How Accounting Outsourcing Benefits Your PE Firm

Summary:

Private equity firms operate under constant pressure to drive performance, manage risk, and maintain strict financial discipline across portfolio companies. Accounting outsourcing has emerged as a strategic lever, helping PE firms improve reporting accuracy, strengthen compliance, support transaction readiness, and scale operations without adding internal complexity. This blog explains how accounting outsourcing benefits PE firms, which functions are best suited for outsourcing, and why working with a proven partner matters in a high-stakes, deal-driven environment.

Private equity firms operate in an environment where speed, accuracy, and risk control are non-negotiable. As portfolios grow more complex and regulatory scrutiny increases, finance and accounting functions often become a bottleneck rather than a support system.

This is where private equity outsourcing has moved from a tactical option to a strategic lever. For PE firms managing multiple investments, outsourcing accounting is no longer just about cost efficiency. It is about building control, improving visibility, and protecting enterprise value across the portfolio.

This blog explores why accounting outsourcing matters for private equity firms and the best suited functions for offshoring that help mitigate risk while supporting long-term value creation.

But before diving into all of this, let us first understand why accounting outsourcing should be regarded as a strategic move for PE firms.

Accounting Outsourcing as a Strategic Priority

Private equity firms are accountable not only for performance, but also for governance. Every reporting delay, compliance gap, or data inconsistency creates risk that can impact valuations and investor confidence.

In-house accounting teams at portfolio companies often struggle with:

- Inconsistent reporting standards

- Limited experience with PE-level compliance

- Manual processes that do not scale

- High turnover at critical reporting stages

Private equity outsourcing addresses these challenges by introducing standardized processes, experienced oversight, and repeatable controls across entities.

Outsourcing adoption among private equity firms jumped from 27% to 40% in just one year. PE firms are now outsourcing beyond fund administration. They are leaning towards expert guidance including financial modeling and growth support.

If your PE firm is considering outsourced accounting, QX is a smart place to start. Trusted by five PE-backed firms for reliable, scalable support.

Lear more!Key Drivers Behind Accounting Outsourcing in Private Equity

1. Risk Mitigation and Stronger Controls

PE-backed companies operate under tight scrutiny. Weak controls often increase exposure to financial misstatements, audit issues, and regulatory penalties.

Outsourced accounting introduces structured review layers, segregation of duties, and documented processes. This reduces dependency on individuals and lowers the risk of errors or fraud across portfolio companies.

2. Consistent, Investor-Ready Reporting

Private equity firms require timely and accurate financial data across investments. They can’t afford variability in reporting quality that creates friction at the fund level.

With private equity outsourcing, reporting frameworks are properly standardized. Month-end closes, management reports, and audit schedules follow a mutually agreed SOP. Thus, improving confidence in numbers presented to LPs and advisors.

3. Scalability Without Operational Overload

As portfolios expand through acquisitions or add-on investments, accounting complexity increases. Scaling in-house teams could be a solution but it is slow and costly, especially when done across multiple entities.

Outsourcing provides immediate access to capacity without long hiring cycles. Whether onboarding a new acquisition or supporting rapid growth, outsourced teams scale in parallel with investment activity.

4. Cost Predictability and Margin Protection

Unplanned accounting costs, rework, and compliance remediation eat into returns. Outsourced models offer predictable pricing and reduce inefficiencies caused by inconsistent support from fragmented internal teams.

For PE firms, private equity outsourcing helps protect margins by aligning accounting costs with portfolio size and complexity.

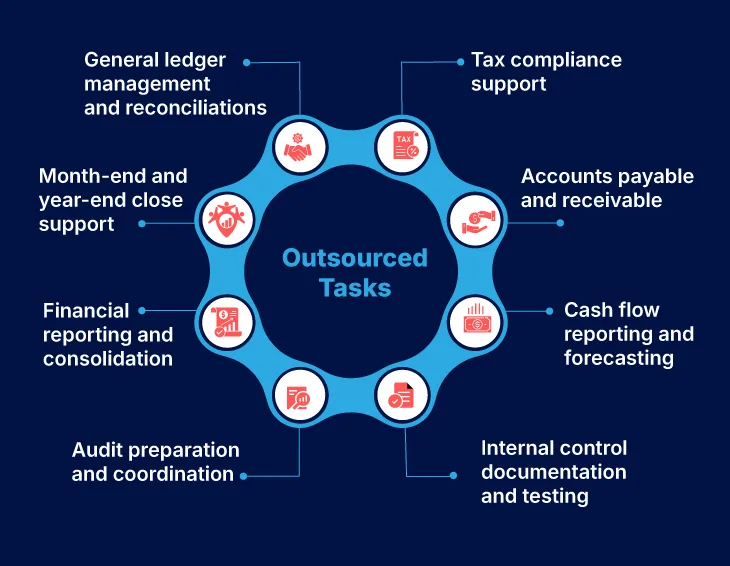

Finance and Accounting Tasks PE Firms Commonly Outsource

Outsourcing these functions allows PE firms and portfolio leadership to focus on performance improvement rather than operational firefighting.

