It’s that time of year again – October is looming, and with it, the Self-Assessment tax return deadline in Ireland. Every accountant in the country knows what this means: a tidal wave of paperwork, last-minute calls from clients, and the never-ending stream of filing requests.

Between juggling client needs and keeping your sanity intact, it’s easy to feel overwhelmed. But what if there was a way to ease the stress, reduce the workload, and still meet every deadline without losing sleep?

Enter: outsourcing Self-Assessment tax returns. If you’ve never considered it before, now might be the perfect time to rethink your strategy. Here’s why outsourcing could be the solution you’ve been looking for this busy season – and beyond.

Why is October Such a Struggle?

As any Irish accountant will tell you, the weeks leading up to 31 October can feel like a race against time. Clients who promised to get you their documents months ago suddenly drop everything on your desk. You’re faced with late submissions, missing information, and the ever-present pressure of making sure every detail is accurate.

Sound familiar? You’re not alone. Thousands of accounting firms across the country face the same challenges, and many are turning to outsourcing as a solution.

It’s not just about getting through the next few weeks – outsourcing is a long-term strategy that can benefit your firm well into the future.

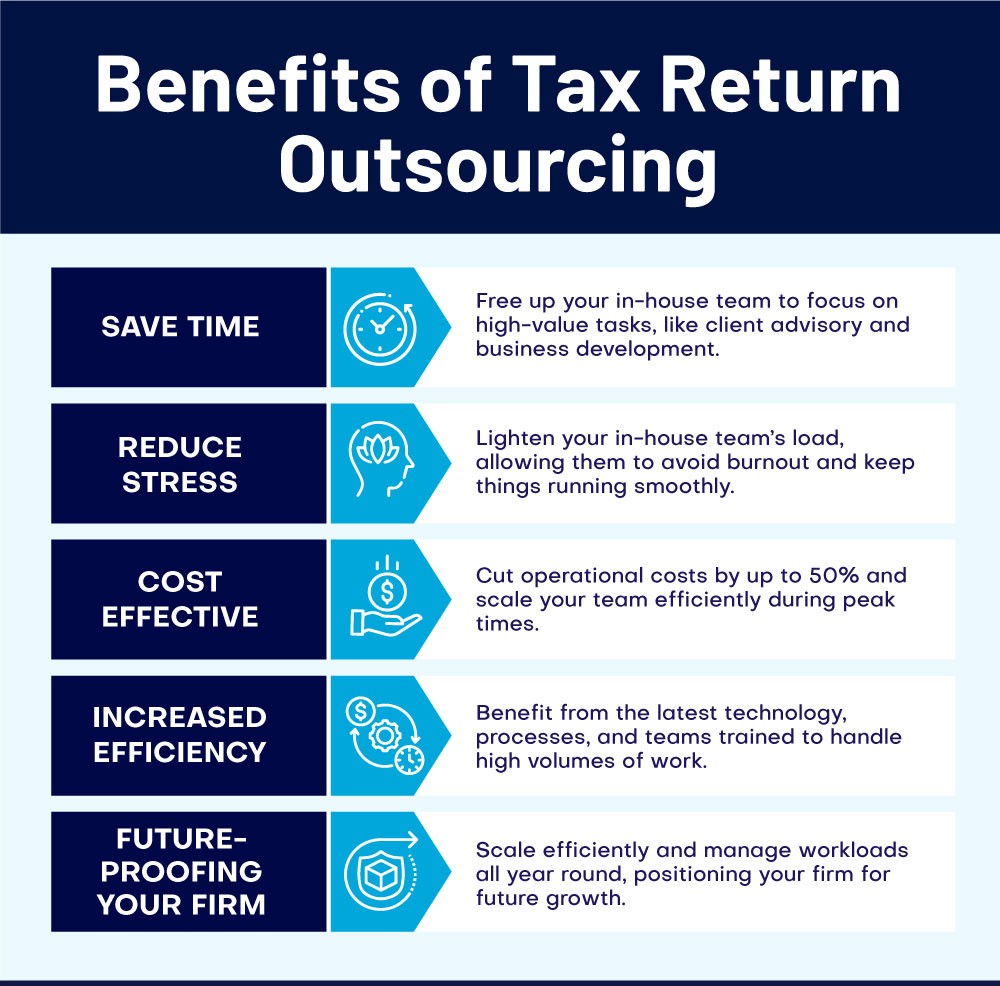

The Benefits of Outsourcing Self-Assessment Tax Returns

So, why is professional tax return outsourcing for Irish firms crucial during this period? The advantages go beyond just meeting deadlines. Here are a few reasons why it’s a smart move:

Is Outsourcing Self-Assessment Tax Returns Secure?

