quality and financial confidence. Businesses also gain clearer visibility into profitability and expenses, which helps control costs and improve margins.

3. Is it cheaper to outsource a QuickBooks bookkeeper than hire in-house?

In many cases, outsourcing is more cost-effective. Hiring in-house comes with fixed expenses like salary, benefits, training, and software management. An outsourced QuickBooks bookkeeper provides access to expertise without long-term overhead. Businesses pay only for the level of support they need, which makes it easier to scale up or down.

4. Can a QuickBooks bookkeeper really help improve cash flow management?

Yes. A QuickBooks bookkeeper keeps receivables, payables, and reconciliations current. This gives business owners a clear view of available cash and upcoming obligations. With accurate cash flow data, companies can plan payments, avoid shortages, and make informed spending decisions instead of reacting late.

5. When should a business move from DIY bookkeeping to a QuickBooks expert?

The shift usually makes sense when transaction volume increases, reporting delays become common, or bookkeeping starts taking time away from revenue-generating work. If financial reports are not ready when needed, or if tax preparation feels stressful every year, it’s a strong sign that professional QuickBooks support is needed.

Bhagyashree Patankar

With over 14 years of global experience in finance and accounting, Bhagyashree is a Chartered Accountant and US CPA with a master’s in Accounting and Finance. She leads an 80+ member team across accounting, audit, and tax, driving operational excellence, talent development, and high-quality delivery. Known for her precision and strategic insight, she transforms financial data into actionable business strategies that enhance decision-making, efficiency, and sustainable growth.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Our Latest Insights

Let’s Work Together

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.

Get Your ROI Estimate

Get Your ROI Estimate