How Outsourcing Supports Value Creation Across the Portfolio

Private equity firms create value by improving operations, financial engineering and the overall firm structure. And reliable accounting is foundational to that process.

With accurate, timely data, operating partners can:

- Identify underperforming cost centers

- Track working capital improvements

- Measure the impact of operational initiatives

- Support integration during M&A activity

Private equity outsourcing ensures that decision-making is supported by clean, current financial information rather than lagging reports. Audits, lender reviews, and exit diligence often expose weaknesses in internal accounting setups. These gaps increase transaction risk and slow timelines.

Outsourced accounting teams operate with audit readiness in mind. Documentation, reconciliations, and controls are maintained continuously, reducing disruption during critical events such as refinancing or exit preparation.

Why the Right Partner Matters

Outsourcing alone does not guarantee success. The value lies in working with a partner that understands private equity expectations, U.S. regulatory standards, and portfolio-level complexity.

A strategic partner like QX brings hands-on experience supporting five PE-backed firms and delivers more than execution. This includes

- Deep familiarity with PE operating models

- Established quality control frameworks

- Secure, compliant delivery models

- Scalable teams aligned to transaction cycles

With private equity outsourcing, the right partner acts as an extension of the PE firm’s operating model, not just a service provider.

Wrapping It Up

For private equity firms, accounting is not a back-office function. It is a control system that underpins governance, performance, and valuation.

Outsourcing finance and accounting enable PE firms to reduce risk, improve visibility, and scale efficiently across their portfolios. When executed with the right partner, it strengthens operational discipline and supports long-term value creation.

If your firm is looking to standardize accounting across investments while maintaining control and compliance, private equity outsourcing can be a decisive advantage.

Ready to strengthen your portfolio’s financial foundation? Connect with us today.

FAQs

1. Why are more private equity firms outsourcing accounting and finance functions?

Private equity firms outsource accounting to improve control, accuracy, and scalability across portfolio companies. Outsourcing helps standardize reporting, reduce risk, and support faster decision-making without increasing internal headcount.

2. Which accounting tasks are most commonly outsourced by PE firms?

PE firms often outsource fund accounting, bookkeeping, financial reporting, reconciliations, compliance support, and transaction-related work and audit preparation.

3. How does accounting outsourcing support value creation in PE-backed companies?

Outsourcing improves financial visibility, enforces stronger controls, and ensures consistent reporting across investments. This allows PE teams to focus on growth initiatives, EBITDA improvement, and exit readiness rather than operational issues.

4. Is accounting outsourcing secure and compliant for PE-backed businesses?

Yes, when done with the right partner. Established providers use secure delivery models, documented controls, and compliance-aligned processes to protect sensitive financial data and meet regulatory expectations.

5. What should PE firms look for in an accounting outsourcing partner?

PE firms should prioritize partners with experience supporting PE-backed companies, strong quality frameworks, scalable teams aligned to deal cycles, and the ability to support both steady-state operations and transaction-driven workloads.

Cora Vollmar

Cora Vollmar is a seasoned professional with over 20 years of experience in accounting, operations, talent management, and business development. Her career began in the construction sector, where she quickly established herself as a leader, achieving triple-digit growth with her CPA team. Cora’s extensive experience includes recruiting for finance and accounting roles, developing innovative STEM-driven solutions to address the U.S. talent deficit, and leading capacity panel discussions across the country.

Recognized as a member of one of America’s fastest-growing construction companies by the Inc. 5000 list for three consecutive years, Cora’s expertise and passion for growth are evident in every aspect of her work. She brings a wealth of knowledge and a dynamic approach to QX Global Group, where she is poised to make a significant impact.

When she’s not working, Cora is an avid traveler with a love for exploring new cultures. She has visited Canada, Mexico, the Caribbean, Europe, the UK, and Central America, with plans to visit Ireland in 2025.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Our Latest Insights

Let’s Work Together

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.

Get Your ROI Estimate

Get Your ROI Estimate