Outsourcing Audit Work to India: A Comprehensive Guide for Irish Accounting Firms

Running an audit firm in Ireland these days feels like juggling flaming torches while walking a tightrope. You’re balancing ever-tightening regulations, increasing client demands, and the constant pressure of finding and retaining top talent.

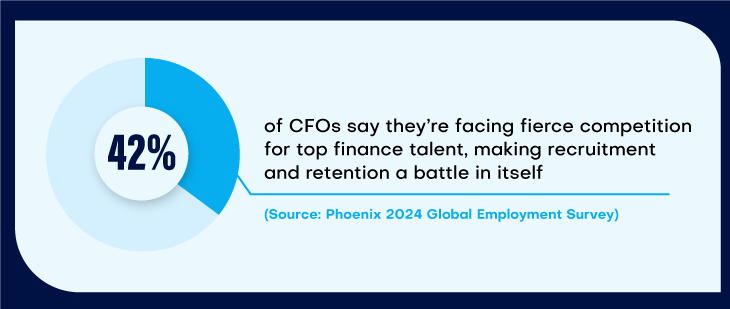

If that sounds familiar, you’re not alone—42% of CFOs are facing the same challenge, leading to an unending struggle with hiring new staff and retaining top talent (Source: Phoenix 2024 Global Employment Survey). Add to that the busy season chaos, and it’s no wonder many firms feel stretched too thin.

“The accountancy profession plays a pivotal role in delivering professional services and advice to all sectors of the Irish economy, but presently, most firms in which CCAB-I members operate have active vacancies that they are unable to fill. There is a critical shortage of accountants with audit experience; and a deficiency of accountants with practice experience of all types, including tax, data analytics, consultancy, and sustainability.”

– Crona Clohisey, Director of Public Affairs, Chartered Accountants Ireland

Here’s where outsourcing comes into play. By partnering with an experienced overseas team, you can ease the workload, cut costs, and focus on what really matters—growing your practice and delighting your clients.

Among the top outsourcing destinations, India stands out, offering skilled auditors, efficient workflows, and significant cost savings. That’s why a large number of accountants are now choosing to outsource audit services to India to maximise their firm’s potential.

If you are new to outsourcing—or if past attempts didn’t quite go as planned—this guide will take you through everything you need to know. From the benefits and models of outsourcing to practical steps to get started, we’ve got you covered. Let’s dive in.

Pooja Kshirsagar

With a rich experience of curating content for various industries, Pooja believes in the power of words in marketing and building brands. She enjoys experimenting with different forms of content and is currently on a mission to add value to the accounting industry through her detailed and researched write-ups.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Our Latest Insights

Let’s Work Together

Explore outsourcing solutions, request a free trial or discuss your practice’s needs with our expert consultants.

Book a Virtual Meeting

Book a Virtual Meeting  Book a Virtual Meeting

Book a Virtual Meeting