One of the first concerns many accountants have when considering outsourcing is security – and understandably so. You’re dealing with sensitive client information, so you want to ensure that it’s handled with the highest level of care.

Reputable providers of Self-Assessment tax outsourcing Ireland understand these concerns and take data security very seriously. They adhere to strict data protection regulations, including GDPR, and implement top-tier encryption to keep your clients’ information safe. Many outsourcing companies even offer secure FTP portals for data sharing, so you can rest easy knowing your files are protected.

Additionally, by working with experienced professionals who are well-versed in handling Self-Assessment tax returns, you reduce the risk of human error that could potentially compromise security. This means your clients’ information is not only safe but also accurately processed.

How Can Outsourcing Reduce Errors in Tax Returns?

Speaking of accuracy – how many sleepless nights have you had worrying about getting every detail right in a Self-Assessment tax return? Mistakes happen, but when it comes to tax filings, even a small error can have big consequences for your clients. Outsourcing can help minimise these risks.

Professional outsourcing teams specialise in tax preparation and are trained to spot discrepancies, missing information, or potential mistakes before they become a problem. They follow strict review processes to ensure that every return is double-checked for accuracy before it’s submitted.

With a dedicated outsourcing partner handling the nitty-gritty details, you can be confident that each tax return is completed correctly the first time around. This not only improves the quality of your work but also enhances your firm’s reputation for reliability and precision.

How Do I Get Started with Outsourcing?

So, you’re convinced that outsourcing Self-Assessment tax returns is the way to go, but how do you actually get started? The good news is that it’s easier than you might think. Here’s a step-by-step guide to help you make the transition:

Final Thoughts

With the Self-Assessment tax return deadline just around the corner, now is the perfect time to consider outsourcing. It’s not just about surviving the October rush – it’s about setting your firm up for success in the long run.

By outsourcing, you can reduce stress, save up to 10 hours weekly, and ensure that every tax return is completed accurately and securely.

So, why not give it a go? You might just find that outsourcing becomes the ace up your sleeve for future tax seasons – and your firm’s continued growth.

Plus, with fewer late nights in the office, you can finally enjoy a pint at your local without the weight of tax returns hanging over your head. Sounds like a win to me!

QXAS: Your Trusted Tax Outsourcing Partner

QX Accounting Services, a market leader in the outsourcing space, specialises in Irish tax compliance outsourcing for accountancy firms. With 20+ years of industry experience, we have worked with 500+ clients across the UK and Ireland, including top firms such as TaxAssist Accountants.

Why Partner with Us?

- 100+ skilled, experienced, and trained tax preparers

- Unmatched expertise in Irish law and compliance

- We work on the software you use

- Managed FTE Solutions with four-eyed review for top-notch quality

- Lightning-fast turnaround time

- 100% GDPR-compliant tax preparation

- 95% CSAT score and 89% NPS

- Seamless replacement of FTEs, if needed

If you are curious to know more about how we can support your firm, call us at +44 208 146 0808 or drop us an email at [email protected]. Click here to speak to an expert directly.

Book a Free Consultation

We hope you enjoyed reading this blog. If you want our team to help you resolve talent gaps, reduce costs and transform your business operations, just book a call.

Pooja Kshirsagar

With a rich experience of curating content for various industries, Pooja believes in the power of words in marketing and building brands. She enjoys experimenting with different forms of content and is currently on a mission to add value to the accounting industry through her detailed and researched write-ups.

Unauthorized copying or plagiarism of our content is a violation of intellectual property rights. We take such matters seriously and will pursue legal action to protect our original work. Anyone found engaging in such activities will be held accountable under applicable laws.

Originally published Sep 26, 2024 01:09:05, updated Sep 26 2024

Topics: outsourcing, self-assessment tax return, tax season